🔍 Ethereum - Macro Outlook by FIBCOS 🧠

“From Contraction to Expansion – The Supercycle Awakens”

🌌 Super Market Cycle: The Final Push Begins

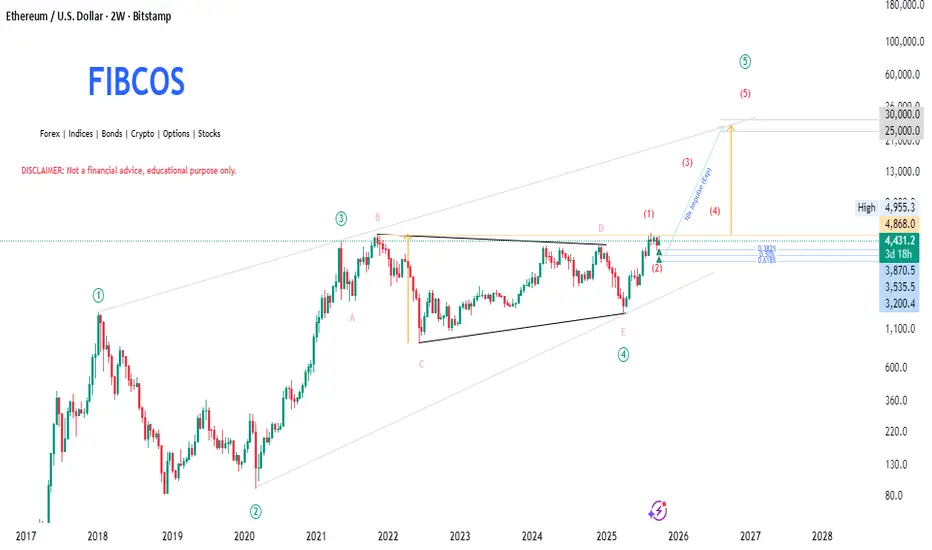

Ethereum is in the final stage of a Grand Supercycle 🌍 — a massive multi-year wave count aligning with the Elliott Wave Theory.

✅ Wave (1) and (2) established early strength

✅ Wave (3) peaked explosively in 2021 📈

✅ Wave (4) formed a beautiful contracting triangle (ABCDE), a classic wave 4 corrective pattern

🟢 Now breaking out of Wave (4), we're entering Wave (5) — the euphoric leg 🚀

🌊 Wave Theory Magic: Riding the Impulse

We're deep into the impulsive sequence — and here's what stands out:

1️⃣ Wave (1) initiated the reversal from the triangle bottom

2️⃣ Wave (2) retraced perfectly to key Fib levels — golden pocket zone ✨

3️⃣ Current move is Wave (3) of (5) — historically the most powerful and extended wave 💥

🔮 Wave (5) targets extend toward $25,000–$30,000 based on Fibonacci projections 🧭

📐 Fibonacci Retracement & Extension: Precision Tools

After Wave (1), ETH retraced to the following golden zones:

🔵 0.382 – $3,870

🟣 0.50 – $3,535

🟢 0.618 – $3,200

These levels acted as strong demand zones 🛡️, where price was absorbed and reversed, showing institutional interest.

📈 For extensions:

Wave (3) targets: ~$15,000 (1.618 extension)

Wave (5) projection: $25K–$30K 🎯

🧠 Smart Money Concept (SMC): Liquidity Engineered Setup

SMC confirms the big players have already positioned:

🪤 ABCDE triangle = liquidity trap

🔥 Wave E = final sweep before the breakout

✅ Structure Break = Smart Money entry signal

🧱 Demand Zone @ ~$3,800–$4,200 = institutional orders filling 🏦

The Change of Character (ChoCH) + Break of Structure (BoS) = textbook confirmation of bullish intent 📚

🧱 Market Structure: From Consolidation to Expansion

We’ve broken multi-year resistance 💥

🔁 Previous All-Time High (ATH) now acting as strong support

📈 Higher highs and higher lows = full bullish market structure

🚀 Confirmed trend shift after accumulation → expansion phase

🔎 Price Action: Clean, Convincing, Bullish

The breakout candle is powerful:

✅ Big-bodied green candles

✅ Little-to-no upper wick = aggressive buyers in control 🐂

✅ Imbalance created below — potential “buy-the-dip” zones between $3,800–$4,200 📉🛒

ETH is now printing strength with every candle — the market is speaking clearly.

🌍 Macro-Fundamental Context – Ethereum’s Underlying Strengths

Ethereum’s fundamentals provide strong structural support for this technical forecast:

ETH ETF Approvals (Pending):

U.S. and global ETF prospects are building momentum, opening gates to institutional inflows akin to Bitcoin's ETF impact.

Layer-2 Scaling Adoption:

Networks like Arbitrum, Optimism, and zkSync are maturing rapidly, improving transaction efficiency and reducing on-chain congestion.

Ethereum 2.0 Transition/PoS Era:

Ongoing deflationary tokenomics (EIP-1559 burn + staking lock-up) are reducing effective circulating supply, supporting price growth.

DeFi Revival:

With macro liquidity cycles turning upward, usage and TVL (Total Value Locked) in Ethereum-based DeFi is expected to rise sharply.

AI x Blockchain Synergy:

Ethereum remains positioned to become the base layer for decentralized AI infrastructure — a potential catalyst for long-term valuation expansion.

These catalysts serve as the fundamental “fuel” behind the unfolding Wave (3) and the eventual Wave (5).

