PROTECTED SOURCE SCRIPT

تم تحديثه Market Profile @joshuuu

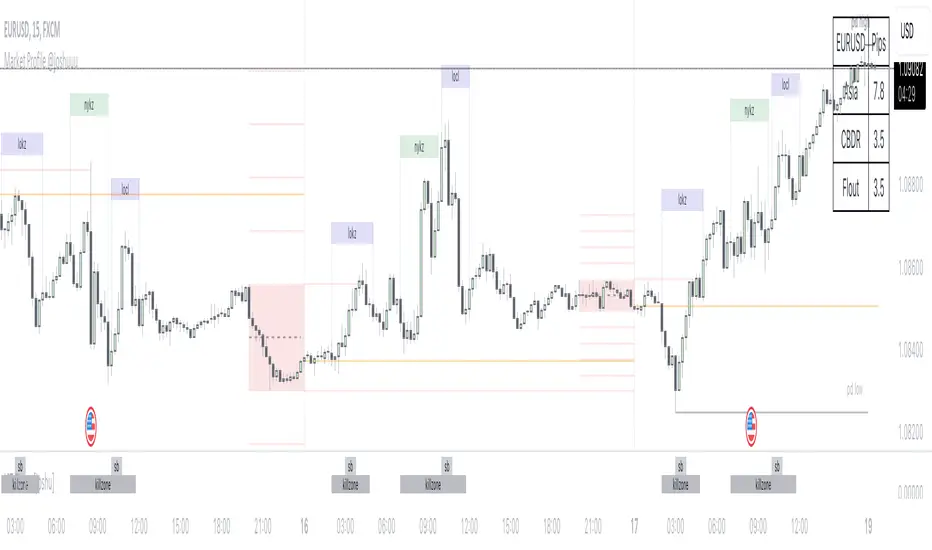

Time is fractal. Every candle has an open, low, high and closing price.

Depending on what timeframe you are on, some opening prices could be more interesting than others.

This indicator tracks, which timeframe you are currently on and displays different things accordingly, so that the chart is never messy.

Below the hourly timeframe, the indicator highlights ICT Killzones, times of the day where most volume occurs and price moves the "cleanest". There are different versions to display those sessions in the settings.

From the hourly timeframe up to the daily timeframe, the indicator shows the "Weekly Profile". It plots the weekly opening line, can highlight daily highs and lows and daily opens and shows the name of the days on the chart.

On the daily timeframe, the indicator switches to a monthly profile. It shows the monthly open, weekly highs/lows AND it shows another concept taught by ICT, the IPDA Lookback.

ICT teaches that especially the last 20, 40 and 60 days PD Arrays and Highs/Lows are important and this indicator highlights those lookback windows accordingly.

The indicator has a lot of settings to make it allow maximum individuality.

Depending on what timeframe you are on, some opening prices could be more interesting than others.

This indicator tracks, which timeframe you are currently on and displays different things accordingly, so that the chart is never messy.

Below the hourly timeframe, the indicator highlights ICT Killzones, times of the day where most volume occurs and price moves the "cleanest". There are different versions to display those sessions in the settings.

From the hourly timeframe up to the daily timeframe, the indicator shows the "Weekly Profile". It plots the weekly opening line, can highlight daily highs and lows and daily opens and shows the name of the days on the chart.

On the daily timeframe, the indicator switches to a monthly profile. It shows the monthly open, weekly highs/lows AND it shows another concept taught by ICT, the IPDA Lookback.

ICT teaches that especially the last 20, 40 and 60 days PD Arrays and Highs/Lows are important and this indicator highlights those lookback windows accordingly.

The indicator has a lot of settings to make it allow maximum individuality.

ملاحظات الأخبار

fixed daily open on weekly profile for future contractsملاحظات الأخبار

added "Background" as Killzone Style Optionملاحظات الأخبار

updated ons session times and added the possibility to display day labels on a timeframe lower than h1. be aware, that day labels always plot at 12ملاحظات الأخبار

added equlibrium, highs and lows to the weekly rangeملاحظات الأخبار

changed standard settings of the weekly profile to not display daily highs/lows and opens. option is obviously still in the settings, so you can turn em on if you prefer that

ملاحظات الأخبار

added the option to choose the devider colorملاحظات الأخبار

bug fixملاحظات الأخبار

added standard deviations, added table that shows pips of Asia, CBDR, Floutملاحظات الأخبار

limited the asia,cbdr,flout pip numbers to only daily profile (below h1)ملاحظات الأخبار

added lines for previous daily, weekly and monthly high/lowملاحظات الأخبار

+ added 0.5 Levels to the Standard Deviationsملاحظات الأخبار

+ added loclملاحظات الأخبار

-نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.