Gold SMC Daily Plan – 28/08

________________________________________

Market Context (SMC perspective):

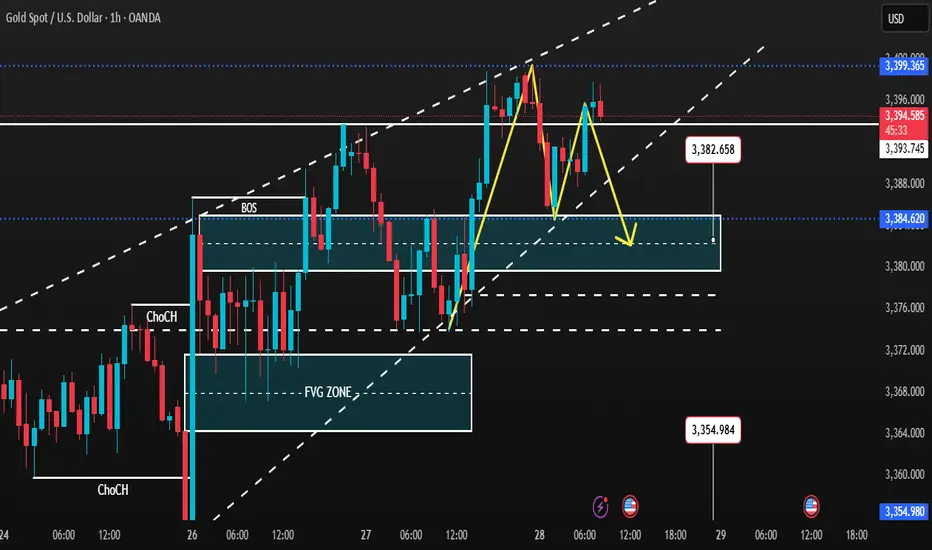

• Price is currently trading around 3395–3396 after an impulsive bullish run and showing early bearish divergence on H4, signaling a potential short-term top.

• Key resistance sits at 3400 – a clean break above could sweep liquidity towards 342x–343x, retesting old ATH.

• If 3370 support breaks, price could retrace deeper into the 335x BUY zone for a strong bullish setup.

________________________________________

Key Levels:

• Resistance: 3396–3400 (Sell Zone), 342x–343x (liquidity sweep area)

• Support: 3370, 3354–3352 (Buy Zone), 3325 (SL for buys)

________________________________________

SMC Zones & Liquidity Pools:

• BUY ZONE 1: 3354–3352 (below liquidity sweep under 3370)

o SL: 3347

o TP: 3365 → 3375 → 3385 → 3395 → 3400+

• BUY ZONE 2: 3380 – 3382

o SL: 3374

o TP: 3390 → 3400 → 3415 →3430 → 3450+

• SELL ZONE: 3408 - 3410 (above recent high)

o SL: 3416

o TP: 3390 → 3380 → 3375 → 3360

________________________________________

Plan & Scenarios:

1. Sell Scenario (Primary Bias – Divergence Play):

o Wait for liquidity grab above 3396–3399 (sweep into resistance)

o Enter short with SL above 3403

o Scale out profits at 3390–3380–3375; leave runner targeting 3360 if support breaks

2. Buy Scenario (Counter Play – Break & Retest):

o If price dips into 3354–3352 buy zone, look for bullish reaction (choch / BOS on lower TF)

o Enter long with SL below 3347

o Target 3365–3375–3385–3395–3400+

________________________________________

Confluence:

• H4 bearish divergence indicating exhaustion at top

• Untapped liquidity zones above 3396 and below 3370

• FVG and imbalance areas aligning with the 335x buy zone

________________________________________

Market Context (SMC perspective):

• Price is currently trading around 3395–3396 after an impulsive bullish run and showing early bearish divergence on H4, signaling a potential short-term top.

• Key resistance sits at 3400 – a clean break above could sweep liquidity towards 342x–343x, retesting old ATH.

• If 3370 support breaks, price could retrace deeper into the 335x BUY zone for a strong bullish setup.

________________________________________

Key Levels:

• Resistance: 3396–3400 (Sell Zone), 342x–343x (liquidity sweep area)

• Support: 3370, 3354–3352 (Buy Zone), 3325 (SL for buys)

________________________________________

SMC Zones & Liquidity Pools:

• BUY ZONE 1: 3354–3352 (below liquidity sweep under 3370)

o SL: 3347

o TP: 3365 → 3375 → 3385 → 3395 → 3400+

• BUY ZONE 2: 3380 – 3382

o SL: 3374

o TP: 3390 → 3400 → 3415 →3430 → 3450+

• SELL ZONE: 3408 - 3410 (above recent high)

o SL: 3416

o TP: 3390 → 3380 → 3375 → 3360

________________________________________

Plan & Scenarios:

1. Sell Scenario (Primary Bias – Divergence Play):

o Wait for liquidity grab above 3396–3399 (sweep into resistance)

o Enter short with SL above 3403

o Scale out profits at 3390–3380–3375; leave runner targeting 3360 if support breaks

2. Buy Scenario (Counter Play – Break & Retest):

o If price dips into 3354–3352 buy zone, look for bullish reaction (choch / BOS on lower TF)

o Enter long with SL below 3347

o Target 3365–3375–3385–3395–3400+

________________________________________

Confluence:

• H4 bearish divergence indicating exhaustion at top

• Untapped liquidity zones above 3396 and below 3370

• FVG and imbalance areas aligning with the 335x buy zone

⚜️ Daily 4 - 6 Swing SIGNALS

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

⚜️ Daily 4 - 6 Swing SIGNALS

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.