OPEN-SOURCE SCRIPT

تم تحديثه [blackcat] L3 Counter Peacock Spread

█ OVERVIEW

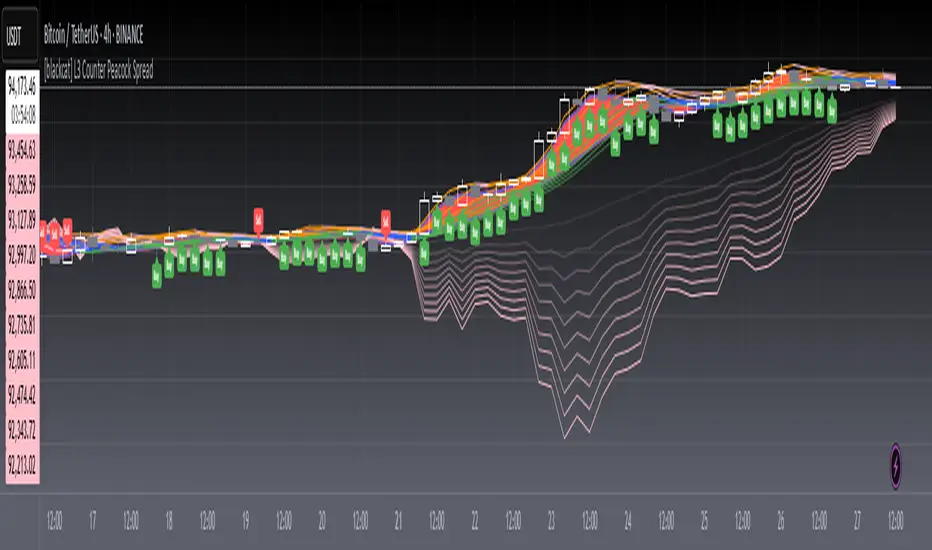

The script titled "[blackcat] L3 Counter Peacock Spread" is an indicator designed for use in TradingView. It calculates and plots various moving averages, K lines derived from these moving averages, additional simple moving averages (SMAs), weighted moving averages (WMAs), and other technical indicators like slope calculations. The primary function of the script is to provide a comprehensive set of visual tools that traders can use to identify trends, potential support/resistance levels, and crossover signals.

█ LOGICAL FRAMEWORK

Input Parameters:

There are no explicit input parameters defined; all variables are hardcoded or calculated within the script.

Calculations:

• Moving Averages: Calculates Simple Moving Averages (SMA) using ta.sma.

• Slope Calculation: Computes the slope of a given series over a specified period using linear regression (ta.linreg).

• K Lines: Defines multiple exponentially adjusted SMAs based on a 30-period MA and a 1-period MA.

• Weighted Moving Average (WMA): Custom function to compute WMAs by iterating through price data points.

• Other Indicators: Includes Exponential Moving Average (EMA) for momentum calculation.

Plotting:

Various elements such as MAs, K lines, conditional bands, additional SMAs, and WMAs are plotted on the chart overlaying the main price action.

No loops control the behavior beyond those used in custom functions for calculating WMAs. Conditional statements determine the coloring of certain plot lines based on specific criteria.

█ CUSTOM FUNCTIONS

█ KEY POINTS AND TECHNIQUES

• Advanced Pine Script Features: Utilization of custom functions for encapsulating complex logic, leveraging TradingView’s library functions (ta.sma, ta.linreg, ta.ema) for efficient computations.

• Optimization Techniques: Efficient computation of K lines via pre-calculated components (multiples of MA30 and MA1). Use of arrays to store intermediate results which simplifies plotting.

• Best Practices: Clear separation between calculation and visualization sections enhances readability and maintainability. Usage of color.new() allows dynamic adjustments without hardcoding colors directly into plot commands.

• Unique Approaches: Introduction of K lines provides an alternative representation of trend strength compared to traditional MAs. Implementation of conditional band coloring adds real-time context to existing visual cues.

█ EXTENDED KNOWLEDGE AND APPLICATIONS

Potential Modifications/Extensions:

• Adding more user-defined inputs for lengths of MAs, K lines, etc., would make the script more flexible.

• Incorporating alert conditions based on crossovers between key lines could enhance automated trading strategies.

