I wasn’t able to post my analysis on TradingView last week, so here’s a structured summary of my ticker reviews from Oct 6–10, segmented by sector with brief commentary. Each includes an update on trend structure and a link to both the original chart and the latest revision as of Friday’s close.

Technology

AMD – Clean follow-through off mid-term support into the upper band of resistance. Strong rejection increases the odds that a mid-term top for the uptrend since April is being formed. Any lower-high formation next week should be approached with caution.

AMD – Clean follow-through off mid-term support into the upper band of resistance. Strong rejection increases the odds that a mid-term top for the uptrend since April is being formed. Any lower-high formation next week should be approached with caution.

Chart:

Previously:

• Upside potential to resistance (Oct 7):

• Downside potential:

• On resistance & bounce potential (Aug 6):

• On macro resistance (Jul 29):

• On macro bottoming potential (Apr):

NVTS – Followed the Aug–Sep setup and delivered a strong breakout Friday, but late-day reversal increases the odds of a longer consolidation into 7.80–6.80 support.

NVTS – Followed the Aug–Sep setup and delivered a strong breakout Friday, but late-day reversal increases the odds of a longer consolidation into 7.80–6.80 support.

Chart:

Previously:

• Breakout and local support (Oct 10):

• Consolidation and upside potential (Sep 30):

• Higher-low potential (Sep 26):

• Mid-term support (Aug 25): tradingview.com/symbols/NASDAQ-NVTS/minds/?mind=TG-GkbRtRaGErSPSXMYcRg

MRVL – Reached the key mid-term resistance zone outlined earlier. Friday’s rejection increases odds of a pullback into 80–72 support over the coming weeks.

MRVL – Reached the key mid-term resistance zone outlined earlier. Friday’s rejection increases odds of a pullback into 80–72 support over the coming weeks.

Chart:

Previously:

• On mid-term top (Oct 10):

• On resistance zone (Oct 2): tradingview.com/symbols/NASDAQ-MRVL/minds/?mind=BTOV58OwQAS_gh52-D_Kvg

WDC – Orderly follow-through to the downside into the 21 EMA.

WDC – Orderly follow-through to the downside into the 21 EMA.

Chart:

Previously: downside potential to 21 EMA –

RBLX – Rejected at local resistance, aligning with the downside structure.

RBLX – Rejected at local resistance, aligning with the downside structure.

Chart:

Previously: downside potential (Oct 8):

REKR – Shows strong relative strength with steady consolidation at support; constructive base-building continues.

REKR – Shows strong relative strength with steady consolidation at support; constructive base-building continues.

Chart:

Previously: follow-through and support (Oct 7):

AI – Friday breakout attempt faded back into support, increasing odds of prolonged base-building and a potential deeper pullback to 17–16.

AI – Friday breakout attempt faded back into support, increasing odds of prolonged base-building and a potential deeper pullback to 17–16.

Chart:

Previously:

On continuation potential (Oct 8):

BB – Failed on immediate continuation and returned to support.

BB – Failed on immediate continuation and returned to support.

Chart:

Previously:

On continuation potential (Oct 8):

OPEN – Constructive consolidation stalled as failed breakouts shifted odds toward a deeper pullback into mid-term support.

OPEN – Constructive consolidation stalled as failed breakouts shifted odds toward a deeper pullback into mid-term support.

Chart:

⸻

Blockchain

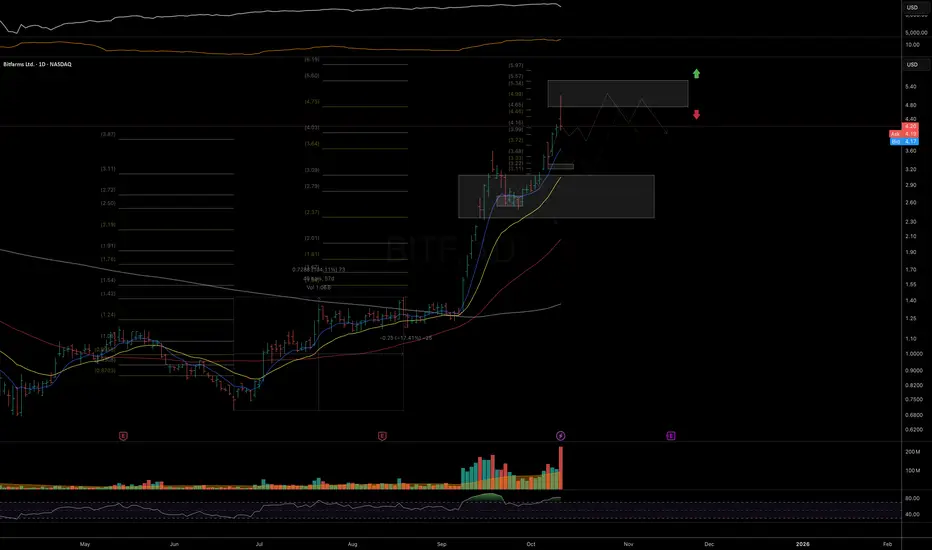

BITF – Tagged the ideal macro resistance zone; odds rise for at least a mid-term top/base formation here.

