OPEN-SOURCE SCRIPT

تم تحديثه OVL_Kikoocycle Beta_Pine3

This script use :

- A custom Chande Kroll Stop for generate the channel

- Some custom Parabolic S.A.R for generate cycles

This script can be separated into 3 categories:

- Channel Kroll generator : one layer for the actual interval and a layer for a Large Timeframe .(with ratio) [You can activate LTF with an option]

- "Range" generator : one layer for actual Interval and a layer for a Large Timeframe.(with automique ratio) [You can activate LTF with an option]

-Targets generator : one layer for actual interval with different trend.

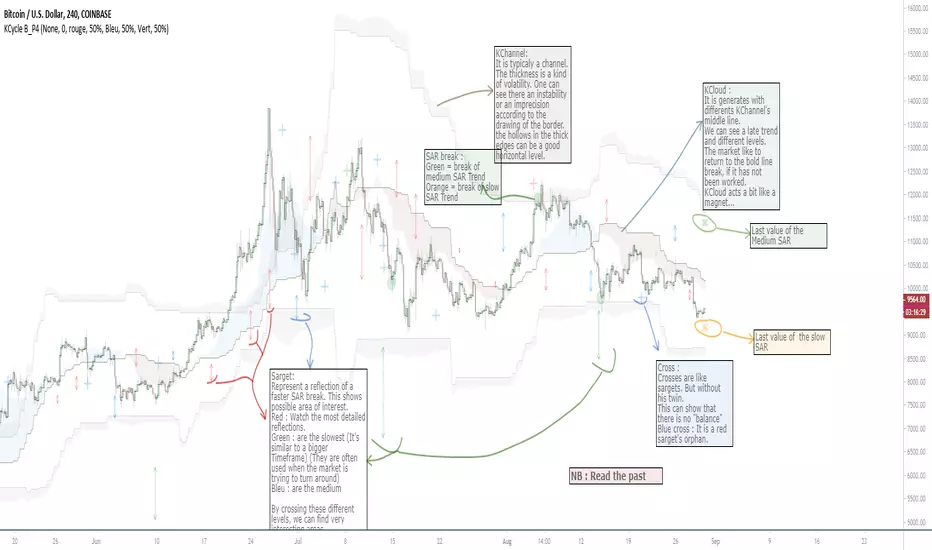

"Channel Kroll" :

- I "hijack" the Chande Kroll Stop formula with custom parameters for generate this channel. Overall, it works like other types of channels like BB, etc... A midline and two borders. The thickness of the borders are relatively important here. A thick border shows some resistance of the area. And so the probability of seeing the market return to its first contact is stronger. While a very thin and vertical border would rather play the role of a breach, a bit like the idea of gaps. Often the market seems to want to go after several cycles.

You can activate its Large TimeFrame version, its midline is strong and fine borders helps to judge the risk.

[u]SARget + "SAR Limited"[/u] :

- (S.A.R + targets) The philosophy of this function is simple... When a small cycle is broken, it creates a mark on a higher cycle. So on until the SAR called "SAR Limited". For simplicity, imagine a fractal image but inverted ... Break the small figure, it will mark the larger figure at this time but to get there you still have to make the way to the small figure.

Targets are : cross ("+") for fast targets(hidden by default because, theire work only on lower interval), squares (for medium trend), Xcross(for large trend) and red cross(they try to find a large contexte). When a target proc, it is for later (market need some cycles for going to, but it is relative to your interval). This gives you speculative goals.

Why 2 targets for a same type and a triangle with a 90deg angle : This give a potential area for management.The triangle help to visualize the SAR and to juge the market reaction. You need to adapte your trade with that...

Targets may be slightly too far because I am a bad coder... Currently the targets appear at the moment of rupture but it would be necessary to wait for the end of the breaking movement. Which can bring a positional error if the break is violent.

RnG and LTF RnG :

- Attempt to generate a Fibo range for each cycle and see interressing areas to enter or exit. This is played with the same philosophy as the Fibo extensions and retracement.

When a new RnG is generated, do not rush. It appears showing 50/50 for both sides. When a new RnG is generated, do not rush. It appears showing 50/50 for both sides. As long as the market is out of the middle zone (the 3 lines) keep in mind the past RnG.

