MACD 50x Leveraged Short Strategy with Real Equity

Hello there ,

Short version of the Macd Long strategy.

MACD Long strategy:

Adding margin: Forbidden or not specified. (Add Margin : No)

Position size: (for each trade) 1%

Stop-Loss: (2% Above Entry Level)

Long: macd crossunder

Exit: macd crossover

Or ofc touching the stop-Loss value as predicted.

These strategies are just examples.

The goal is to observe true equity and equity change.

Warning: This strategy simulation is for Short direction only.

Regards.

Macd-v

MACD 50x Leveraged Long Strategy Results with Real Equity Hello there.

I was looking for a way to simulate leveraged transactions in Tradingview and this script came out.

You can examine the equity graph without looking at the strategy results.

Thus, the facts will come to light.

Strategy parameters:

Adding margin: Forbidden or not specified. (Add Margin : No)

Position size: (for each trade) 1%

Stop-Loss: (2%)

Long: macd crossover

Exit: macd crossunder

Or ofc touching the stop-Loss value as predicted.

Warning: This strategy simulation is for Long direction only.

Regards.

MACD Strategy with trailing ATR stopThis is a trend based strategy that uses EMA and SMA intersection for determining the direction of the trend and MACD for the entry signal. At the same time, the strategy uses ATR, which is working as a trailing stop.

The strategy entry will work when the Trend ribbon will turn green and MACD line will crossover the signal line. This strategy also takes into account the pyramiding and allows to enter the second time if the signal will repeat itself.

There are 3 exit points. The first 10% of the position will be closed when the price will increase by 1%. The second portion of 50% will be closed when the price reaches 5% Take profit target. The remaining 40 % of the position will wait for the exit signal which will occur when the price closes below the ATR line.

The strategy is using a fixed amount in dollars, each time the entry occurs the strategy will enter with 100$ in the order.

The strategy can be applied to other crypto assets. However, they will require input changes.

Best of luck with your trading.

Crypto BOT lower timeframesThis is a crypto bot designed for lower time frames.

Its made of 2 EMA, one fast and one slower . They are combined together with Stochastic, MACD and price action patterns.

For entries we have multiple conditions :

First we check if one of our last 4 closed candles crossed above or below the faster EMA. After that for long, we check that last close is above the fast EMA, that the fast ema is above the slower EMA, at the same time that the histogram from MACD is positive and that we have crossover with the oversold line on stochastic. For the short , the opposite of long.

For exit we have TP/SL mechanic based on price % movement, in this example if the price moved 10% from the initial position it will exit.

BTC and ETH Long strategy - version 2I wrote my first article in May 2020. See below

BTC and ETH Long strategy - version1

After 6 months, it is now time to check the result of my script for the last 6 months.

XBTUSD (4H): 14/05/2020 --> 22/11/2020 = +78% in 4 trades

ETHXBT (4H): 14/05/2020 --> 22/11/2020 = +21% in 9 trades

ETHUSD (4H): 14/05/2020 --> 22/11/2020 = +90% in 6 trades

Using the signals from this strategy to trade manually has shown that this was a bit frustrating because of the low rate of winning trades.

If you have to enter 100 trades and see 75% of them failing and 25% winning, this is frustrating. For sure the strategy makes good money but it is difficult to hold this mentality.

So, I have reviewed and modified it to get a higher winning rate.

After few days of work, tests and validation, I managed to get a wining rate close to 60%.

The key element was also to decrease the number of trades by using a higher time frame. (4H candles instead of 2H candles).

- Entry in position is based on

MACD, EMA (20), SMA (100), SMA (200) moving up

AND EMA (20) > SMA (100)

AND SMA (100) > SMA (200)

- Exit the position if: Stoploss is reached OR EMA (20) crossUnder SMA (100)

The goal of this new script is to be able to follow the signals manually and only make few trades per years.

I have also validated it against some other altcoins where some are giving very good results.

Here are some results for 2020 (from 01/01/2020 until now (22/11/2020). Those results are the one I get when using 4H candles.

ETH/USD: +144% in 8 trades.

BTC/USD: +120% in 7 trades.

ETH/BTC: +33% in 9 trades.

ICX/USD: +123% in 10 trades.

LINK/USD: +155% in 11 trades.

MLN/USD: +388% in 8 trades.

