Weekly Analysis: #Nifty50

Date: 18th Aug 2025

Firstly huge apologies.. I understand that I'm sharing the weekly report after 2 months.. At this point it feels more like a quarterly analysis rather than a weekly one.

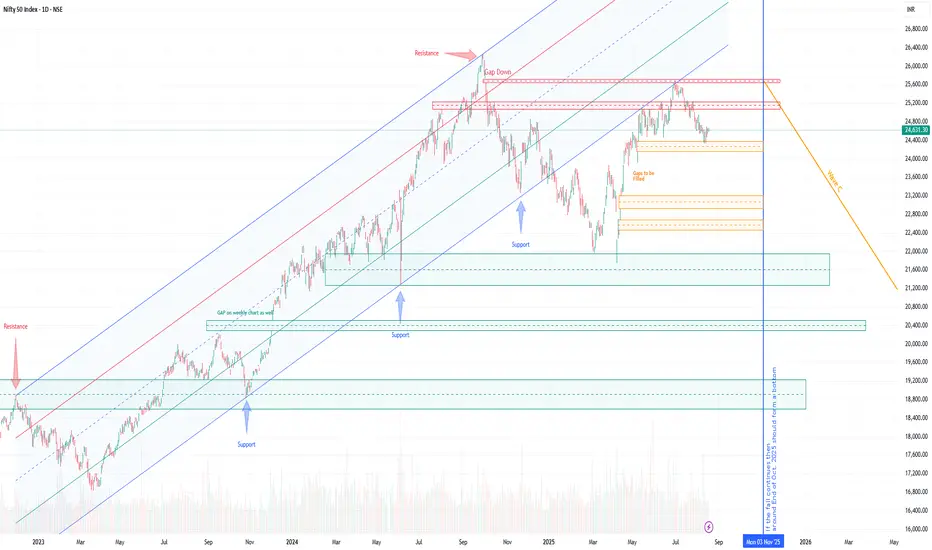

As per that last weekly analysis published on 9th June 2025 #Nifty was at 25,000 and now it's trading at 24, 631.. basically there was nothing much happening or going at that time going to happen. Hence, I stayed quiet.. and it has panned out in the same way. If you remember reading the analysis from Nov 2024 to June 2025, I had mentioned that I will only be taking fresh entry, once Nifty closes above 25,800 and sustains due to the gap. And recently Nifty has been rejected from the same zone. Also, in my last post published on 23rd July there were indications that market may correct and it has indeed.

24,400 is strong support and a break-down below this with a red confirmation candle will take us further down. Nifty was moving in an upward channel from March 2023 and is now being rejected from the bottom of this upward channel (as we can see in the chart). The 3 gaps on the downside have yet to be filled and they will fill in the following months. We may experience a small bullish move toward 25000-25200 in the short-term, but this will only be a bulltrap. 20,200 to 19,500 is a support I still see being tested before we start the next bull-run. Remember! this is on-going Wave 4 (since Covid-Crash) and in the last Wave, which is Wave 5 people have the most optimism view of the market. But, this is the phase where all big players cash-out at high valuations selling everything to retail-traders. In fact retails traders are already giving huge exits to FIIs through their SIPs (DII buying).

I'm still holding cash and my entry in new stocks will either be above 25,800 levels or around 20,000 levels.. May start adding below 21,000. But, will keep y'all posted.

Chart - Remains the same, will update new information once mentioned levels are achieved on either side.

Mid/Long term view - More pain expected in next few moths.

#USDINR #DXY - #DollarIndex is loosing momentum but so is #Rupee.. not at all good for the overall economy and the markets. USDINR is forming a cup and handle, the target for which is coming to 92/USD.. When this happens brace yourself and sit tight, it will seem that everything is coming to an end but it wont.. this is where the market will most likely bottom out.

#Gold - If you remember reading analysis for Gold.. 3,300-3,400 was my exit target. Yes, it did go till 3,511. But mostly has been in the exit range.. Again this seems like distribution to me.

#CrudeOil #BrentCrude - Extremely weak now.. As I had mentioned in one of my older posts, that if Oil ETF was available I would have purchased it. And during the #iranisraelwar it would have made us good money. But sadly such an instrument is not available for

us.

Do Like, Comment, Bookmark and follow. This helps with platform algorithm to push the content to more people!

Date: 18th Aug 2025

Firstly huge apologies.. I understand that I'm sharing the weekly report after 2 months.. At this point it feels more like a quarterly analysis rather than a weekly one.

As per that last weekly analysis published on 9th June 2025 #Nifty was at 25,000 and now it's trading at 24, 631.. basically there was nothing much happening or going at that time going to happen. Hence, I stayed quiet.. and it has panned out in the same way. If you remember reading the analysis from Nov 2024 to June 2025, I had mentioned that I will only be taking fresh entry, once Nifty closes above 25,800 and sustains due to the gap. And recently Nifty has been rejected from the same zone. Also, in my last post published on 23rd July there were indications that market may correct and it has indeed.

24,400 is strong support and a break-down below this with a red confirmation candle will take us further down. Nifty was moving in an upward channel from March 2023 and is now being rejected from the bottom of this upward channel (as we can see in the chart). The 3 gaps on the downside have yet to be filled and they will fill in the following months. We may experience a small bullish move toward 25000-25200 in the short-term, but this will only be a bulltrap. 20,200 to 19,500 is a support I still see being tested before we start the next bull-run. Remember! this is on-going Wave 4 (since Covid-Crash) and in the last Wave, which is Wave 5 people have the most optimism view of the market. But, this is the phase where all big players cash-out at high valuations selling everything to retail-traders. In fact retails traders are already giving huge exits to FIIs through their SIPs (DII buying).

I'm still holding cash and my entry in new stocks will either be above 25,800 levels or around 20,000 levels.. May start adding below 21,000. But, will keep y'all posted.

Chart - Remains the same, will update new information once mentioned levels are achieved on either side.

Mid/Long term view - More pain expected in next few moths.

#USDINR #DXY - #DollarIndex is loosing momentum but so is #Rupee.. not at all good for the overall economy and the markets. USDINR is forming a cup and handle, the target for which is coming to 92/USD.. When this happens brace yourself and sit tight, it will seem that everything is coming to an end but it wont.. this is where the market will most likely bottom out.

#Gold - If you remember reading analysis for Gold.. 3,300-3,400 was my exit target. Yes, it did go till 3,511. But mostly has been in the exit range.. Again this seems like distribution to me.

#CrudeOil #BrentCrude - Extremely weak now.. As I had mentioned in one of my older posts, that if Oil ETF was available I would have purchased it. And during the #iranisraelwar it would have made us good money. But sadly such an instrument is not available for

us.

Do Like, Comment, Bookmark and follow. This helps with platform algorithm to push the content to more people!

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.