🎯 Final Word: All Systems GO 🚀

The confluence is undeniable:

✅ Super Cycle 🔁

✅ Elliott Wave 📊

✅ SMC Smart Money 📈

✅ Price Action 🔍

✅ Market Structure 🏗️

✅ Fibonacci Levels 📏

✅ Fundamentals 🌍

💡 Ethereum is positioned to explode into its Wave (5) super-cycle with $30,000 as a potential macro target.

If you're looking for the high time frame narrative, this is as strong as it gets. Don’t chase. Plan the entry on retracements and ride the wave 🌊.

💬 "Structure unlocks direction, and Fibonacci refines destination." – FIBCOS

📘 Disclaimer: This is a structural, educational market outlook. Not financial advice. Please do your own due diligence and risk management.

#FIBCOS #ElliottWave #SmartMoneyConcept #MarketAnalysis #Gold #XAUUSD #ElliottWave #WaveTheory #SuperCycle #MacroTrend #SmartMoney #Fibonacci #PriceAction #Commodities #TechnicalAnalysis #LongTermOutlook

“From Contraction to Expansion – The Supercycle Awakens”

🌌 Super Market Cycle: The Final Push Begins

Ethereum is in the final stage of a Grand Supercycle 🌍 — a massive multi-year wave count aligning with the Elliott Wave Theory.

✅ Wave (1) and (2) established early strength

✅ Wave (3) peaked explosively in 2021 📈

✅ Wave (4) formed a beautiful contracting triangle (ABCDE), a classic wave 4 corrective pattern

🟢 Now breaking out of Wave (4), we're entering Wave (5) — the euphoric leg 🚀

🌊 Wave Theory Magic: Riding the Impulse

We're deep into the impulsive sequence — and here's what stands out:

1️⃣ Wave (1) initiated the reversal from the triangle bottom

2️⃣ Wave (2) retraced perfectly to key Fib levels — golden pocket zone ✨

3️⃣ Current move is Wave (3) of (5) — historically the most powerful and extended wave 💥

🔮 Wave (5) targets extend toward $25,000–$30,000 based on Fibonacci projections 🧭

📐 Fibonacci Retracement & Extension: Precision Tools

After Wave (1), ETH retraced to the following golden zones:

🔵 0.382 – $3,870

🟣 0.50 – $3,535

🟢 0.618 – $3,200

These levels acted as strong demand zones 🛡️, where price was absorbed and reversed, showing institutional interest.

📈 For extensions:

Wave (3) targets: ~$15,000 (1.618 extension)

Wave (5) projection: $25K–$30K 🎯

🧠 Smart Money Concept (SMC): Liquidity Engineered Setup

SMC confirms the big players have already positioned:

🪤 ABCDE triangle = liquidity trap

🔥 Wave E = final sweep before the breakout

✅ Structure Break = Smart Money entry signal

🧱 Demand Zone @ ~$3,800–$4,200 = institutional orders filling 🏦

The Change of Character (ChoCH) + Break of Structure (BoS) = textbook confirmation of bullish intent 📚

🧱 Market Structure: From Consolidation to Expansion

We’ve broken multi-year resistance 💥

🔁 Previous All-Time High (ATH) now acting as strong support

📈 Higher highs and higher lows = full bullish market structure

🚀 Confirmed trend shift after accumulation → expansion phase

🔎 Price Action: Clean, Convincing, Bullish

The breakout candle is powerful:

✅ Big-bodied green candles

✅ Little-to-no upper wick = aggressive buyers in control 🐂

✅ Imbalance created below — potential “buy-the-dip” zones between $3,800–$4,200 📉🛒

ETH is now printing strength with every candle — the market is speaking clearly.

🌍 Macro-Fundamental Context – Ethereum’s Underlying Strengths

Ethereum’s fundamentals provide strong structural support for this technical forecast:

ETH ETF Approvals (Pending):

U.S. and global ETF prospects are building momentum, opening gates to institutional inflows akin to Bitcoin's ETF impact.

Layer-2 Scaling Adoption:

Networks like Arbitrum, Optimism, and zkSync are maturing rapidly, improving transaction efficiency and reducing on-chain congestion.

Ethereum 2.0 Transition/PoS Era:

Ongoing deflationary tokenomics (EIP-1559 burn + staking lock-up) are reducing effective circulating supply, supporting price growth.

DeFi Revival:

With macro liquidity cycles turning upward, usage and TVL (Total Value Locked) in Ethereum-based DeFi is expected to rise sharply.

AI x Blockchain Synergy:

Ethereum remains positioned to become the base layer for decentralized AI infrastructure — a potential catalyst for long-term valuation expansion.

These catalysts serve as the fundamental “fuel” behind the unfolding Wave (3) and the eventual Wave (5).

🎯 Final Word: All Systems GO 🚀

The confluence is undeniable:

✅ Super Cycle 🔁

✅ Elliott Wave 📊

✅ SMC Smart Money 📈

✅ Price Action 🔍

✅ Market Structure 🏗️

✅ Fibonacci Levels 📏

✅ Fundamentals 🌍

💡 Ethereum is positioned to explode into its Wave (5) super-cycle with $30,000 as a potential macro target.

If you're looking for the high time frame narrative, this is as strong as it gets. Don’t chase. Plan the entry on retracements and ride the wave 🌊.

💬 "Structure unlocks direction, and Fibonacci refines destination." – FIBCOS

📘 Disclaimer: This is a structural, educational market outlook. Not financial advice. Please do your own due diligence and risk management.

#FIBCOS #ElliottWave #SmartMoneyConcept #MarketAnalysis #Gold #XAUUSD #ElliottWave #WaveTheory #SuperCycle #MacroTrend #SmartMoney #Fibonacci #PriceAction #Commodities #TechnicalAnalysis #LongTermOutlook

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.