ADA/USD: +180% in 7 trades.

LINK/BTC: +97% in 10 trades.

The best is that above results are without considering compound effect. If you re-invest all gains done in each new trade, this will give you the below results :)

ETH/USD: +189% in 8 trades.

BTC/USD: +260% in 7 trades.

ETH/BTC: +29% in 9 trades.

ICX/USD: +112% in 10 trades.

LINK/USD: +222% in 11 trades.

MLN/USD: +793% in 8 trades.

ADA/USD: +319% in 7 trades.

LINK/BTC: +103% in 10 trades.

As you can see, the results are good and the number of trades for 11 months is not big, which allows the trader to place orders manually.

But still, I'm lazy :), so, I have also coded this strategy in HaasScript language which allows you to automate this strategy using the HaasOnline software specialized in automated crypto trading.

I hope that this strategy will give you ideas or will be the starting point for your own strategy.

Let me know if you need more details.

Amazing strategy for silver -XAGUSD, XAGEUR etcToday I bring an amazing strategy that works for 1h time frames for silver.

Its made of price actions movement combined together with MACD and simple moving average

It does not use neither stop loss/take profit levels. Instead it will always exit at the next candle after it opens a trade.

The rules are the next one :

For short condition : we have a bull candle, and candle is above the moving average, and MACD histogram is > 0 and last high0 and candle close > last high1 and, previus high1 and candle close > last high2

At the same time, viceversa for long condition.

In development terms, this is the formula

long1 = (close > open ) and time_cond and close > out and hist > 0 and hist > hist and high > high and high > high and close > high and close > high and close > high

short1 = (close < open) and time_cond and close < out and hist < 0 and hist < hist and low < low and low < low and close < low and close < low and close < low

But when we enter the trade, we enter in reverse, like lets say we go long -> for this we apply the short1 condition. If we go short we apply the long1 condition.

If you have any questions , please let me know .

Stock Market Strategy : VWAP, MACD, EMA, Breakout, BBHello there,

Today I bring you a stock market strategy, specialized in NASDAQ stocks.

Its a daytrading strategy, that can only do a max of 1 trade per day. In this case it only trades the first 2 opening hours of the market.

The rules are simple :

We follow the trend based on a big EMA, in this case 200, after that, we check for VWAP direction , then, we check histogram from MACD. This is the simple logic of the strategy.

Inside there is another strategy, that not just do the above, but also uses Bollinger bands, and checks for breakout of bottom or top line. Also it uses Average directional Index, for even a bigger criteria .

So for example a long condition it would be : candle is above the ema, and candle is above vwap, and histogram is positive, and candle break the top bb level and ADI < 40 -> long signal . The opposite works for short(ADI > 20).

In this case all this criterias are between the first 2 hours of market. So we enter between the first hour, and exit in the next hour. For this we need to use very short time frames.

Hope you enjoy it.

Let me know if you have any questions

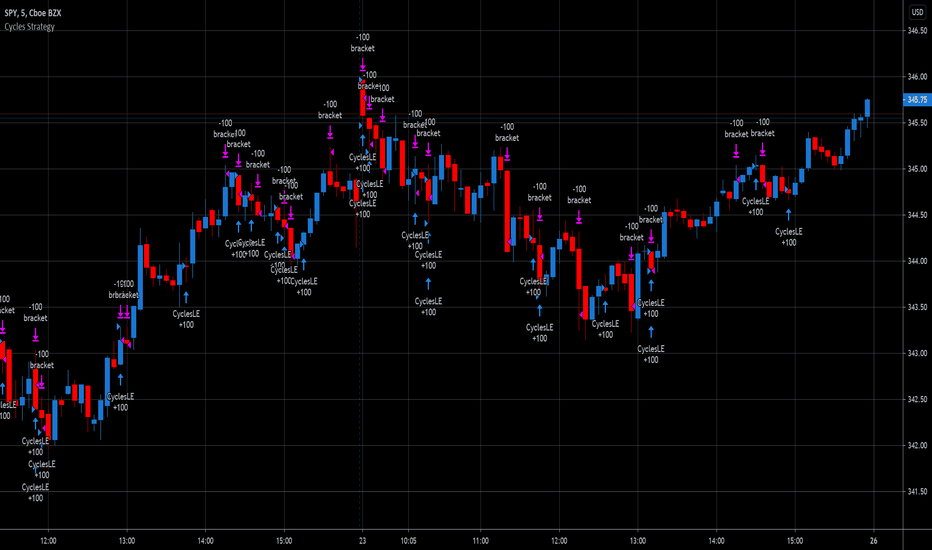

Cycles StrategyThis is back-testable strategy is a modified version of the Stochastic strategy. It is meant to accompany the modified Stochastic indicator: "Cycles".

