PROTECTED SOURCE SCRIPT

تم تحديثه MTF Fusion - S/R Levels [TradingIndicators]

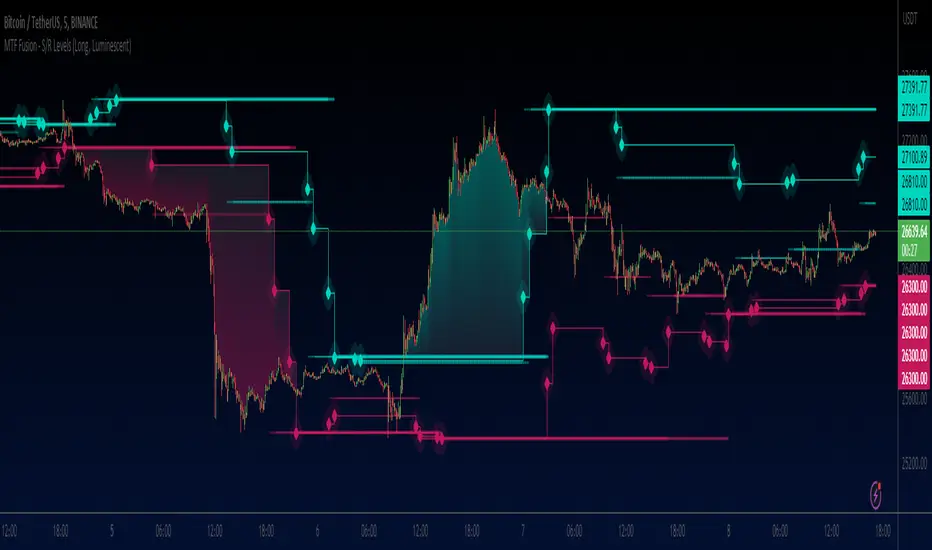

MTF Fusion S/R Levels intelligently adapt to whatever timeframe you're trading - dynamically calculating pivot-based support and resistance levels combined from four appropriate higher timeframes to give you a much broader view of the market and an edge in your trading decisions. It is the second indicator in our MTF Fusion series, and leverages our MTF Fusion algorithm - only this time to visualize pivot-based S/R levels and zones.

These levels are not programmed to repaint - so you can use them in real-time just as they appeared historically.

What is MTF Fusion?

Multi-Timeframe (MTF) Fusion is the process of combining calculations from multiple timeframes higher than the chart's into one 'fused' value or indicator. It is based on the idea that integrating data from higher timeframes can help us to better identify short-term trading opportunities within the context of long-term market trends.

How does it work?

Let's use the context of this indicator, which calculates S/R Levels based on pivot points, as an example to explain how MTF Fusion works and how you can perform it yourself.

Step 1: Selecting Higher Timeframes

The first step is to determine the appropriate higher timeframes to use for the fusion calculation. These timeframes should typically be chosen based on their ability to provide meaningful price levels and action which actively affect the price action of the smaller timeframe you're focused on. For example, if you are trading the 5 minute chart, you might select the 15 minute, 30 minute, and hourly timeframe as the higher timeframes you want to fuse in order to give you a more holistic view of the trends and action affecting you on the 5 minute. In this indicator, four higher timeframes are automatically selected depending on the timeframe of the chart it is applied to.

Step 2: Gathering Data and Calculations

Once the higher timeframes are identified, the next step is to calculate the data from these higher timeframes that will be used to calculate your fused values. In this indicator, for example, the values of support and resistance levels are calculated by determining pivot points for all four higher timeframes.

Step 3: Fusing the Values From Higher Timeframes

The next step is to actually combine the values from these higher timeframes to obtain your 'fused' indicator values. The simplest approach to this is to simply average them. If you have calculated the value of a support level from three higher timeframes, you can, for example, calculate your 'multi-timeframe fused level' as (HigherTF_Support_Level_1 + HigherTF_Support_Level_2 + HigherTF_Support_Level_3) / 3.0.

Step 4: Visualization and Interpretation

Once the calculations are complete, the resulting fused indicator values are plotted on the chart. These values reflect the fusion of data from the multiple higher timeframes, giving a broader perspective on the market's behavior and potentially valuable insights without the need to manually consider values from each higher timeframe yourself.

What makes this script unique? Why is it closed source?