BITF – Tagged the ideal macro resistance zone; odds rise for at least a mid-term top/base formation here.

Chart:

Previously:

On upside continuation (Oct 7):

HIVE – Rejection at the top of mid-term resistance; probabilities favor the start of a reversal phase.

HIVE – Rejection at the top of mid-term resistance; probabilities favor the start of a reversal phase.

Chart:

Previously:

On macro resistance (Oct 6):

On more immediate upside potential (Sep 24): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=Vd571diiT1u3xVGH1kGhKw

•On bullish potential (Sep 10): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=UqHPKBdtQzCEipcKminPNQ

• On bullish trend structure (Jul 21): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=Y4zxqZwzRtyaDD8lmywGhw

BKKT – No follow-through on continuation setup, but key local support still holds; structure remains intact while above it.

BKKT – No follow-through on continuation setup, but key local support still holds; structure remains intact while above it.

Chart:

Previously:

On continuation (Oct 9):

BULL – Rotating back toward macro support near 11; monitoring for higher-low formation and reversal trigger.

BULL – Rotating back toward macro support near 11; monitoring for higher-low formation and reversal trigger.

Chart:

Previously:

On reversal and macro support (Oct 8):

On immediate bullish potential (Sep 26): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=GqGeyQoBR6SKSPusscGaaA

• On macro support (Sep 19): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=1zpzfLwhSNyk5xrc_bXRBg

• On macro support (Sep 4): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=6lTB3WHIQAiRNPeDukZ1Wg&exchange=NASDAQ

• On mid-term resistance (Aug 6): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=7SfNQ0fPQY2Zet6MU4KB6g&exchange=NASDAQ

• On support and bounce potential (Jul 30): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=XQmtVEynRcu7Pye2Rw0E9Q&exchange=NASDAQ

BTM – Bullish setup invalidated by breakdown into mid-term support.

BTM – Bullish setup invalidated by breakdown into mid-term support.

Chart:

Previously:

On bullish follow-through if LOD holds (Oct 6):

⸻

Biotechnology / Healthcare

VKTX – Strong follow-through from September update; watching for consolidation back into key EMAs to reset momentum.

VKTX – Strong follow-through from September update; watching for consolidation back into key EMAs to reset momentum.

Chart:

Previously:

On follow-through (Oct 6):

• On break-out potential (Sep 30): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=RyuxrFPaTMyJkFMZLAfOoQ

• On resistance zone (Aug 11): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=VLFAH1asTO2WJt4Y-TgXyw

• On upside momentum continuation (Jul 18): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=4owGJV5ZQaO33WP1hAviSg

• Original setup (Jun 30): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=Ug0UI_DXRAu5b95LGXIyog

• Follow-up (Jul 8): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=fZQV2wcyRL2hB7nariJikg

NTLA – Clean follow-through into mid-term resistance; rising odds for a topping/base formation.

NTLA – Clean follow-through into mid-term resistance; rising odds for a topping/base formation.

Chart:

Previously:

On break-out to resistance zone (Oct 8):

On support and bullish trend-structure (Sep 26): tradingview.com/symbols/NASDAQ-NTLA/minds/?mind=B8f6LFmoSxGopGgzEMnUPQ

PGEN – Couldn’t stage a recovery yet but remains within mid-term support; stabilization needed for a constructive setup.

PGEN – Couldn’t stage a recovery yet but remains within mid-term support; stabilization needed for a constructive setup.

Chart:

Previously:

On potential reversal (Oct 8):

On mid-term support (Sep 15): tradingview.com/symbols/NASDAQ-PGEN/minds/?mind=Wd5W0WZ3R-qeB9zVjFAHHw

ABCL – Momentum attempt resumed but failed to follow-through; still constructive above 21 EMA.

ABCL – Momentum attempt resumed but failed to follow-through; still constructive above 21 EMA.

Chart:

Previously:

On local support and continuation potential (Oct 8):

On support and bullish trend-structure (Oct 7):

⸻

Energy

GTE – Impulsive advance at risk of morphing into a diagonal correction; elevated probability of retesting September higher lows.

GTE – Impulsive advance at risk of morphing into a diagonal correction; elevated probability of retesting September higher lows.

Chart:

Previously:

On constructive looking consolidation (Oct 6):

⸻

Miscellaneous / Other

SLDP – Rising risk of a local top after Friday’s distribution; while above 21 EMA, a final push into resistance remains possible.

SLDP – Rising risk of a local top after Friday’s distribution; while above 21 EMA, a final push into resistance remains possible.

Chart:

Previously:

On follow-through and resistance zone (Oct 6):

On mid-term support and bullish potential (Sep 19): tradingview.com/symbols/NASDAQ-SLDP/minds/?mind=DStjOaOpSeGPWFwB-md_dA

DPRO – Solid 2.5-day follow-through from the Oct update; Friday’s action suggests increased consolidation or reversal risk.

DPRO – Solid 2.5-day follow-through from the Oct update; Friday’s action suggests increased consolidation or reversal risk.

