AlphaSync | QuantEdgeB

🛠️ Overview

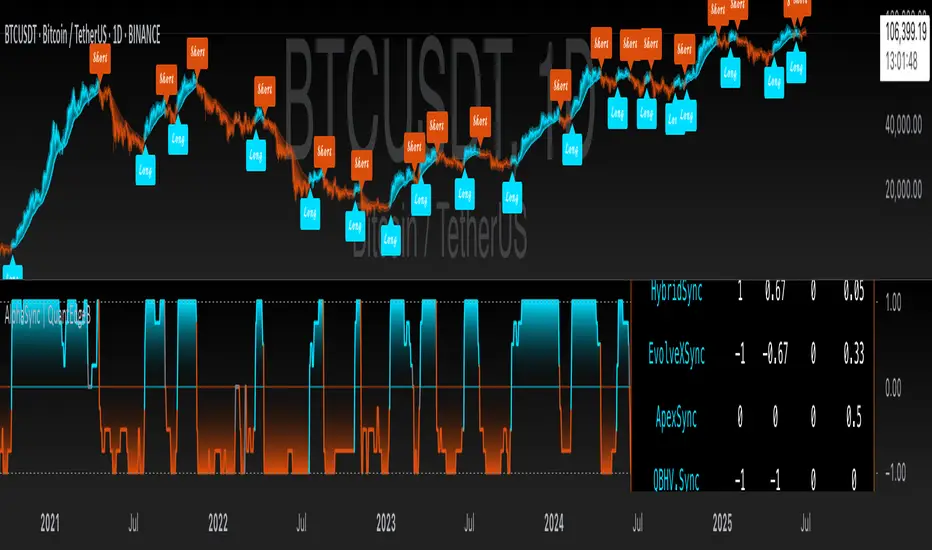

AlphaSync is a comprehensive medium-term market guidance system designed for major assets such as BTC, ETH, and SOL. This system helps traders determine the overall market direction by integrating three universal strategies (EvolveXSync, ApexSync, QBHV Sync) and a Hybrid strategy (HybridSync).

🚀 What Makes AlphaSync Unique?

✅ Multi-Strategy Fusion → A robust blend of technical, economic, on-chain, and volatility-driven insights.

✅ HybridSync Component (90% Non-Price Factors) → Incorporates macro and liquidity signals to balance pure price-based models.

✅ Structured Decision-Making → The Trend Confluence score aggregates all sub-strategies, providing a unified market signal.

__________________________________________________________________________________

✨ Key Features

🔹 HybridSync (Hybrid Model)

Utilizes on-chain, economic, liquidity, and volatility factors to provide a fundamental market risk outlook. Unlike technical models, it derives signals primarily from macroeconomic indicators, risk appetite gauges, and capital flows.

🔹 EvolveXSync, & ApexSync (Technical Strategies)

Both strategies are purely price-based, relying on volatility-adjusted trend models, adaptive moving averages, and statistical deviations to confirm bullish or bearish trends.

🔹 QBHV Sync (Momentum & Deviation-Based System)

A fusion of momentum-deviation and a volatility-driven trend confirmation model, designed to detect shifts in momentum while filtering out market noise.

🔹 Trend Confluence (Final Aggregated Signal)

A weighted combination of all four models, delivering a single, structured signal to eliminate conflicting indicators and refine decision-making.

__________________________________________________________________________________

📊 How It Works

1️⃣ HybridSync – Non-Price Market Structure Analysis

HybridSync is an economic and liquidity-based framework, integrating macro variables, credit spreads, volatility indices, capital flows, and on-chain dynamics to assess risk-on/risk-off conditions.

📌 Key Components:

✔ On-Chain Metrics → Tracks investor behavior, exchange flows, and market cap ratios.

✔ Liquidity Indicators → Monitors global money supply (M2), Federal Reserve balance sheet, credit markets, and capital flows.

✔ Volatility & Risk Metrics → Uses MOVE, VIX, VVIX ratios, and bond market stress indicators to identify risk sentiment shifts.

🔹 Why HybridSync?

• Price alone does not dictate the market; macro liquidity and risk factors are often leading indicators of price movement, especially when it comes to risk assets such as cryptocurrencies.

• Improves decision-making in uncertain market environments, particularly during high-volatility or trendless conditions.

2️⃣ EvolveXSync, & ApexSync – Trend-Following & Volatility Models

Both EvolveXSync, & ApexSync are technical strategies, independently designed to capture trend strength and volatility dynamics.