Application Scenarios:

• Useful for both intraday and swing trading due to the combination of short-term and long-term MAs along with trend analysis via slopes and K lines.

• Can be integrated into larger systems combining this indicator with others like oscillators or volume-based metrics.

Related Concepts:

• Understanding how linear regression works internally aids in grasping the slope calculation.

• Familiarity with WMA versus SMA helps appreciate why different types of averaging might be necessary depending on market dynamics.

• Knowledge of candlestick patterns can complement insights gained from this indicator.

The script titled "[blackcat] L3 Counter Peacock Spread" is an indicator designed for use in TradingView. It calculates and plots various moving averages, K lines derived from these moving averages, additional simple moving averages (SMAs), weighted moving averages (WMAs), and other technical indicators like slope calculations. The primary function of the script is to provide a comprehensive set of visual tools that traders can use to identify trends, potential support/resistance levels, and crossover signals.

█ LOGICAL FRAMEWORK

Input Parameters:

There are no explicit input parameters defined; all variables are hardcoded or calculated within the script.

Calculations:

• Moving Averages: Calculates Simple Moving Averages (SMA) using ta.sma.

• Slope Calculation: Computes the slope of a given series over a specified period using linear regression (ta.linreg).

• K Lines: Defines multiple exponentially adjusted SMAs based on a 30-period MA and a 1-period MA.

• Weighted Moving Average (WMA): Custom function to compute WMAs by iterating through price data points.

• Other Indicators: Includes Exponential Moving Average (EMA) for momentum calculation.

Plotting:

Various elements such as MAs, K lines, conditional bands, additional SMAs, and WMAs are plotted on the chart overlaying the main price action.

No loops control the behavior beyond those used in custom functions for calculating WMAs. Conditional statements determine the coloring of certain plot lines based on specific criteria.

█ CUSTOM FUNCTIONS

- calculate_slope(src, length):

• Purpose: To calculate the slope of a time-series data point over a specified number of periods.

• Functionality: Uses linear regression to find the current and previous slopes and computes their difference scaled by the timeframe multiplier.

• Parameters:

– src: Source of the input data (e.g., closing prices).

– length: Periodicity of the linreg calculation.

• Return Value: Computed slope value. - calculate_ma(source, length):

• Purpose: To calculate the Simple Moving Average (SMA) of a given source over a specified period.

• Functionality: Utilizes TradingView’s built-in ta.sma function.

• Parameters:

– source: Input data series (e.g., closing prices).

– length: Number of bars considered for the SMA calculation.

• Return Value: Calculated SMA value. - calculate_k_lines(ma30, ma1):

• Purpose: Generates multiple exponentially adjusted versions of a 30-period MA relative to a 1-period MA.

• Functionality: Multiplies the 30-period MA by coefficients ranging from 1.1 to 3 and subtracts multiples of the 1-period MA accordingly.

• Parameters:

– ma30: 30-period Simple Moving Average.

– ma1: 1-period Simple Moving Average.

• Return Value: Returns an array containing ten different \u2003\u2022 "K line" values. - calculate_wma(source, length):

• Purpose: Computes the Weighted Moving Average (WMA) of a provided series over a defined period.

• Functionality: Iterates backward through the last 'n' bars, weights each bar according to its position, sums them up, and divides by the total weight.

• Parameters:

– source: Price series to average.

– length: Length of the lookback window.

• Return Value: Calculated WMA value.

█ KEY POINTS AND TECHNIQUES

• Advanced Pine Script Features: Utilization of custom functions for encapsulating complex logic, leveraging TradingView’s library functions (ta.sma, ta.linreg, ta.ema) for efficient computations.

• Optimization Techniques: Efficient computation of K lines via pre-calculated components (multiples of MA30 and MA1). Use of arrays to store intermediate results which simplifies plotting.

• Best Practices: Clear separation between calculation and visualization sections enhances readability and maintainability. Usage of color.new() allows dynamic adjustments without hardcoding colors directly into plot commands.

• Unique Approaches: Introduction of K lines provides an alternative representation of trend strength compared to traditional MAs. Implementation of conditional band coloring adds real-time context to existing visual cues.

█ EXTENDED KNOWLEDGE AND APPLICATIONS

Potential Modifications/Extensions:

• Adding more user-defined inputs for lengths of MAs, K lines, etc., would make the script more flexible.

