PROTECTED SOURCE SCRIPT

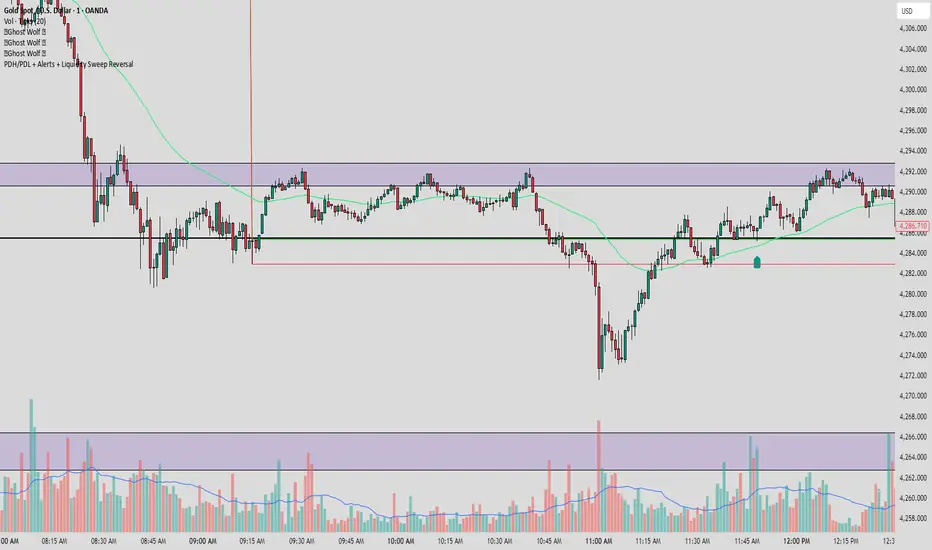

تم تحديثه PDH/PDL + Alerts + Liquidity Sweep Reversal

This indicator is designed for traders who utilize Price Action to identify high-probability reversal zones at daily liquidity levels. It automatically plots the Previous Day High (PDH) and Previous Day Low (PDL) and monitors them for institutional "fake-outs" or liquidity sweeps.

Core Functionality

Daily Liquidity Levels: Automatically fetches and plots the PDH and PDL with custom labels and line styles.

Strict Reversal Logic: Unlike standard breakout indicators, this script looks for specific "trap" behavior where price pierces a level and is immediately rejected.

Institutional Precision Tooltips: Includes built-in precision guides for Wick Percentages and Lookback counts based on professional trading standards.

The "Strict Reversal" Setup

The indicator only triggers a Buy/Sell label when three specific criteria are met:

The Lookback: The level must have been respected as a boundary for a user-defined number of candles (Default: 7), confirming its strength.

The Sequence: The candle must open on the "safe" side of the level, pierce through it to grab liquidity, and then close back on the original side.

The Rejection (Wick %): The candle must leave a significant wick (Default: 72%). This 72% threshold aligns with the 2.5x Wick-to-Body ratio, signaling a violent institutional rejection.

Alert Options

The script features four consolidated alert conditions for seamless automation:

Sell Signal (Rejection): Triggers on strict bearish wick sweeps at key levels.

Buy Signal (Rejection): Triggers on strict bullish wick sweeps at key levels.

Price Cross Up: Alerts when price breaks above either PDH or PDL.

Price Cross Down: Alerts when price breaks below either PDH or PDL.

How to Use

Scalping: Use a 3–5 candle lookback on the 1m or 5m timeframe.

Intraday Reversals: Use the 7–10 candle lookback on the 5m or 15m timeframe for standard SMC setups.

Swing Trading: Use the 15+ candle lookback on the 1h or 4h timeframe to target major daily liquidity pools.

Core Functionality

Daily Liquidity Levels: Automatically fetches and plots the PDH and PDL with custom labels and line styles.

Strict Reversal Logic: Unlike standard breakout indicators, this script looks for specific "trap" behavior where price pierces a level and is immediately rejected.

Institutional Precision Tooltips: Includes built-in precision guides for Wick Percentages and Lookback counts based on professional trading standards.

The "Strict Reversal" Setup

The indicator only triggers a Buy/Sell label when three specific criteria are met:

The Lookback: The level must have been respected as a boundary for a user-defined number of candles (Default: 7), confirming its strength.

The Sequence: The candle must open on the "safe" side of the level, pierce through it to grab liquidity, and then close back on the original side.

The Rejection (Wick %): The candle must leave a significant wick (Default: 72%). This 72% threshold aligns with the 2.5x Wick-to-Body ratio, signaling a violent institutional rejection.

Alert Options

The script features four consolidated alert conditions for seamless automation:

Sell Signal (Rejection): Triggers on strict bearish wick sweeps at key levels.

Buy Signal (Rejection): Triggers on strict bullish wick sweeps at key levels.

Price Cross Up: Alerts when price breaks above either PDH or PDL.

Price Cross Down: Alerts when price breaks below either PDH or PDL.

How to Use

Scalping: Use a 3–5 candle lookback on the 1m or 5m timeframe.

Intraday Reversals: Use the 7–10 candle lookback on the 5m or 15m timeframe for standard SMC setups.

Swing Trading: Use the 15+ candle lookback on the 1h or 4h timeframe to target major daily liquidity pools.

ملاحظات الأخبار

This indicator is designed for traders who utilize Price Action to identify high-probability reversal zones at daily liquidity levels. It automatically plots the Previous Day High (PDH) and Previous Day Low (PDL) and monitors them for institutional "fake-outs" or liquidity sweeps.Core Functionality

Daily Liquidity Levels: Automatically fetches and plots the PDH and PDL with custom labels and line styles.

Strict Reversal Logic: Unlike standard breakout indicators, this script looks for specific "trap" behavior where price pierces a level and is immediately rejected.

Institutional Precision Tooltips: Includes built-in precision guides for Wick Percentages and Lookback counts based on professional trading standards.

The "Strict Reversal" Setup

The indicator only triggers a Buy/Sell label when three specific criteria are met:

The Lookback: The level must have been respected as a boundary for a user-defined number of candles (Default: 7), confirming its strength.

The Sequence: The candle must open on the "safe" side of the level, pierce through it to grab liquidity, and then close back on the original side.

The Rejection (Wick %): The candle must leave a significant wick (Default: 72%). This 72% threshold aligns with the 2.5x Wick-to-Body ratio, signaling a violent institutional rejection.

Alert Options

The script features four consolidated alert conditions for seamless automation:

Sell Signal (Rejection): Triggers on strict bearish wick sweeps at key levels.

Buy Signal (Rejection): Triggers on strict bullish wick sweeps at key levels.

Price Cross Up: Alerts when price breaks above either PDH or PDL.

Price Cross Down: Alerts when price breaks below either PDH or PDL.

How to Use

Scalping: Use a 3–5 candle lookback on the 1m or 5m timeframe.

Intraday Reversals: Use the 7–10 candle lookback on the 5m or 15m timeframe for standard SMC setups.

Swing Trading: Use the 15+ candle lookback on the 1h or 4h timeframe to target major daily liquidity pools.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.