PROTECTED SOURCE SCRIPT

تم تحديثه Gabriel's Crypto Cycle Master [Multi-Asset]

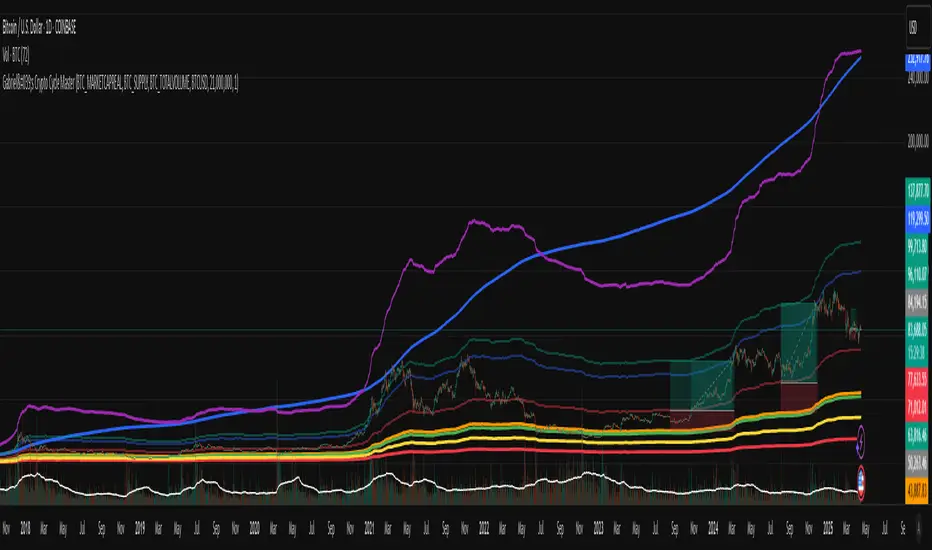

🧠 Gabriel's Crypto Cycle Master [Multi-Asset]

Gabriel’s Crypto Cycle Master is a comprehensive macro valuation tool designed to identify long-term accumulation and distribution zones for any crypto asset using custom on-chain and price-based models.

🔹 Fully Multi-Asset Support

Manually input full tickers from COINMETRICS, GLASSNODE, or INDEX to track:

Realized Market Cap

On-chain Supply

Total Transaction Volume

USD-denominated Price

🔹 Core Metrics Modeled

This script computes major macroeconomic valuation layers based on widely researched concepts:

Realized Price – Network's cost basis

Top Cap – 35× average historical cap

Delta Top – Gap between Realized Price and Average Cap

CVDD – Cumulative Value Days Destroyed

Terminal Price – Network floor based on age and velocity

Balanced Price – Realized minus Terminal (via regression)

🔹 Advanced Bands for Over/Undervaluation

Around Realized Price, this tool dynamically plots:

Golden Ratio Band (×φ) — "Warm Zone" undervaluation

Euler's e Band (×e) — "Caution Zone" deeper value

Pi Band (×π) — "Overheated" zone when crossed upward

🔹 Built-in Alerts

Alerts fire when:

Price crosses below or above any band

Price drops under Terminal Price

Price recovers above the network floor

🔹 Ideal For

Long-term crypto cycle investors

On-chain analysts

DCA accumulation and distribution timing

Macro-level Bitcoin or ETH valuation zones

⚙️ Setup

Manually enter tickers for Market Cap, Supply, Volume, and Price for your preferred crypto asset.

Adjust CVDD cap (21M for BTC, ~120M for ETH) if analyzing a different coin.

Enable/disable specific valuation layers and alert bands via checkboxes.

Built by OneWallStreetQuant | Dynamic adaptation by Gabriel

Published for educational and cycle analysis use — not financial advice.

Ideal for Daily Charts, since the estimate formula was created on that timeframe.

Gabriel’s Crypto Cycle Master is a comprehensive macro valuation tool designed to identify long-term accumulation and distribution zones for any crypto asset using custom on-chain and price-based models.

🔹 Fully Multi-Asset Support

Manually input full tickers from COINMETRICS, GLASSNODE, or INDEX to track:

Realized Market Cap

On-chain Supply

Total Transaction Volume

USD-denominated Price

🔹 Core Metrics Modeled

This script computes major macroeconomic valuation layers based on widely researched concepts:

Realized Price – Network's cost basis

Top Cap – 35× average historical cap

Delta Top – Gap between Realized Price and Average Cap

CVDD – Cumulative Value Days Destroyed

Terminal Price – Network floor based on age and velocity

Balanced Price – Realized minus Terminal (via regression)

🔹 Advanced Bands for Over/Undervaluation

Around Realized Price, this tool dynamically plots:

Golden Ratio Band (×φ) — "Warm Zone" undervaluation

Euler's e Band (×e) — "Caution Zone" deeper value

Pi Band (×π) — "Overheated" zone when crossed upward

🔹 Built-in Alerts

Alerts fire when:

Price crosses below or above any band

Price drops under Terminal Price

Price recovers above the network floor

🔹 Ideal For

Long-term crypto cycle investors

On-chain analysts

DCA accumulation and distribution timing

Macro-level Bitcoin or ETH valuation zones

⚙️ Setup

Manually enter tickers for Market Cap, Supply, Volume, and Price for your preferred crypto asset.

Adjust CVDD cap (21M for BTC, ~120M for ETH) if analyzing a different coin.

Enable/disable specific valuation layers and alert bands via checkboxes.

Built by OneWallStreetQuant | Dynamic adaptation by Gabriel

Published for educational and cycle analysis use — not financial advice.

Ideal for Daily Charts, since the estimate formula was created on that timeframe.

ملاحظات الأخبار

I added scaling; however, inputting the tickers yourself is still the best for altcoins.ملاحظات الأخبار

I added two new bands based off top cap & delta topنص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

Gabriel Amadeus

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

Gabriel Amadeus

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.