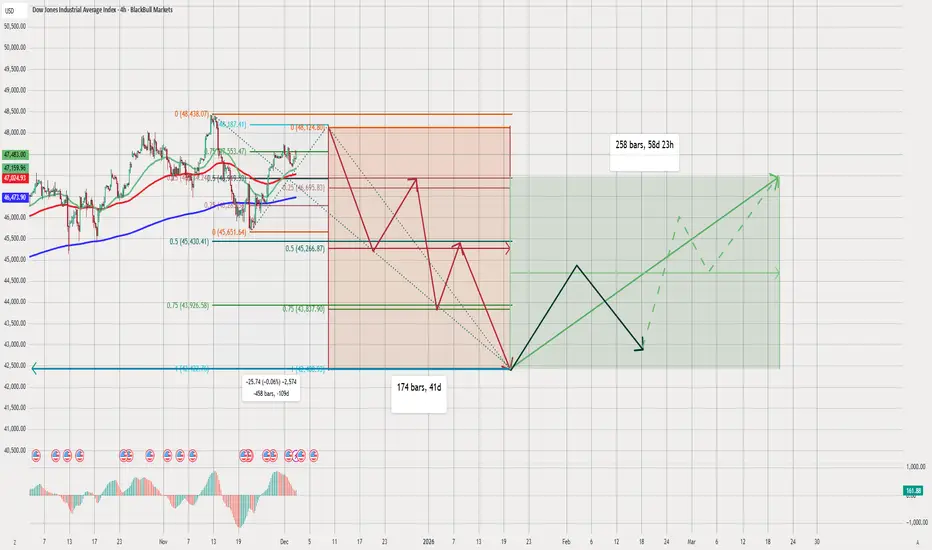

US30 (Dow Jones) Technical Analysis – 4H Chart

chart shows a well-structured bearish scenario, followed by a medium-term bullish reversal setup. combining Fibonacci retracement levels, time cycles, moving averages, and projected wave paths to map the market direction.

Below is a detailed breakdown:

1️⃣ Current Market Structure

Price recently reached a local top near 48,127.

After this, the chart suggests expect a significant downward correction.

Price is fluctuating above the:

Green MA (short-term)

Red MA (medium-term)

Blue 200 MA (long-term)

projected path shows a breakdown below these moving averages soon.

2️⃣ Fibonacci Levels (Important Zones)

From the recent high, your Fibonacci retracement levels are:

0.25 → 46,699

0.5 → 45,274

0.75 → 43,950

These levels align with your expected downward waves.

Major Support Zone

Large green zone near 41,700 – 42,200

This is where your final bearish wave ends

It also overlaps with a long-term Fibonacci cluster

This suggests it is the target bottom of the correction.

3️⃣ Bearish Projection (Red Wave Path)

chart shows multiple downward swings:

Initial drop from 48,127 → 45,274

Bounce to retest resistance

Deeper decline toward 44,000 – 43,500

Another bounce

Final capitulation to 41,700

🟥 Final Bearish Target:

~41,700

This matches the blue horizontal support line.

🔹 Duration of Bearish Cycle

174 bars (~41 days)

This suggests the decline completes around late January 2026.

4️⃣ Bullish Reversal Phase (Green + Black Path)

After reaching the bottom around 41,700, your chart shows two phases:

Phase 1 – Strong Rebound (Black Path)

A sharp rally into early February:

First rally to around 44,500 – 45,000

Short-term pullback

Then continuation higher

Phase 2 – Trend Recovery (Green Path)

Long-term green path shows:

A steady upward channel

Price aiming toward 48,000 – 49,000 again

The green dotted lines show alternative bullish scenarios

🔹 Total Recovery Time

258 bars (~58 days)

Targeting mid-March 2026 for a full recovery.

5️⃣ Interpretation of Moving Averages

Price will break below the moving averages during the correction.

Long-term recovery will push back above the:

50 MA (green)

100 MA (red)

200 MA (blue)

This confirms a trend reversal after the bottom is hit.

6️⃣ Summary of Your Outlook

📉 Short-Term Bias: Bearish

Price expected to drop from the top

Multiple lower highs / lower lows

Target bottom: 41,700

📉 Medium-Term Bias: Consolidation & Reversal

Strong bounce after the bottom

Wave structure suggests accumulation

📈 Long-Term Bias: Bullish

Recovery back toward all-time highs

Market structure returns to an uptrend by March 2026

✔️ Final Conclusion

chart suggests a full cycle:

Top formation near 48,127

Multi-wave decline (target 41,700)

41-day bearish cycle

Strong bullish reversal

Full recovery within ~58 days

This is a very clean Elliott-wave-style projection supported by Fibonacci and time cycles.

chart shows a well-structured bearish scenario, followed by a medium-term bullish reversal setup. combining Fibonacci retracement levels, time cycles, moving averages, and projected wave paths to map the market direction.

Below is a detailed breakdown:

1️⃣ Current Market Structure

Price recently reached a local top near 48,127.

After this, the chart suggests expect a significant downward correction.

Price is fluctuating above the:

Green MA (short-term)

Red MA (medium-term)

Blue 200 MA (long-term)

projected path shows a breakdown below these moving averages soon.

2️⃣ Fibonacci Levels (Important Zones)

From the recent high, your Fibonacci retracement levels are:

0.25 → 46,699

0.5 → 45,274

0.75 → 43,950

These levels align with your expected downward waves.

Major Support Zone

Large green zone near 41,700 – 42,200

This is where your final bearish wave ends

It also overlaps with a long-term Fibonacci cluster

This suggests it is the target bottom of the correction.

3️⃣ Bearish Projection (Red Wave Path)

chart shows multiple downward swings:

Initial drop from 48,127 → 45,274

Bounce to retest resistance

Deeper decline toward 44,000 – 43,500

Another bounce

Final capitulation to 41,700

🟥 Final Bearish Target:

~41,700

This matches the blue horizontal support line.

🔹 Duration of Bearish Cycle

174 bars (~41 days)

This suggests the decline completes around late January 2026.

4️⃣ Bullish Reversal Phase (Green + Black Path)

After reaching the bottom around 41,700, your chart shows two phases:

Phase 1 – Strong Rebound (Black Path)

A sharp rally into early February:

First rally to around 44,500 – 45,000

Short-term pullback

Then continuation higher

Phase 2 – Trend Recovery (Green Path)

Long-term green path shows:

A steady upward channel

Price aiming toward 48,000 – 49,000 again

The green dotted lines show alternative bullish scenarios

🔹 Total Recovery Time

258 bars (~58 days)

Targeting mid-March 2026 for a full recovery.

5️⃣ Interpretation of Moving Averages

Price will break below the moving averages during the correction.

Long-term recovery will push back above the:

50 MA (green)

100 MA (red)

200 MA (blue)

This confirms a trend reversal after the bottom is hit.

6️⃣ Summary of Your Outlook

📉 Short-Term Bias: Bearish

Price expected to drop from the top

Multiple lower highs / lower lows

Target bottom: 41,700

📉 Medium-Term Bias: Consolidation & Reversal

Strong bounce after the bottom

Wave structure suggests accumulation

📈 Long-Term Bias: Bullish

Recovery back toward all-time highs

Market structure returns to an uptrend by March 2026

✔️ Final Conclusion

chart suggests a full cycle:

Top formation near 48,127

Multi-wave decline (target 41,700)

41-day bearish cycle

Strong bullish reversal

Full recovery within ~58 days

This is a very clean Elliott-wave-style projection supported by Fibonacci and time cycles.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.