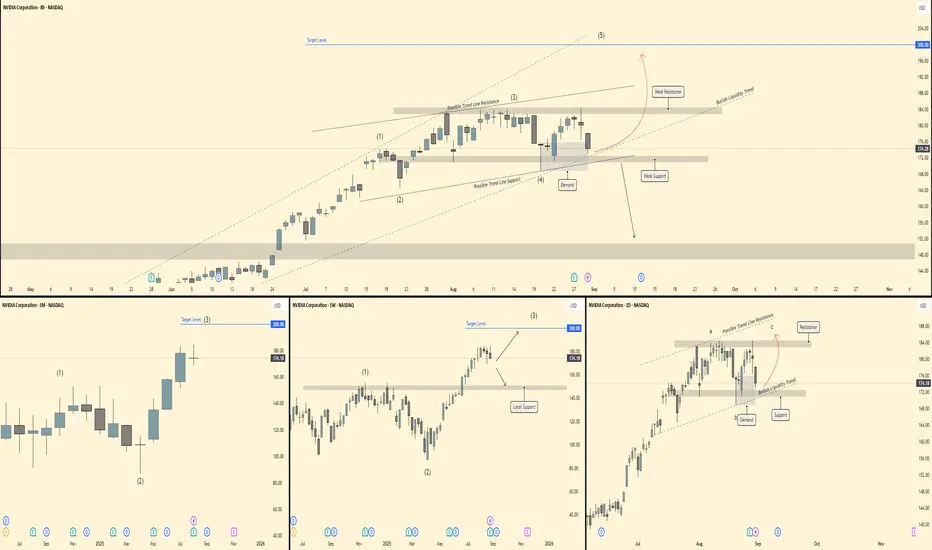

📊 NVDA – Multi-Timeframe Outlook

🔎 Monthly (1M)

Strong bullish structure with clear Elliott Wave progression (1)-(3) unfolding.

Current candle shows retracement after a parabolic push, but higher timeframe structure remains intact.

Target level stands at 200 USD, aligning with Wave (3) completion zone.

🕰 Weekly (1W)

NVDA completed Wave (3) near 184, now pulling back into a local support zone ~160 – 165.

Structure suggests a corrective Wave (4) before potential continuation higher.

As long as support holds, expectation remains for a Wave (5) push towards 200+.

⏱ Daily (1D)

Price coiling inside a corrective a-b-c structure under trendline resistance.

Demand/support zone ~170 – 172 is acting as the base.

Break above 184 resistance confirms bullish continuation, while loss of support opens risk towards 152 (deeper retrace).

⏳ 8H

Clear retracement into demand after Wave (3) high.

Price holding trendline support + demand confluence.

If buyers step in, expect a rally into Wave (5) targeting 190 – 200.

Breakdown of demand would shift momentum bearish short-term.

🎯 Trade Plan

Bias: Bullish continuation (Wave 5 setup)

Entry Zone: 170 – 175 (demand/support)

Targets: 184 (short-term), 200 (medium-term)

Invalidation: Break & close below 160 support

🔎 Monthly (1M)

Strong bullish structure with clear Elliott Wave progression (1)-(3) unfolding.

Current candle shows retracement after a parabolic push, but higher timeframe structure remains intact.

Target level stands at 200 USD, aligning with Wave (3) completion zone.

🕰 Weekly (1W)

NVDA completed Wave (3) near 184, now pulling back into a local support zone ~160 – 165.

Structure suggests a corrective Wave (4) before potential continuation higher.

As long as support holds, expectation remains for a Wave (5) push towards 200+.

⏱ Daily (1D)

Price coiling inside a corrective a-b-c structure under trendline resistance.

Demand/support zone ~170 – 172 is acting as the base.

Break above 184 resistance confirms bullish continuation, while loss of support opens risk towards 152 (deeper retrace).

⏳ 8H

Clear retracement into demand after Wave (3) high.

Price holding trendline support + demand confluence.

If buyers step in, expect a rally into Wave (5) targeting 190 – 200.

Breakdown of demand would shift momentum bearish short-term.

🎯 Trade Plan

Bias: Bullish continuation (Wave 5 setup)

Entry Zone: 170 – 175 (demand/support)

Targets: 184 (short-term), 200 (medium-term)

Invalidation: Break & close below 160 support

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.