• Incorporating alert conditions based on crossovers between key lines could enhance automated trading strategies.

Application Scenarios:

• Useful for both intraday and swing trading due to the combination of short-term and long-term MAs along with trend analysis via slopes and K lines.

• Can be integrated into larger systems combining this indicator with others like oscillators or volume-based metrics.

Related Concepts:

• Understanding how linear regression works internally aids in grasping the slope calculation.

• Familiarity with WMA versus SMA helps appreciate why different types of averaging might be necessary depending on market dynamics.

• Knowledge of candlestick patterns can complement insights gained from this indicator.

ملاحظات الأخبار

OVERVIEWThe script provides a comprehensive moving average crossover strategy using red, blue, green, and pink moving average clusters to help traders identify market trends, support and resistance levels, and generate buy and sell signals through moving average crossovers.

FEATURES

Red moving average cluster for long-term trends (e.g., 200-day moving average)

Blue moving average cluster for medium-term trends (e.g., 50-day moving average)

Green moving average cluster for short-term trends (e.g., 10-day moving average)

Pink moving average cluster for reverse trend opportunities

Visual alerts for crossover events

Option to enable or disable sound alerts

Customizable colors for moving averages and signals

HOW TO USE

Install the script on your TradingView chart.

Customize the settings in the "Inputs" section:

Set the lengths for the red, blue, green, and pink moving averages

Choose the colors for each moving average cluster

Enable or disable sound alerts

Observe the chart for crossover signals between the moving averages.

Use the signals as a basis for making trading decisions, considering the market context and combining with other indicators.

MOVING AVERAGE CLUSTERS

Red Cluster: Represents long-term trends (e.g., 200-day moving average)

Blue Cluster: Represents medium-term trends (e.g., 50-day moving average)

Green Cluster: Represents short-term trends (e.g., 10-day moving average)

Pink Cluster: Identifies short-term trading opportunities against the main trend

SIGNALS AND TRENDS

Buy Signal: Short-term moving average crossing above medium or long-term moving average

Sell Signal: Short-term moving average crossing below medium or long-term moving average

Trend Reversal: Pink moving average crossing other moving averages to indicate potential trend reversals

LIMITATIONS

The script is based on historical data and does not guarantee future performance.

It is recommended to use the script in conjunction with other analysis tools.

The effectiveness of the strategy may vary depending on the market conditions and asset being traded.

Trading against the trend (using the pink cluster) carries higher risks and requires strict stop-losses and signal confirmation.

NOTES

The script is designed for educational purposes and should not be considered financial advice.

Users are encouraged to backtest the strategy on a demo account before applying it to live trades.

Insights from different moving average clusters can provide a more comprehensive view of market trends and potential turning points.

THANKS

Special thanks to the TradingView community for their support and feedback.

ملاحظات الأخبار

OVERVIEW The L3 Counter Peacock Spread indicator is a comprehensive trading tool that combines multiple moving averages, weighted moving averages, and K-line analysis to identify potential entry points in the market.FEATURES

• Multiple Moving Averages:

MA3, MA10, and MA30 lines

Customizable slope calculation function

Dynamic band visualization between key MAs

• Advanced Technical Analysis:

Calculated K-lines ranging from K1 to K20

Weighted Moving Average implementation

EMA-based momentum measurement (MMV)

SSL channel integration

• Trend Detection Tools:

Daily SMAs (D3-D11) with dynamic coloring

WMA overlays with directional indication

Slope trend detection system

HOW TO USE

Setup:

Apply the script on your desired chart timeframe

Adjust max_labels_count if needed for higher resolution charts

Interpretation:

Monitor crossover patterns between different MA bands

Observe K-line formations within the spread pattern

Watch for divergences or convergences among overlapping indicators

Trading Signals:

Look for green up arrows indicating bullish setups

Identify red down arrows signaling bearish opportunities

Consider alert notifications as additional confirmation

LIMITATIONS

• The strategy may produce false signals during highly volatile periods.

• Best suited for longer timeframes where trends are more defined.

• Performance can vary across different asset classes and markets.

NOTES

This indicator should be used alongside other forms of technical analysis and risk management strategies. It's recommended to backtest thoroughly before applying it to live trading situations.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

إخلاء المسؤولية

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

إخلاء المسؤولية

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.