PROTECTED SOURCE SCRIPT

MAC-Z Indicator with Slope-Based Coloring - Vondor X

MAC-Z Indicator with Trend-Based Slope Filtering and Background Shading

Author: Vondor

Description:

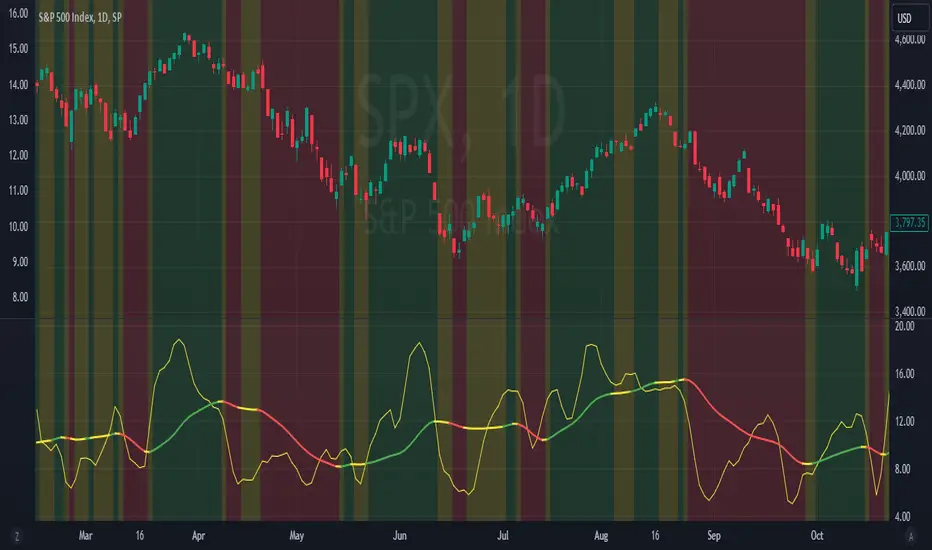

The MAC-Z Indicator is an advanced technical analysis tool designed to assess momentum and trend strength using a combination of Z-score and MACD principles. The indicator applies a calculated MAC-Z value, which is derived from a weighted combination of a VWAP Z-score and MACD-style moving averages. The inclusion of a short-term Simple Moving Average (SMA) on the MAC-Z helps identify potential crossovers, providing signals of momentum changes.

Additionally, this enhanced version incorporates trend-based slope filtering, which adjusts the coloring and background of the chart based on the slope of the MAC-Z SMA (SMAMACZ). The filter helps to distinguish between uptrends, downtrends, and flat trends. Dynamic color coding is used to visualize the direction of the trend:

Green: Uptrend, indicating positive momentum.

Red: Downtrend, indicating negative momentum.

Yellow: Flat or sideways trend.

How It Works:

MAC-Z Calculation: The indicator computes a MAC-Z value, blending the Z-score (a standardized measure of relative price) and MACD (trend-following momentum).

SMA Slope Filter: A short-term SMA on the MAC-Z value smooths the signal, and the slope of this SMA determines trend direction. The slope's magnitude is compared against a threshold to determine whether it is flat, up, or down.

Visual Cues: The indicator uses color coding for the MAC-Z SMA line and applies background shading to highlight uptrend, downtrend, and flat trend conditions.

Inputs:

Z-Score Length (lengthz): Defines the period for calculating the VWAP Z-score.

Standard Deviation Length (lengthStdev): The lookback period for standard deviation in the MACD calculation.

MAC-Z Constant A & B (A, B): Constants used to adjust the impact of the Z-score and MACD in the final MAC-Z formula.

Laguerre Smoothing (useLag, gamma): Optional smoothing using the Laguerre filter to reduce noise.

SMA MAC-Z Length (SZlen): Length of the short SMA applied to the MAC-Z to create crossover signals.

Flat Slope Threshold: Defines the sensitivity for detecting flat trends (default is 0.08).