While the process described above is fairly unique and sounds simple, the truly important key lies in determining which higher timeframes to fuse together, and how to weight their values when calculating the fused end result in such a way that best leverages their relationship for useful TA.

This MTF Fusion indicator employs a smart, adaptive algorithm which automatically selects appropriate higher timeframes to use in fusion calculations depending on the timeframe of the chart it is applied to. It also uses a dynamic algorithm to adjust and weight the lookbacks used for pivot and S/R level calculations depending on each higher timeframe's relationship to the chart timeframe. These algorithms are based on extensive testing and are the reason behind this script's closed source status.

Included Features

Options

These levels are not programmed to repaint - so you can use them in real-time just as they appeared historically.

What is MTF Fusion?

Multi-Timeframe (MTF) Fusion is the process of combining calculations from multiple timeframes higher than the chart's into one 'fused' value or indicator. It is based on the idea that integrating data from higher timeframes can help us to better identify short-term trading opportunities within the context of long-term market trends.

How does it work?

Let's use the context of this indicator, which calculates S/R Levels based on pivot points, as an example to explain how MTF Fusion works and how you can perform it yourself.

Step 1: Selecting Higher Timeframes

The first step is to determine the appropriate higher timeframes to use for the fusion calculation. These timeframes should typically be chosen based on their ability to provide meaningful price levels and action which actively affect the price action of the smaller timeframe you're focused on. For example, if you are trading the 5 minute chart, you might select the 15 minute, 30 minute, and hourly timeframe as the higher timeframes you want to fuse in order to give you a more holistic view of the trends and action affecting you on the 5 minute. In this indicator, four higher timeframes are automatically selected depending on the timeframe of the chart it is applied to.

Step 2: Gathering Data and Calculations

Once the higher timeframes are identified, the next step is to calculate the data from these higher timeframes that will be used to calculate your fused values. In this indicator, for example, the values of support and resistance levels are calculated by determining pivot points for all four higher timeframes.

Step 3: Fusing the Values From Higher Timeframes

The next step is to actually combine the values from these higher timeframes to obtain your 'fused' indicator values. The simplest approach to this is to simply average them. If you have calculated the value of a support level from three higher timeframes, you can, for example, calculate your 'multi-timeframe fused level' as (HigherTF_Support_Level_1 + HigherTF_Support_Level_2 + HigherTF_Support_Level_3) / 3.0.

Step 4: Visualization and Interpretation

Once the calculations are complete, the resulting fused indicator values are plotted on the chart. These values reflect the fusion of data from the multiple higher timeframes, giving a broader perspective on the market's behavior and potentially valuable insights without the need to manually consider values from each higher timeframe yourself.

What makes this script unique? Why is it closed source?

While the process described above is fairly unique and sounds simple, the truly important key lies in determining which higher timeframes to fuse together, and how to weight their values when calculating the fused end result in such a way that best leverages their relationship for useful TA.

This MTF Fusion indicator employs a smart, adaptive algorithm which automatically selects appropriate higher timeframes to use in fusion calculations depending on the timeframe of the chart it is applied to. It also uses a dynamic algorithm to adjust and weight the lookbacks used for pivot and S/R level calculations depending on each higher timeframe's relationship to the chart timeframe. These algorithms are based on extensive testing and are the reason behind this script's closed source status.

Included Features

- Fusion Support and Resistance Levels

- Dynamic Multi-Timeframe S/R Levels

- Breakaway Zone fills to highlight breakouts and breakdowns from the Fusion S/R Levels

- Customizable lookback approach

- Pre-built color stylings

Options

- Fusion View: Show/hide the Fusion S/R Levels calculated from multiple higher timeframes

- MTF View: Show/hide the S?R levels from multiple higher timeframes used to calculate the Fusion S/R Levels

- Breakaway Zones: Show/hide the fill for zones where price breaks away from the Fusion S/R Levels

- Lookback: Select how you want your S/R Levels to be calculated (longer = long-term levels, shorter = short-term levels)

- Pre-Built Color Styles: Use a pre-built color styling (uncheck to use your own colors)

- Manual Color Styles: When pre-built color styles are disabled, use these color inputs to define your own

ملاحظات الأخبار

request.security() calls set to barmerge.lookahead_off to prevent deceptive calculations.نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.