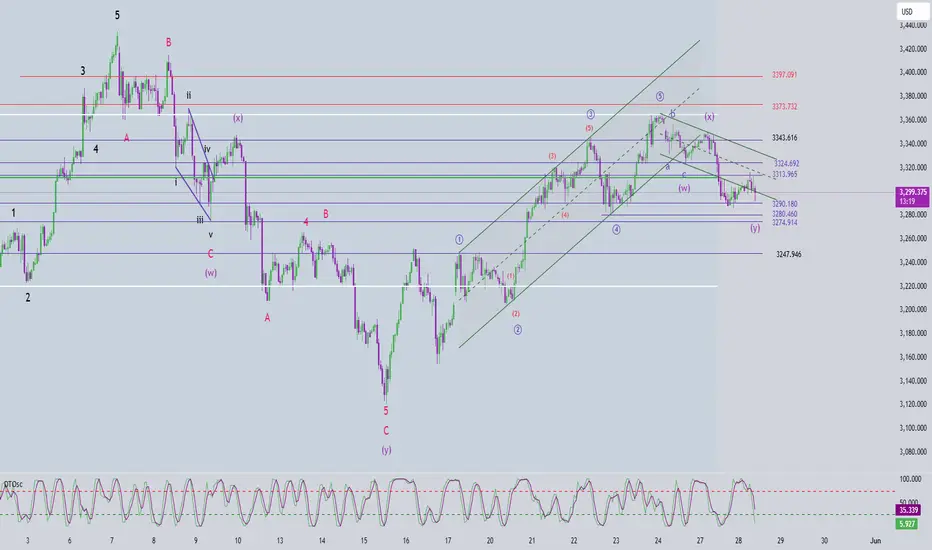

🔍 Current Wave Structure

After a sharp drop yesterday, price has mildly recovered and is now consolidating around the 3314 zone. The correction has nearly reached the target of wave C (green). However, the current rebound is weak, marked by small, overlapping H1 candles — suggesting the bullish structure is not yet convincing.

At this point, we’re tracking two main scenarios:

✅ Scenario 1 – Correction Completed

Wave C seems complete, and price might be starting a new bullish trend.

That said, the overlapping candles on H1 could also indicate the formation of a leading diagonal for wave 1.

In this case, wave 2 is likely to be a strong retracement — typically forming as a zigzag or flat correction.

📌 Strategy:

Wait for wave 2 to complete before looking for a better buy opportunity.

🌀 Scenario 2 – Correction Still in Progress

If the price continues to move slowly or goes sideways, we could be in wave b of a double zigzag correction (wave Y).

🎯 Wave c within wave Y may target 3324.

However, if price breaks below 3284 before hitting 3324, it would likely mean wave c has started, with an expected end near 3280–3274.

📈 Momentum Outlook

D1: Momentum remains bearish ⇒ primary trend still points downward.

H4: Momentum is currently rising ⇒ we may see a temporary recovery today.

H1: Approaching oversold ⇒ if reversal signals appear, short-term buy setups may emerge.

🎯 Trade Plan for Today (28/05/2025)

🔹 Buy Scalp

Entry: 3292 – 3289

SL: 3282

TP1: 3313

TP2: 3324

🔹 Buy Swing

Entry: 3280 – 3277

SL: 3270

TP1: 3290

TP2: 3313

TP3: 3324

🕰️ Expected timing: From London session through New York close

🔸 Sell Zone

Entry: 3324 – 3327

SL: 3334

TP1: 3313

TP2: 3290

TP3: 3280

🕰️ Ideal entry: If price hits resistance during US session or late London

📌 All scenarios will be updated as soon as wave 2 completes or if price clearly breaks below 3284.

Be patient — let the market confirm before taking action.

تم فتح الصفقة

🕵️♂️ H4 Chart Observation – XAUUSDOn the H4 timeframe, we’re seeing bullish candles with short bodies, indicating a lack of strong momentum behind the move.

📈 H4 momentum is approaching overbought territory —

If the current candle closes and the next one follows through, we could start seeing signs of a potential bearish reversal.

🔍 Our plan:

Keep monitoring H4 momentum. Once it enters the overbought zone, we’ll shift to the H1 timeframe to look for Sell setups with confirmation.

📢 Sometimes signals appear on TradingView with a slight delay!

🚀 Join our Telegram channel to get instant updates and real-time scalping signals:

👉 t.me/+xkFQ95yHVOEwNDc1

🚀 Join our Telegram channel to get instant updates and real-time scalping signals:

👉 t.me/+xkFQ95yHVOEwNDc1

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

📢 Sometimes signals appear on TradingView with a slight delay!

🚀 Join our Telegram channel to get instant updates and real-time scalping signals:

👉 t.me/+xkFQ95yHVOEwNDc1

🚀 Join our Telegram channel to get instant updates and real-time scalping signals:

👉 t.me/+xkFQ95yHVOEwNDc1

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.