OPEN-SOURCE SCRIPT

Pivot Percentile Trend - Strategy [presentTrading]

█ Introduction and How it is Different

The "Pivot Percentile Trend - Strategy" from PresentTrading represents a paradigm shift in technical trading strategies. What sets this strategy apart is its innovative use of pivot percentiles, a method that goes beyond traditional indicator-based analyses. Unlike standard strategies that might depend on single-dimensional signals, this approach takes a multi-layered view of market movements, blending percentile calculations with SuperTrend indicators for a more nuanced and dynamic market analysis.

This strategy stands out for its ability to process multiple data points across various timeframes and pivot lengths, thereby capturing a broader and more detailed picture of market trends. It's not just about following the price; it's about understanding its position in the context of recent historical highs and lows, offering a more profound insight into potential market movements.

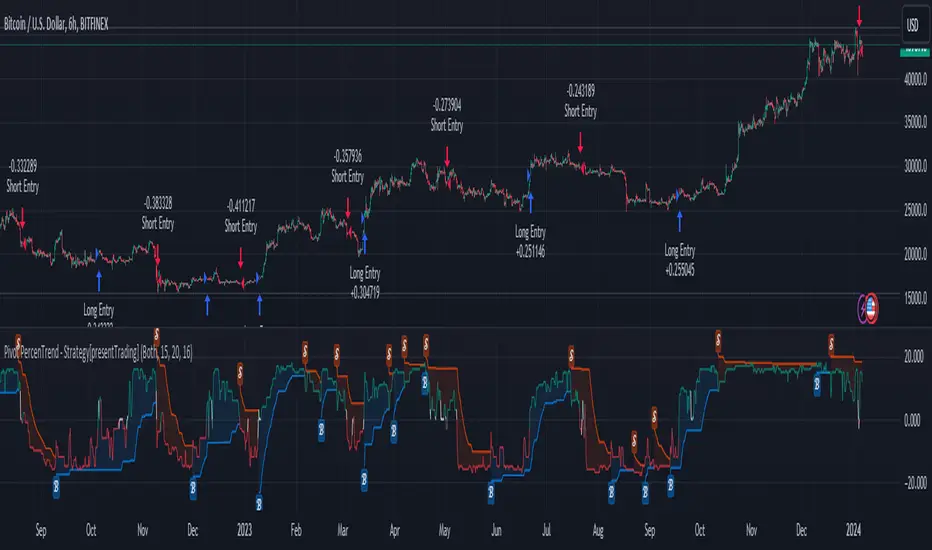

BTC 6h L/S

Where traditional methods might react to market changes, the Pivot Percentile Trend strategy anticipates them, using a calculated approach to identify trend strengths and weaknesses. This foresight gives traders a significant advantage, allowing for more strategic decision-making and potentially increasing the chances of successful trades.

In essence, this strategy introduces a more comprehensive and proactive approach to trading, harnessing the power of advanced percentile calculations combined with the robustness of SuperTrend indicators. It's a strategy designed for traders who seek a deeper understanding of market dynamics and a more calculated approach to their trading decisions.

Local picture

█ Strategy, How It Works: Detailed Explanation

🔶 Percentile Calculations

- The strategy employs percentile calculations to assess the relative position of current market prices against historical data.

- For a set of lengths (e.g., `length * 1`, `length * 2`, up to `length * 7`), it calculates the 75th percentile for high values (`percentilesHigh`) and the 25th percentile for low values (`percentilesLow`).

- These percentiles provide a sense of where the current price stands compared to recent price ranges.

Length - 10

Length - 15

🔶 SuperTrend Indicator

- The SuperTrend indicator is a key component, providing trend direction signals.

- It uses the `currentTrendValue`, derived from the difference between bull and bear strengths calculated from the percentile data.

* used the Supertrend toolkit by EliCobra

🔶 Trend Strength Counts

- The strategy calculates counts of bullish and bearish indicators based on comparisons between the current high and low against high and low percentiles.

- `countBull` and `countBear` track the number of times the current high is above the high percentiles and the current low is below the low percentiles, respectively.

- Weak bullish (`weakBullCount`) and bearish (`weakBearCount`) counts are also determined by how often the current lows and highs fall within the percentile range.

*The idea of this strength counts mainly comes from 'Trend Strength Over Time' federalTacos5392b

🔶 Trend Value Calculation

- The `currentTrendValue` is a crucial metric, computed as `bullStrength - bearStrength`.

- It indicates the market's trend direction, where a positive value suggests a bullish trend and a negative value indicates a bearish trend.

🔶 Trade Entry and Exit Logic

- The entry points for trades are determined by the combination of the trend value and the direction indicated by the SuperTrend indicator.

- For a long entry (`shouldEnterLong`), the `currentTrendValue` must be positive and the SuperTrend indicator should show a downtrend.

- Conversely, for a short entry (`shouldEnterShort`), the `currentTrendValue` should be negative with the SuperTrend indicating an uptrend.

- The strategy closes positions when these conditions reverse.

█ Trade Direction

The strategy is versatile, allowing traders to choose their preferred trading direction: long, short, or both. This flexibility enables traders to tailor their strategies to their market outlook and risk appetite.

█ Default Settings and Customization

1. Trade Direction: Selectable as Long, Short, or Both, affecting the type of trades executed.

2. Indicator Source: Pivot Percentile Calculations, key for identifying market trends and reversals.

3. Lengths for Percentile Calculation: Various configurable lengths, influencing the scope of trend analysis.

4. SuperTrend Settings: ATR Length 20, Multiplier 18, affecting indicator sensitivity and trend detection.

5. Style Options: Custom colors for bullish (green) and bearish (red) trends, aiding visual interpretation.

6. Additional Settings: Includes contrarian signals and UI enhancements, offering strategic and visual flexibility.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

Watch patiently/ then trade

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

Watch patiently/ then trade

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.