📌 Core Mechanisms:

✔ VIDYA-Based Trend Detection → Adaptive moving averages adjust dynamically to price swings.

✔ SD-Filtered EMA Models → Uses normalized standard deviation levels to confirm trend validity.

✔ ATR-Adjusted Breakout Filters → Prevents false signals by incorporating dynamic volatility assessments.

🔹 Why Two UniStrategies?

• EvolveXSync, & ApexSync have different calculation methods, providing diverse perspectives on trend confirmation.

• Ensures robustness by mitigating overfitting to a single price-based model.

3️⃣ QBHV Sync – Momentum Deviation & Trend Confirmation

This component blends Bollinger Momentum Deviation (BMD) with a percentile-based trend model to confirm trend shifts.

📌 Core Components:

✔ Bollinger Momentum Deviation → A normalized SMA-SD filter detects overbought/oversold conditions.

✔ Percentile-Based Trend Confirmation → Ensures trends align with long-term volatility structure.

✔ Adaptive Signal Filtering → Prevents unnecessary trade signals by refining thresholds dynamically.

🔹 Why QBHV Sync?

• Adds a statistical layer to trend assessment, preventing whipsaws in volatile conditions.

• Complements HybridSync by ensuring price movements align with broader market forces.

4️⃣ Trend Confluence – The Final Aggregated Signal

AlphaSync blends HybridSync, EvolveXSync, ApexSync, and QBHV Sync into one final output.

📌 How It’s Weighted ? Equal Weight to remove any bias and over-reliance on one input.

✔ HybridSync (Macro & On-Chain Factors) → 25% Weight

✔ UniStrat V1 (Pure Trend) → 25% Weight

✔ UniStrat V2 (Trend + ATR) → 25% Weight

✔ QBHV Sync (Momentum & Deviation) → 25% Weight

🔹 Why Merge These Into One System?

The core philosophy behind AlphaSync is to create a holistic, structured decision-making framework that eliminates the weaknesses of single-method trading approaches. Instead of relying solely on technical indicators, which can lag or fail in macro-driven markets, AlphaSync blends price-based trend signals with macroeconomic, liquidity, and risk-adjusted models.

This multi-layered approach ensures that the system:

✔ Adapts dynamically to different market environments.

✔ Eliminates conflicting signals by creating a structured confluence score.

✔ Prevents over-reliance on a single market model, improving robustness.

📌 Final Signal Interpretation:

✅ Long Signal → AlphaSync Score > Long Threshold

❌ Short Signal → AlphaSync Score < Short Threshold

__________________________________________________________________________________

👥 Who Should Use AlphaSync?

✅ Medium-Term Traders & Portfolio Managers → Ideal for traders who require macro-confirmed trend signals.

✅ Systematic & Quantitative Traders → Designed for algorithmic integration and structured decision-making.

✅ Long-Term Position Traders → Helps identify major trend shifts and capital rotation opportunities.

✅ Risk-Conscious Investors → Incorporates macro volatility assessments to minimize unnecessary risk exposure.

__________________________________________________________________________________

📊 Backtest Mode - Evaluating Historical Performance

AlphaSync includes a fully integrated backtest module, allowing traders to assess its historical performance metrics.

🔹 Backtest Metrics Displayed:

✔ Equity Max Drawdown → Measures historical peak loss.

✔ Profit Factor → Evaluates profitability vs. loss ratio.

✔ Sharpe & Sortino Ratios → Risk-adjusted return metrics.

✔ Total Trades & Win Rate → Performance across different market cycles.

✔ Half Kelly Criterion → Optimal position sizing based on historical returns.

📌 Disclaimer:Backtest results are based on past performance and do not guarantee future success. Always incorporate real-time validation and risk management in live trading.

🚀 Why This Matters?

✅ Strategy Validation → See how AlphaSync performs across various market conditions.

✅ Customizable Analysis → Adjust parameters and observe real-time backtest results.

✅ Risk Awareness → Understand potential drawdowns before deploying capital.