Modifications to the Stochastic strategy include;

1. Programmable settings for the Stochastic Periods (%K, %D and Smooth %K).

2. Programmable settings for the MACD Periods (Fast, Slow, Smoothing)

3. Programmable thresholds for %K, to qualify a potential entry strategy.

4. Programmable thresholds for %D, to qualify a potential exit strategy.

5. Buttons to choose which components to use in the trading algorithm.

6. Choose the month and year to back test.

The trading algorithm:

1. When %K exceeds the upper/lower threshold and then hooks down/up, in the direction of the Moving Average (MA). This is the minimum entry qualification.

2. When %D exceeds the lower/upper threshold and angled in the direction of the trade, is the exit qualification.

3. Additional entry filters include the direction of MACD, Signal and %D. Also, the "cliff", being a long entry is a higher high or a short entry is a lower low.

4. Strategy can only go "Long" or "Short" depending on the selected setting.

5. By matching the settings in the "Cycles" indicator, you can (almost) see what the strategy is doing.

6. Be sure to select the "Recalculate" buttons, to recalculate on every new Tick, for best results.

Please click the Like button and leave a comment if you appreciate this script. Improvements will be implemented as time goes on.

I am not a licensed trade advisor. This strategy is for entertainment only. Use at your own risk!

Simple and efficient MACD crypto strategy with risk managementToday I am glad to bring you another great creation suited for crypto markets.

MARKET

Its a simple and efficient strategy, designed for crypto markets( btcusd , btcusdt and so on), and suited for for higher time charts : like 1hour, 4hours, 1 day and so on.

Preferably to use 1h time charts.

COMPONENTS

MACD with simple moving average

ENTRY DESCRIPTION

For entries we have :

We check the direction with MACD . Depending if its an uptrend and positive level on histogram of MACD we go long, otherwise we go short.

RISK MANAGEMENT

In this strategy we use a stop loss based on our equity. For this example I choosed a 2% risk .That means if our account has 100.000 eur, it will automatically close the trade if we lose 2.000.

We dont use a take profit level.

In this example also we use a 100.000 capital account, risking 5% on each trade, but since its underleveraged, we only use 5000 of that ammount on every trade. With leveraged it can be achieved better profits and of course at the same time we will encounter bigger losses.

The comission applied is 5$ and a slippage of 5 points aswell added.

For any questions or suggestions regarding the script , please let me know.

High/low crypto strategy with MACD/PSAR/ATR/EWaveToday I am glad to bring you another great creation of mine, this time suited for crypto markets.

MARKET

Its a high and low strategy, designed for crypto markets( btcusd , btcusdt and so on), and suited for for higher time charts : like 1hour, 4hours, 1 day and so on.

Preferably to use 1h time charts.

COMPONENTS

Higher high and lower low between different candle points

MACD with simple moving average

PSAR for uptrend and downtrend

Trenddirection made of a modified moving average and ATR

And lastly elliot wave oscillator to have an even better precision for entries and exits.

ENTRY DESCRIPTION

For entries we have : when the first condition is meet(we have a succession on higher high or lower lows), then we check the macd histogram level, then we pair that with psar for the direction of the trend, then we check the trend direction based on atr levels with MA applied on it and lastly to confirm the direction we check the level of elliot wave oscillator. If they are all on the same page we have a short or a long entry.

STATS

Its a low win percentage , we usually have between 10-20% win rate, but at the same time we use a 1:30 risk reward ratio .

By this we achieve an avg profit factor between 1.5- 2.5 between different currencies.

RISK MANAGEMENT

In this example, the stop loss is 0.5% of the price fluctuation ( 10.000 -> 9950 our sl), and tp is 15% (10.000 - > 11500).

In this example also we use a 100.000 capital account, risking 5% on each trade, but since its underleveraged, we only use 5000 of that ammount on every trade. With leveraged it can be achieved better profits and of course at the same time we will encounter bigger losses.