Chart:

Previously:

On local support and continuation (Oct 7):

DLO – Disappointing fade after a promising start; must hold above 50-DMA to reassert upside momentum.

DLO – Disappointing fade after a promising start; must hold above 50-DMA to reassert upside momentum.

Chart:

Previously:

On break-out potential (Oct 8):

On pullback potential (Sep 22): tradingview.com/symbols/NASDAQ-DLO/minds/?mind=Zjk8an6VRFSLNP-Fdy3u7g

• On downside potential and support (Sep 3): tradingview.com/symbols/NASDAQ-DLO/minds/?mind=ceWeIiDKQ9-w4TabhWnsUw

Thank you for your attention and have a great start of the week!

Technology

Chart:

Previously:

• Upside potential to resistance (Oct 7):

• Downside potential:

• On resistance & bounce potential (Aug 6):

• On macro resistance (Jul 29):

• On macro bottoming potential (Apr):

Chart:

Previously:

• Breakout and local support (Oct 10):

• Consolidation and upside potential (Sep 30):

• Higher-low potential (Sep 26):

• Mid-term support (Aug 25): tradingview.com/symbols/NASDAQ-NVTS/minds/?mind=TG-GkbRtRaGErSPSXMYcRg

Chart:

Previously:

• On mid-term top (Oct 10):

• On resistance zone (Oct 2): tradingview.com/symbols/NASDAQ-MRVL/minds/?mind=BTOV58OwQAS_gh52-D_Kvg

Chart:

Previously: downside potential to 21 EMA –

Chart:

Previously: downside potential (Oct 8):

Chart:

Previously: follow-through and support (Oct 7):

Chart:

Previously:

On continuation potential (Oct 8):

Chart:

Previously:

On continuation potential (Oct 8):

Chart:

⸻

Blockchain

Chart:

Previously:

On upside continuation (Oct 7):

Chart:

Previously:

On macro resistance (Oct 6):

On more immediate upside potential (Sep 24): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=Vd571diiT1u3xVGH1kGhKw

•On bullish potential (Sep 10): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=UqHPKBdtQzCEipcKminPNQ

• On bullish trend structure (Jul 21): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=Y4zxqZwzRtyaDD8lmywGhw

Chart:

Previously:

On continuation (Oct 9):

Chart:

Previously:

On reversal and macro support (Oct 8):

On immediate bullish potential (Sep 26): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=GqGeyQoBR6SKSPusscGaaA

• On macro support (Sep 19): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=1zpzfLwhSNyk5xrc_bXRBg

• On macro support (Sep 4): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=6lTB3WHIQAiRNPeDukZ1Wg&exchange=NASDAQ

• On mid-term resistance (Aug 6): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=7SfNQ0fPQY2Zet6MU4KB6g&exchange=NASDAQ

• On support and bounce potential (Jul 30): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=XQmtVEynRcu7Pye2Rw0E9Q&exchange=NASDAQ

Chart:

Previously:

On bullish follow-through if LOD holds (Oct 6):

⸻

Biotechnology / Healthcare

Chart:

Previously:

On follow-through (Oct 6):

• On break-out potential (Sep 30): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=RyuxrFPaTMyJkFMZLAfOoQ

• On resistance zone (Aug 11): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=VLFAH1asTO2WJt4Y-TgXyw

• On upside momentum continuation (Jul 18): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=4owGJV5ZQaO33WP1hAviSg

• Original setup (Jun 30): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=Ug0UI_DXRAu5b95LGXIyog

• Follow-up (Jul 8): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=fZQV2wcyRL2hB7nariJikg

Chart:

Previously:

On break-out to resistance zone (Oct 8):

On support and bullish trend-structure (Sep 26): tradingview.com/symbols/NASDAQ-NTLA/minds/?mind=B8f6LFmoSxGopGgzEMnUPQ

Chart:

Previously:

On potential reversal (Oct 8):

On mid-term support (Sep 15): tradingview.com/symbols/NASDAQ-PGEN/minds/?mind=Wd5W0WZ3R-qeB9zVjFAHHw

Chart:

Previously:

On local support and continuation potential (Oct 8):

On support and bullish trend-structure (Oct 7):

⸻

Energy

Chart:

Previously:

On constructive looking consolidation (Oct 6):

⸻

Miscellaneous / Other

Chart:

Previously:

On follow-through and resistance zone (Oct 6):

On mid-term support and bullish potential (Sep 19): tradingview.com/symbols/NASDAQ-SLDP/minds/?mind=DStjOaOpSeGPWFwB-md_dA

Chart:

Previously:

On local support and continuation (Oct 7):

Chart:

Previously:

On break-out potential (Oct 8):

On pullback potential (Sep 22): tradingview.com/symbols/NASDAQ-DLO/minds/?mind=Zjk8an6VRFSLNP-Fdy3u7g

• On downside potential and support (Sep 3): tradingview.com/symbols/NASDAQ-DLO/minds/?mind=ceWeIiDKQ9-w4TabhWnsUw

Thank you for your attention and have a great start of the week!

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.