Usage:

The MAC-Z Indicator is particularly useful for identifying trend reversals, momentum shifts, and spotting overbought/oversold conditions. By filtering out noise using the SMA slope-based coloring, it can help avoid false signals in periods of small oscillations.

Best Timeframes:

This indicator is most effective on longer time periods, such as 4-hour or daily charts, where price movements are more stable and less prone to short-term market noise. Using it on lower timeframes may result in frequent false signals and more "choppy" market conditions.

The background shading and color-coded lines make it easy to spot trend changes, helping traders make informed decisions about entering or exiting trades based on longer-term momentum shifts.

Conclusion:

The MAC-Z Indicator with trend filtering is a powerful tool for identifying momentum-driven market trends. It combines the strengths of Z-scores, MACD, and moving average crossovers to provide clear signals, making it an excellent choice for traders who focus on longer timeframes, such as daily or 4-hour charts, to capture significant trend movements.

Author: Vondor

Description:

The MAC-Z Indicator is an advanced technical analysis tool designed to assess momentum and trend strength using a combination of Z-score and MACD principles. The indicator applies a calculated MAC-Z value, which is derived from a weighted combination of a VWAP Z-score and MACD-style moving averages. The inclusion of a short-term Simple Moving Average (SMA) on the MAC-Z helps identify potential crossovers, providing signals of momentum changes.

Additionally, this enhanced version incorporates trend-based slope filtering, which adjusts the coloring and background of the chart based on the slope of the MAC-Z SMA (SMAMACZ). The filter helps to distinguish between uptrends, downtrends, and flat trends. Dynamic color coding is used to visualize the direction of the trend:

Green: Uptrend, indicating positive momentum.

Red: Downtrend, indicating negative momentum.

Yellow: Flat or sideways trend.

How It Works:

MAC-Z Calculation: The indicator computes a MAC-Z value, blending the Z-score (a standardized measure of relative price) and MACD (trend-following momentum).

SMA Slope Filter: A short-term SMA on the MAC-Z value smooths the signal, and the slope of this SMA determines trend direction. The slope's magnitude is compared against a threshold to determine whether it is flat, up, or down.

Visual Cues: The indicator uses color coding for the MAC-Z SMA line and applies background shading to highlight uptrend, downtrend, and flat trend conditions.

Inputs:

Z-Score Length (lengthz): Defines the period for calculating the VWAP Z-score.

Standard Deviation Length (lengthStdev): The lookback period for standard deviation in the MACD calculation.

MAC-Z Constant A & B (A, B): Constants used to adjust the impact of the Z-score and MACD in the final MAC-Z formula.

Laguerre Smoothing (useLag, gamma): Optional smoothing using the Laguerre filter to reduce noise.

SMA MAC-Z Length (SZlen): Length of the short SMA applied to the MAC-Z to create crossover signals.

Flat Slope Threshold: Defines the sensitivity for detecting flat trends (default is 0.08).

Usage:

The MAC-Z Indicator is particularly useful for identifying trend reversals, momentum shifts, and spotting overbought/oversold conditions. By filtering out noise using the SMA slope-based coloring, it can help avoid false signals in periods of small oscillations.

Best Timeframes:

This indicator is most effective on longer time periods, such as 4-hour or daily charts, where price movements are more stable and less prone to short-term market noise. Using it on lower timeframes may result in frequent false signals and more "choppy" market conditions.

The background shading and color-coded lines make it easy to spot trend changes, helping traders make informed decisions about entering or exiting trades based on longer-term momentum shifts.

Conclusion:

The MAC-Z Indicator with trend filtering is a powerful tool for identifying momentum-driven market trends. It combines the strengths of Z-scores, MACD, and moving average crossovers to provide clear signals, making it an excellent choice for traders who focus on longer timeframes, such as daily or 4-hour charts, to capture significant trend movements.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.