When the market is out of range, you can use the FibRetracement tool for have extensions. One point at each end, as on the presentation graph. (Values 1.14, 1.272, 1.414, 1.618, 1.786, 2, 2.4 and 4 work well.) If too extrem you can active the LTF version.

Never fomo a break, market like to pull a level... Observe and be patient.

It's easier to use than to explain xD

NB : Do not use the LTF as context. For this, it is better to look at a higher interval.

I invite you to look in the style tab of the script and deselect the plots named UNCHECKEME, this will ease your browser.

- A custom Chande Kroll Stop for generate the channel

- Some custom Parabolic S.A.R for generate cycles

This script can be separated into 3 categories:

- Channel Kroll generator : one layer for the actual interval and a layer for a Large Timeframe .(with ratio) [You can activate LTF with an option]

- "Range" generator : one layer for actual Interval and a layer for a Large Timeframe.(with automique ratio) [You can activate LTF with an option]

-Targets generator : one layer for actual interval with different trend.

"Channel Kroll" :

- I "hijack" the Chande Kroll Stop formula with custom parameters for generate this channel. Overall, it works like other types of channels like BB, etc... A midline and two borders. The thickness of the borders are relatively important here. A thick border shows some resistance of the area. And so the probability of seeing the market return to its first contact is stronger. While a very thin and vertical border would rather play the role of a breach, a bit like the idea of gaps. Often the market seems to want to go after several cycles.

You can activate its Large TimeFrame version, its midline is strong and fine borders helps to judge the risk.

[u]SARget + "SAR Limited"[/u] :

- (S.A.R + targets) The philosophy of this function is simple... When a small cycle is broken, it creates a mark on a higher cycle. So on until the SAR called "SAR Limited". For simplicity, imagine a fractal image but inverted ... Break the small figure, it will mark the larger figure at this time but to get there you still have to make the way to the small figure.

Targets are : cross ("+") for fast targets(hidden by default because, theire work only on lower interval), squares (for medium trend), Xcross(for large trend) and red cross(they try to find a large contexte). When a target proc, it is for later (market need some cycles for going to, but it is relative to your interval). This gives you speculative goals.

Why 2 targets for a same type and a triangle with a 90deg angle : This give a potential area for management.The triangle help to visualize the SAR and to juge the market reaction. You need to adapte your trade with that...

Targets may be slightly too far because I am a bad coder... Currently the targets appear at the moment of rupture but it would be necessary to wait for the end of the breaking movement. Which can bring a positional error if the break is violent.

RnG and LTF RnG :

- Attempt to generate a Fibo range for each cycle and see interressing areas to enter or exit. This is played with the same philosophy as the Fibo extensions and retracement.

When a new RnG is generated, do not rush. It appears showing 50/50 for both sides. When a new RnG is generated, do not rush. It appears showing 50/50 for both sides. As long as the market is out of the middle zone (the 3 lines) keep in mind the past RnG.

When the market is out of range, you can use the FibRetracement tool for have extensions. One point at each end, as on the presentation graph. (Values 1.14, 1.272, 1.414, 1.618, 1.786, 2, 2.4 and 4 work well.) If too extrem you can active the LTF version.

Never fomo a break, market like to pull a level... Observe and be patient.

It's easier to use than to explain xD

NB : Do not use the LTF as context. For this, it is better to look at a higher interval.

I invite you to look in the style tab of the script and deselect the plots named UNCHECKEME, this will ease your browser.

ملاحظات الأخبار

Update :- Conversion V5

- Turn off by default "Detailed Sarget"

- Option "GoldenLTF" Spivot preset is broken (Need a square time for understand why, I just turn off this option )

ملاحظات الأخبار

Update :- Fix transparent colors

- Fix "GoldenLTF" Spivot preset

ملاحظات الأخبار

Updates :- Detailed Sarget are not longer calculated when they are hidden

- Fibo ratio adjustment for Detailed Sarget and their orphans

- Add an option show/hide Orphans. Now they are hidden by default

- Add a dark mode option

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.