The comission applied is 5$ and a slippage of 5 points aswell added.

For any questions or suggestions regarding the script , please let me know.

Full strategy AllinOne with risk management MACD RSI PSAR ATR MAHey, I am glad to present you one of the strategies where I put a lot of time in it.

This strategy can be adapted to all type of timecharts like scalping, daytrading or swing.

The context is the next one :

First we have the ATR to calculate our TP/SL points. At the same time we have another rule once we enter(we enter based on % risk from total equity, in this example 1%, at the same time, lowest ammount for this example is 0.1 lots, but can be modified to 0.01), so we can exit both by tp/sl points, or by losing 1% of our equity or winning 1% of our total equity. It's dinamic.

The strategy is made from

Trend direction :

PSAR

First confirmation point :

Crossover between 10EMA and Bollinger bands middle point

Second confirmation

MACD histogram

Third confirmation

RSI overbought/oversold levels

For entries : we check trend with psar, then once ema cross bb middle point, we confirm together with rsi level for overbought/oversold and macd histogram ( > 0 or <0).

We exit, when we have opposite sign, like from buy to sell or sell to buy, or when we reach tp/sl points, or when we reach % basaed equity points.

It can be changed to be fixed lots, or fixed tp/sl , you just have to uncomment the size from entries, and tp/sl lines.

At the same time, it has the possibility if one desires, to trade only concrete forex session like european, asian and so on for intraday trading.

Hope you enjoy it.

Let me know how it goes.

MACD+ Strategy [SystemAlpha]This is a strategy based on MACD Oscillator . Instead of using just the normal crossovers, we use trend filters, trailing stop loss and take profit targets. This strategy was developed for crypto, forex and stocks on daily timeframe but feel free to experiment on 15 minutes or higher using heikin ashi or normal candles

In this strategy you have a choice of:

Trend Filters:

- Average Directional Index ( ADX ) – buy when price is trend is up and sell when trend is down.

- Moving Average (MA) – buy when price close above the defined moving average and sell when price close below moving average

- Parabolic SAR – buy when SAR is above price is above price and sell when SAR is below price.

- All - Use ADX , MA and SAR as filters

For MA Filter , you can use the “TF MA Type” and "TF MA Period" parameter to select Simple or Exponential Moving Average and length.

Stop Loss:

- Average True Range (ATR) – ATR % stop as trailing stop loss.

- Parabolic SAR ( SAR ) – Parabolic SAR adapted as trailing stop loss.

For ATR , you can use the “ATR Trailing Stop Multiplier” parameter to set an initial offset for trailing stop loss.

Take Profit Target:

- Average True Range (ATR) – ATR % stop as trailing stop loss.

- Standard % – Percent as target profit

For ATR , you can use the “ATR Take Profit Multiplier” parameter to set an initial offset for trailing stop loss.

Additional feature include:

- Regular and Hidden Divergence display and alerts

STRATEGY ONLY:

- Set back test date range

- Set trade direction - Long, Short or Both

- Use timed exit - Select method and bars

- Method 1: Exit after specified number of bars.

- Method 2: Exit after specified number of bars, ONLY if position is currently profitable.

- Method 3: Exit after specified number of bars, ONLY if position is currently losing.

TradingView Links:

Alerts:

MACD:

How to use:

1. Apply the script by browsing through Indicators --> Invite-Only scripts and select the indicator

2. Once loaded, click the gear (settings) button to select/adjust the parameters based on your preference.

3. Wait for the next BUY or SELL signal to enter the trade!

Disclaimer:

The indicator and signals generated do not constitute investment advice; are provided solely for informational purposes and therefore is not an offer to buy or sell a security; are not warranted to be correct, complete or accurate; and are subject to change without notice.

CDC Action Zone V.2 Strategy BacktestPublished for backtest purpose

All credit to : CDC Action Zone V.2 by piriya33

จัดทำขึ้นเพื่อการดูผล Backtest เขียวซื้อแดงขาย

ตัวสคริปท์มีการเพิ่ม

- Strategy Long/Short/Both // ปรับได้ใน Setting

- Back test range // ปรับได้ใน Setting

MACD Trend Following Strategy How it work ?

Work like normal MACD because this is MACD without any modify but i add color of candlestick and strategy.

