OPEN-SOURCE SCRIPT

Mean Reversion Trading V1

Overview

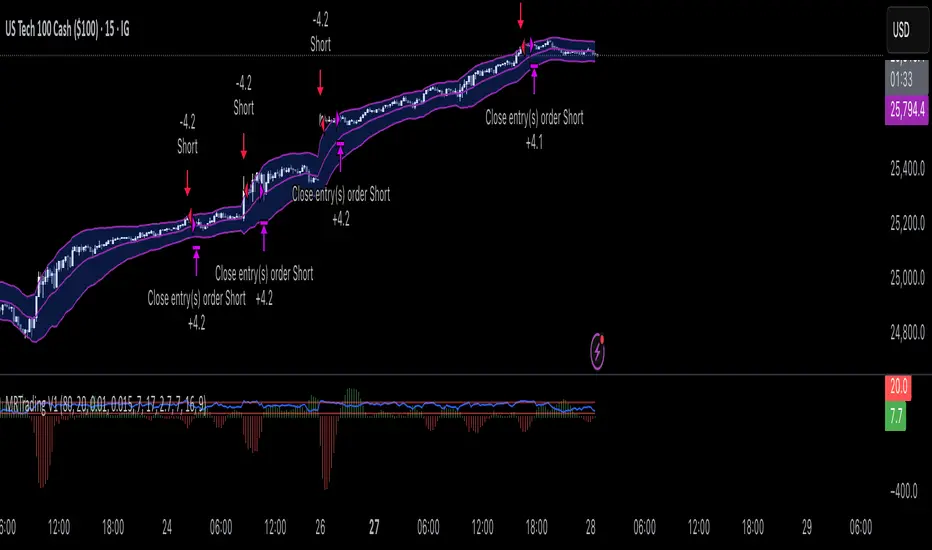

This is a simple mean reversion strategy that combines RSI, Keltner Channels, and MACD Histograms to predict reversals. Current parameters were optimized for NASDAQ 15M and performance varies depending on asset. The strategy can be optimized for specific asset and timeframe.

How it works

Long Entry (All must be true):

1. RSI < Lower Threshold

2. Close < Lower KC Band

3. MACD Histogram > 0 and rising

4. No open trades

Short Entry (All must be true):

1. RSI > Upper Threshold

2. Close > Upper KC Band

3. MACD Histogram < 0 and falling

4. No open trades

Long Exit:

1. Stop Loss: Average position size x ( 1 - SL percent)

2. Take Profit: Average position size x ( 1 + TP percent)

3. MACD Histogram crosses below zero

Short Exit:

1. Stop Loss: Average position size x ( 1 + SL percent)

2. Take Profit: Average position size x ( 1 - TP percent)

3. MACD Histogram crosses above zero

Settings and parameters are explained in the tooltips.

Important

Initial capital is set as 100,000 by default and 100 percent equity is used for trades

This is a simple mean reversion strategy that combines RSI, Keltner Channels, and MACD Histograms to predict reversals. Current parameters were optimized for NASDAQ 15M and performance varies depending on asset. The strategy can be optimized for specific asset and timeframe.

How it works

Long Entry (All must be true):

1. RSI < Lower Threshold

2. Close < Lower KC Band

3. MACD Histogram > 0 and rising

4. No open trades

Short Entry (All must be true):

1. RSI > Upper Threshold

2. Close > Upper KC Band

3. MACD Histogram < 0 and falling

4. No open trades

Long Exit:

1. Stop Loss: Average position size x ( 1 - SL percent)

2. Take Profit: Average position size x ( 1 + TP percent)

3. MACD Histogram crosses below zero

Short Exit:

1. Stop Loss: Average position size x ( 1 + SL percent)

2. Take Profit: Average position size x ( 1 - TP percent)

3. MACD Histogram crosses above zero

Settings and parameters are explained in the tooltips.

Important

Initial capital is set as 100,000 by default and 100 percent equity is used for trades

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.