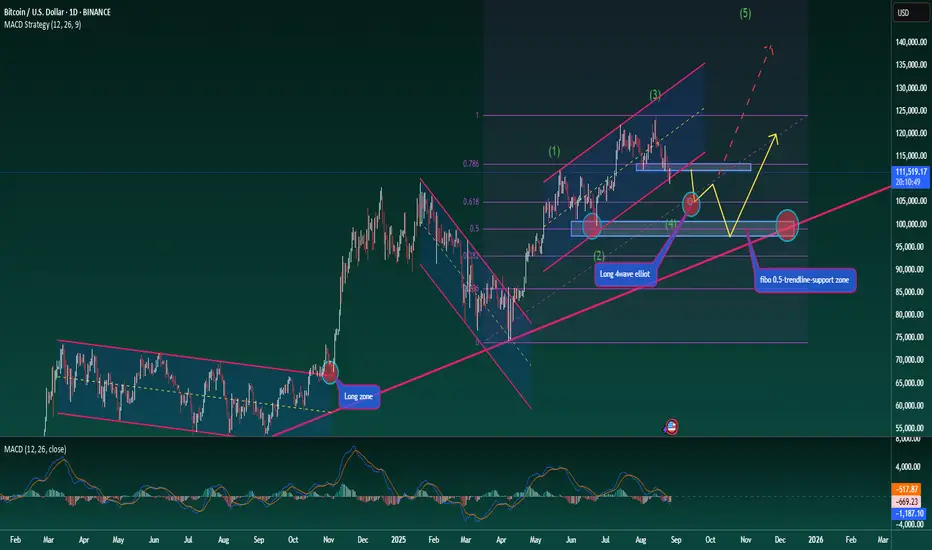

Bitcoin – Long-Term Outlook with Elliott Wave Structure

Hello traders,

Taking a step back for a medium- to long-term perspective on BTC. The broader trend remains bullish, yet for any rally to be sustainable, corrective phases are essential. Right now, BTC is in a corrective move, which aligns with wave 4 of the Elliott Wave structure.

To measure the depth of this correction before wave 5 develops, we can look at the Fibonacci retracement levels. Two zones stand out as significant: 0.618 and 0.5.

At 0.618, support is strong but not yet decisive. If price reacts here and wave 5 unfolds, the Elliott count stays intact and relatively clean.

At 0.5, this is often the ideal retracement level on Fibonacci. The chart also shows this as a major structural support. If it breaks, deeper downside could follow, as the ascending trendline also suggests.

Long-Term Trading Plan

Entry 1: Around the 0.618 retracement at 105k

Entry 2: Around the 0.5 retracement at 99k

This setup forms the basis for a medium-term strategy, but if the second zone (99k) holds strongly, it could well serve as the foundation for a longer-term bullish cycle.

Stay patient, keep risk management at the forefront, and let the structure play out.

What’s your take on BTC’s long-term wave structure? Drop your thoughts in the comments and let’s discuss.

Hello traders,

Taking a step back for a medium- to long-term perspective on BTC. The broader trend remains bullish, yet for any rally to be sustainable, corrective phases are essential. Right now, BTC is in a corrective move, which aligns with wave 4 of the Elliott Wave structure.

To measure the depth of this correction before wave 5 develops, we can look at the Fibonacci retracement levels. Two zones stand out as significant: 0.618 and 0.5.

At 0.618, support is strong but not yet decisive. If price reacts here and wave 5 unfolds, the Elliott count stays intact and relatively clean.

At 0.5, this is often the ideal retracement level on Fibonacci. The chart also shows this as a major structural support. If it breaks, deeper downside could follow, as the ascending trendline also suggests.

Long-Term Trading Plan

Entry 1: Around the 0.618 retracement at 105k

Entry 2: Around the 0.5 retracement at 99k

This setup forms the basis for a medium-term strategy, but if the second zone (99k) holds strongly, it could well serve as the foundation for a longer-term bullish cycle.

Stay patient, keep risk management at the forefront, and let the structure play out.

What’s your take on BTC’s long-term wave structure? Drop your thoughts in the comments and let’s discuss.

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jmo_lLLuUuYwZTI1

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jmo_lLLuUuYwZTI1

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jmo_lLLuUuYwZTI1

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jmo_lLLuUuYwZTI1

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.