The color meaning :

Green= macd > signal and macd>0 (Buy)

Red= macd < signal and macd<0 (Sell)

Yellow= macd > signal and macd<0 (Maybe reversal point)

Blue= macd < signal and macd>0 (Maybe reversal point)

Feature

- Back test range

- Long/Short option

- Modifiable MACD Setting

Combing in MACD and MTFHi all, I'm trying to wedge in the MACD into a multiple timeframe. Scope is to create:

1) an alert when the MACD across all timeframes is positive,

2) an alert when the MACD across all timeframes is negative, and

3) one when neither of them is applicable.

Would anyone be so kind to give it some thoughts, please?

//@version=2

strategy(" Easy MTF Strategy", overlay=false)

TF_1_time = input("3", "Timeframe 1")

TF_2_time = input("5", "Timeframe 2")

TF_3_time = input("15", "Timeframe 3")

TF_4_time = input("30", "Timeframe 4")

fastLen = input(title="Fast Length", type=integer, defval=12)

slowLen = input(title="Slow Length", type=integer, defval=26)

sigLen = input(title="Signal Length", type=integer, defval=9)

= macd(close, fastLen, slowLen, sigLen)

width = 5

upcolor = green

downcolor = red

neutralcolor = blue

linestyle = line

TF_1 = security(tickerid, TF_1_time, open) < security(tickerid, TF_1_time, close) ? true:false

TF_1_color = TF_1 ? upcolor:downcolor

TF_2 = security(tickerid, TF_2_time, open) < security(tickerid, TF_2_time, close) ? true:false

TF_2_color = TF_2 ? upcolor:downcolor

TF_3 = security(tickerid, TF_3_time, open) < security(tickerid, TF_3_time, close) ? true:false

TF_3_color = TF_3 ? upcolor:downcolor

TF_4 = security(tickerid, TF_4_time, open) < security(tickerid, TF_4_time, close) ? true:false

TF_4_color = TF_4 ? upcolor:downcolor

TF_global = TF_1 and TF_2 and TF_3 and TF_4

TF_global_bear = TF_1 == false and TF_2 == false and TF_3 == false and TF_4 == false

TF_global_color = TF_global ? green : TF_global_bear ? red : white

TF_trigger_width = TF_global ? 6 : width

plot(1, style=linestyle, linewidth=width, color=TF_1_color)

plot(5, style=linestyle, linewidth=width, color=TF_2_color)

plot(10, style=linestyle, linewidth=width, color=TF_3_color)

plot(15, style=linestyle, linewidth=width, color=TF_4_color)

plot(25, style=linestyle, linewidth=4, color=TF_global_color)

exitCondition_Long = TF_global_bear

exitCondition_Short = TF_global

longCondition = TF_global

if (longCondition)

strategy.entry("MTF_Long", strategy.long)

shortCondition = TF_global_bear

if (shortCondition)

strategy.entry("MTF_Short", strategy.short)

strategy.close("MTF_Long", when=exitCondition_Long)

strategy.close("MTF_Short", when=exitCondition_Short)

MacD 200 Day Moving Average Signal Crossover StrategyThis works on most time frames, but I noticed the 4 hour for BTCUSD on coinbase seems to work well as an example. The strategy is pretty simple. I was inspired by a youtube video that said to backtest their strategy so I did. Most of the time it doesn't work but sometimes it's pretty good as in the case I showed.

Basically, you buy if the MacD crossers over the signal line and the histogram is below 0 and you are above the 200 day moving average. Do the opposite to sell!

StarbuxI made this in starbucks .

Bullish hammer trading signal algorithm

using MACD for trend determination and holding period.

DEMA Strategy with MACDThe Double Exponential Moving Average (DEMA) indicator was introduced in January 1994 by Patrick G. Mulloy, in an article in the "Technical Analysis of Stocks & Commodities" magazine: "Smoothing Data with Faster Moving Averages"

It attempts to remove the inherent lag associated to Moving Averages by placing more weight on recent values. The name suggests this is achieved by applying a double exponential smoothing which is not the case. The name double comes from the fact that the value of an EMA (Exponential Moving Average) is doubled. To keep it in line with the actual data and to remove the lag the value "EMA of EMA" is subtracted from the previously doubled ema.