Behavior Across Crypto Majors:

BTC

ETH

SOL

📌 Disclaimer: Backtest results are based on historical data and past market behavior. Performance is not indicative of future results and should not be considered financial advice. Always conduct your own backtests and research before making any investment decisions. 🚀

__________________________________________________________________________________

📌 Customization & Default Settings

📌 AlphaSync Input Parameters & Default Values

🔹 Strategy Configuration

• Color Mode → "Strategy"

• Extra Plots → true

• Long/Cash Signal Label → false

• AlphaSync Dashboard → true

• Enable BackTest Table → false

• Enable Equity Curve → false

• Table Position → "Bottom Left"

• Start Date → '01 Jan 2018 00:00'

• AlphaSync Long Threshold → 0.00

• AlphaSync Short Threshold → 0.00

🔹 QBHV.Sync

• DEMA Source → close

• DEMA Length → 14

• Percentile Length → 35

• ATR Length → 14

• Long Multiplier (ATR Up) → 1.8

• Short Multiplier (ATR Down) → 2.5

• Momentum Length → 8

• Momentum Source → close

• Base Length (SMA Calculation) → 40

• Source for BMD → close

• Standard Deviation Length → 30

• SD Multiplier → 0.7

• Long Threshold → 72

• Short Threshold → 59

🔹 EvolveXSync Configuration

• VIDYA Loop Length → 2

• VIDYA Loop Hist Length → 5

• Vidya Loop Long Threshold → 40

• Vidya Loop Short Threshold → 10

• Dynamic EMA Length → 12

• Dynamic EMA SD Length → 30

• Dynamic EMA Upper SD Weight → 1.032

• Dynamic EMA Lower SD Weight → 1.02

• SD Median Length → 12

• Normalized Median Length → 20

• Median SD Length → 30

• Median Long SD Weight → 0.98

• Median Short SD Weight → 1.04

🔹ApexSync Configuration

• DEMA Length → 30

• DEMA ATR Length → 14

• DEMA ATR Multiplier → 1.0

• G-VIDYA Length → 9

• G-VIDYA Hist Length → 30

• VIDYA ATR Length → 14

• VIDYA ATR Multiplier → 1.7

• SD Kijun Length → 24

• Normalized Kijun Length → 50

• KIJUN SD Length → 32

• KIJUN Long SD Weight → 0.98

• KIJUN Short SD Weight → 1.02

🔹 Risk Mosaic (Macro & Liquidity Component)

• Risk Signal Smoothing Length (EMA) → 8

🚀 AlphaSync is fully customizable to match different market conditions and trading styles

🚀 By default, AlphaSync is optimized for structured, medium-term market guidance.

__________________________________________________________________________________

📌 Conclusion

AlphaSync redefines medium-term trend analysis by merging technical, fundamental, and quantitative models into one unified system. Unlike traditional strategies that rely solely on price action, AlphaSync incorporates macroeconomic and liquidity factors, ensuring a more holistic market view.

🔹 Key Takeaways:

1️⃣ Hybrid + Technical Fusion – Balances macro & price-based strategies for stronger decision-making.

2️⃣ Multi-Factor Trend Aggregation – Reduces false signals by merging independent methodologies.

3️⃣ Structured, Data-Driven Approach – Designed for quantitative trading and risk-aware portfolio allocation.

📌 Master the market with precision and confidence | QuantEdgeB

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

نص برمجي للمستخدمين المدعوين فقط

يمكن فقط للمستخدمين الذين تمت الموافقة عليهم من قبل المؤلف الوصول إلى هذا البرنامج النصي. ستحتاج إلى طلب الإذن والحصول عليه لاستخدامه. يتم منح هذا عادةً بعد الدفع. لمزيد من التفاصيل، اتبع تعليمات المؤلف أدناه أو اتصل ب BaseTrustCapital مباشرة.

لا توصي TradingView بالدفع مقابل برنامج نصي أو استخدامه إلا إذا كنت تثق تمامًا في مؤلفه وتفهم كيفية عمله. يمكنك أيضًا العثور على بدائل مجانية ومفتوحة المصدر في نصوص مجتمعنا.

تعليمات المؤلف

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

إخلاء المسؤولية

نص برمجي للمستخدمين المدعوين فقط

يمكن فقط للمستخدمين الذين تمت الموافقة عليهم من قبل المؤلف الوصول إلى هذا البرنامج النصي. ستحتاج إلى طلب الإذن والحصول عليه لاستخدامه. يتم منح هذا عادةً بعد الدفع. لمزيد من التفاصيل، اتبع تعليمات المؤلف أدناه أو اتصل ب BaseTrustCapital مباشرة.

لا توصي TradingView بالدفع مقابل برنامج نصي أو استخدامه إلا إذا كنت تثق تمامًا في مؤلفه وتفهم كيفية عمله. يمكنك أيضًا العثور على بدائل مجانية ومفتوحة المصدر في نصوص مجتمعنا.

تعليمات المؤلف

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only