OPEN-SOURCE SCRIPT

TREND 123

### TREND - Wave Trend Oscillator (Optimized)

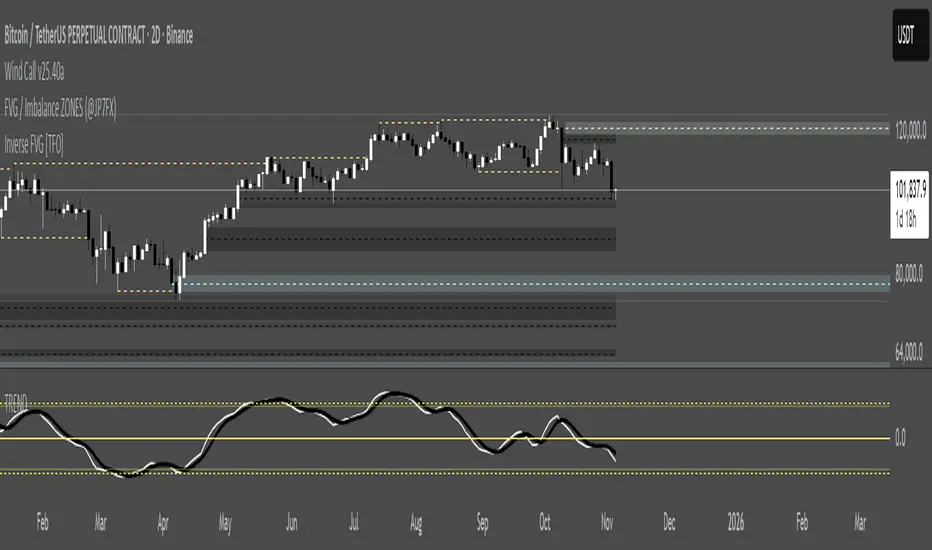

This indicator is an optimized version of the classic Wave Trend Oscillator, a powerful tool for identifying market momentum, overbought/oversold conditions, and potential trend shifts. Built on the foundational work of LazyBear, this script has been refined for clarity and enhanced with key features to provide a more comprehensive trading view.

#### Key Features and Functionality

The indicator plots two primary lines, WT1 (Wave Trend 1) and WT2 (Wave Trend 2), in a separate pane below the price chart.

,

Momentum and Trend Identification:

,

WT1 (Blue Line): Represents the faster-moving component, reflecting immediate market momentum.

,

WT2 (Orange Line): Acts as a signal line, a smoothed version of WT1.

,

Crossovers: A cross of WT1 above WT2 is typically interpreted as a bullish signal, while a cross below WT2 suggests a bearish signal.

,

Overbought and Oversold Zones:

The script includes four configurable horizontal lines to define critical zones: two for ,

Overbought (e.g., +60 and +53) and two for Oversold (e.g., -60 and -53).

When the WT lines enter the Overbought zone, it signals that the asset may be due for a pullback. Conversely, entering the Oversold zone suggests a potential bounce.,

,

Sensitivity Control:

A unique ,

Sensitivity Factor input allows users to fine-tune the oscillator's responsiveness to price changes. A lower factor makes the indicator more sensitive, while a higher factor provides smoother, less volatile readings.

,

Visual Enhancements (Configurable):

,

Histogram: An optional histogram plots the difference between WT1 and WT2. This visual aid helps gauge the strength of the current momentum—the larger the bar, the stronger the trend in that direction.

,

Information Table: An optional, dynamic table is displayed on the chart, providing a quick, real-time summary of the indicator's status, including:

,

Current State: Neutral, Overbought (), or Oversold ().

,

Trend: Bullish () or Bearish (), based on the WT1/WT2 crossover.

The current values of WT1 and WT2.,

#### How to Use It

This indicator is best used as a confirmation tool alongside price action or other trend-following indicators.

This indicator is an optimized version of the classic Wave Trend Oscillator, a powerful tool for identifying market momentum, overbought/oversold conditions, and potential trend shifts. Built on the foundational work of LazyBear, this script has been refined for clarity and enhanced with key features to provide a more comprehensive trading view.

#### Key Features and Functionality

The indicator plots two primary lines, WT1 (Wave Trend 1) and WT2 (Wave Trend 2), in a separate pane below the price chart.

,

Momentum and Trend Identification:

,

WT1 (Blue Line): Represents the faster-moving component, reflecting immediate market momentum.

,

WT2 (Orange Line): Acts as a signal line, a smoothed version of WT1.

,

Crossovers: A cross of WT1 above WT2 is typically interpreted as a bullish signal, while a cross below WT2 suggests a bearish signal.

,

Overbought and Oversold Zones:

The script includes four configurable horizontal lines to define critical zones: two for ,

Overbought (e.g., +60 and +53) and two for Oversold (e.g., -60 and -53).

When the WT lines enter the Overbought zone, it signals that the asset may be due for a pullback. Conversely, entering the Oversold zone suggests a potential bounce.,

,

Sensitivity Control:

A unique ,

Sensitivity Factor input allows users to fine-tune the oscillator's responsiveness to price changes. A lower factor makes the indicator more sensitive, while a higher factor provides smoother, less volatile readings.

,

Visual Enhancements (Configurable):

,

Histogram: An optional histogram plots the difference between WT1 and WT2. This visual aid helps gauge the strength of the current momentum—the larger the bar, the stronger the trend in that direction.

,

Information Table: An optional, dynamic table is displayed on the chart, providing a quick, real-time summary of the indicator's status, including:

,

Current State: Neutral, Overbought (), or Oversold ().

,

Trend: Bullish () or Bearish (), based on the WT1/WT2 crossover.

The current values of WT1 and WT2.,

#### How to Use It

This indicator is best used as a confirmation tool alongside price action or other trend-following indicators.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.