DEMA is a very responsive system. A lot of signals can be generated only when trading with DEMA. In this strategy, I combined Dema buy-sell signals with MACD indicator. When you activate MACD confirmation from settings; When DEMA comes to long situation, the MACD histogram is checked to be positive.

Trend Trader Strategy with MACDThis is plots the indicator developed by Andrew Abraham in the Trading the Trend article of TASC September 1998

The strategy I use has already been published explicitly by HPotter, you can review the core code from there.

I have converted the existing strategy codes that have been published into the strategy and the result looks great but I noticed that the indicator performed too much in short periods like 1 minute and I thought it would be healthier to get MACD approval. MACD approval will come selected by default. When the indicator reaches the buy status, if the macd histogram is positive, it enters the long process. By removing this confirmation from the settings window, you can see the normal signal frequency of the indicator.

This strategy is mainly based on trend signals. In fact, I am publishing this strategy to use in alternating trading for Bear-Bull crypto coins.

What does the bear-bull comparison mean?

You can open the same chart in the ETHBEAR / USDT symbol as opposed to the ETHBULL / USDT symbol that appears on the chart. When BUY signal comes in bull symbol, SELL will come in bear symbol. When BUY signal comes in bear symbol, SELL will come in bull symbol. In this way, very fast and very high profit can be obtained by alternating operation.

WMA + MACD strategy with trailing stopHi!

That's my first strategy. I already learn pine, so i will work on it more. Now i search how to make trailing stop working.

"WMA + MACD strategy with traiing stop" is very simple strategy which is designated for stocks market. It is created only to take long positions.

Buy signal is when WMA(120) is below price and macd(10,20,10) histogram is higher than 0.

Position should be automaticly closed when price hits stoploss level.

One transaction should be max 20% of our capital and stoploss is set 3% lower than last closing price.

kurdistan MACD & RSI & EMA Hello friends

This indicator can help you to combine the three indicators together

EMA (20), MACD (12, 26, 20), RSI (14)

Apply ema20 to rsi as the signal line

Long arrival time

Price above EMA20, MACD above signal line and RSI above signal line

Short arrival time

Price below EMA20, MACD below signal line and RSI below signal line

MACD_RSI strategyUse three indicator to entry a position

EMA (20), MACD (12, 26, 20), RSI (14)

apply ema20 on rsi as signal line

Entry long when

price above EMA20, MACD above signal line and RSI above signal line

Entry short when

price below EMA20, MACD below signal line and RSI below signal line

Study only, use it under your own risk.

MacD (Future Known or Unknown) StrategyThis indicator/strategy is to be used as a way to baseline the top potential any strategy could have with other strategies and indicators.

What I have created literally shows the BEST moves possible you could have made in my opinion for SHORTING or LONGING using only the MacD values of the 4 hour while on the 30 minute chart.

To use this, try checking out XBTUSD on the 30 minute chart . It will work under different time frames but works best on the 30 minute chart in my opinion. It WILL NOT WORK Above 2 hours time frame.

DO NOT TRADE WITH THIS indicator . I can't emphasize this enough. These results only work because of the lookahead_on parameter. A lot of scam indicators and strategies use this to trick people on tradingView into buying their scripts.

This code is OPEN SOURCE and as such there is nothing to hide and no scam!

I like to use this as a comparison tool for how good I 'could' have traded and at what points those were. By knowing where the perfect trading positions are, you can create real indicators and scripts that try to find patterns in those positions.

This also shows that IF you could know the direction the MacD was going what amazing results you could get ^_~.

This is meant purely for entertainment purposes and for comparing against your own scripts.

I've included the options in the settings to allow ONLY LONG or ONLY SHORTS. By default it attempts both buy attempts. You can also change your starting ($) amount and commission percentage that is taken per trade as well.

Also included in the options is the ability to set the back testing time frame to see how it performs during just certain time periods.

Finally a color explanation

Red - MacD 4 hour going down

Green - MacD 4 hour going up

Purple - MacD 4 hour going down (from an up position)

Yellow - MacD 4 hour going up (from a down position)

Notice the program will always buy right before it turns into a yellow color since it knows the future.

In the options you can turn off 'use the future' to see the horrible results if you trade the moment you know which direction the MacD 4 hour is actually going. I will revise this script in the future with attempts to work without knowing the future as play options to get better results.

If you have any questions or comments, please do not hesitate to ask!