PROTECTED SOURCE SCRIPT

تم تحديثه Arjunology for Stocks Indicator

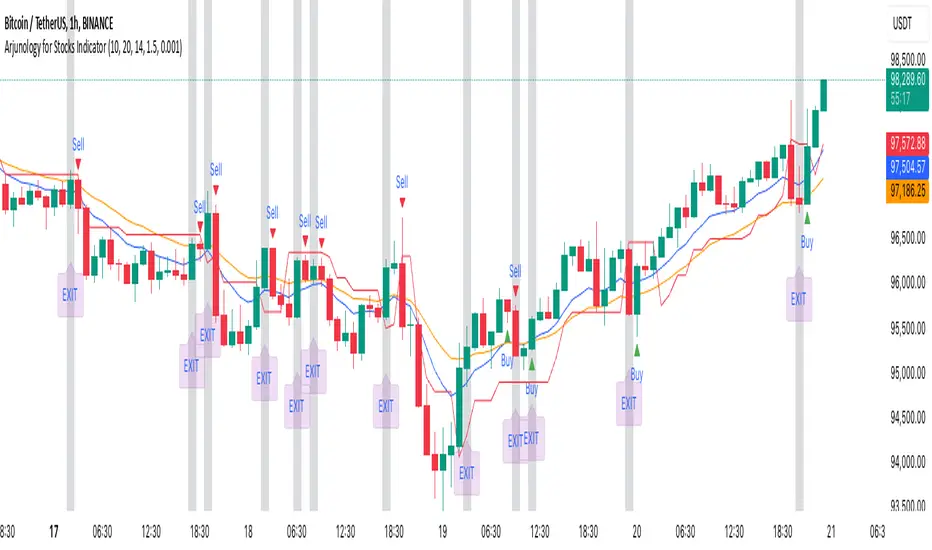

Arjunology for Stocks Indicator is a unique trend-following and exit management system that combines the power of Exponential Moving Averages (EMA) and Average True Range (ATR) to capture market trends and manage trade exits dynamically. It is designed to help traders identify potential buy and sell points based on market trends while incorporating volatility adjustments to avoid false signals and provide more reliable trade entries and exits.

Key Features:

1. Exponential Moving Averages (EMAs):

• Two EMAs (Short EMA and Long EMA) are used to determine trend direction and potential crossover signals.

• Short EMA reacts quickly to price changes, giving an indication of shorter-term trends.

• Long EMA provides a more stable measure of the overall trend direction, helping filter out market noise.

• Bullish Crossovers: When the short EMA crosses above the long EMA, it signals a potential uptrend (buy condition).

• Bearish Crossovers: When the short EMA crosses below the long EMA, it signals a potential downtrend (sell condition).

2. Average True Range (ATR):

• ATR is used to assess market volatility and avoid false signals during low volatility periods.

• A trailing stop loss mechanism based on ATR ensures that the indicator adapts to the current market environment, with higher volatility allowing for wider stops and lower volatility leading to tighter stops.

• A flat ATR threshold is used to avoid signals during quiet periods, where price movement may be too insignificant to trade effectively.

3. Buy and Sell Visual Cues:

• Green Triangle at the bottom of the candle when a bullish crossover (buy) condition is met.

• Red Triangle at the top of the candle when a bearish crossover (sell) condition is met.

• These visual cues help traders quickly identify trade entry points based on the trend signals.

4. Dynamic Exit Management:

• The indicator provides an Blue candle background to highlight exit points, with an “EXIT” label at the bottom of the candle in blue. This visual exit signal ensures clarity when a trade should be exited based on the trend reversal.

Justification for Combining EMAs and ATR in This Script:

The Exponential Moving Averages (EMAs) and Average True Range (ATR) serve complementary purposes in this script, enhancing each other’s functionality to provide a more complete trading system:

1. Trend Identification with EMAs:

• The combination of short and long EMAs is a widely trusted method for determining the trend direction. The crossovers between these EMAs provide clear entry signals for buy or sell trades. However, relying solely on EMAs can lead to false signals during periods of low volatility or market consolidation.

2. ATR for Volatility and Stop Loss:

• To prevent false signals during low-volatility conditions, the script uses ATR as a filter. This ensures that trades are only taken when the market has enough momentum, reducing the risk of being caught in “choppy” conditions where price action may be flat and untradeable.

• Additionally, the ATR-based trailing stop provides dynamic trade management, adjusting stop-loss levels according to the current volatility. This makes the system adaptive and prevents tight stops in volatile conditions or unnecessarily wide stops in calm markets.

3. Why They Work Together:

• The EMAs handle the trend direction, which is the foundation of the trading system, while the ATR adjusts the trade management to account for changing volatility. This means that the trader is always entering trades that are likely to follow a strong trend, while avoiding stagnant markets and using volatility-adaptive exit points.

• Without ATR, EMAs might generate signals during low-volatility periods that are unreliable. On the other hand, ATR alone wouldn’t provide a clear direction for trend-following. Together, these indicators create a balanced approach where trades are not only timely but also carefully managed.

How to Use:

• Buy Entry: Enter when the green triangle appears, indicating a bullish EMA crossover.

• Sell Entry: Enter short when the red triangle appears, indicating a bearish EMA crossover.

• Exit: Follow the orange background and blue “EXIT” label as a visual cue to exit the trade.

The combination of these tools allows traders to identify meaningful trend reversals while also managing risk dynamically, making the Arjunology for Stocks Indicator both versatile and effective for various market conditions.

Key Features:

1. Exponential Moving Averages (EMAs):

• Two EMAs (Short EMA and Long EMA) are used to determine trend direction and potential crossover signals.

• Short EMA reacts quickly to price changes, giving an indication of shorter-term trends.

• Long EMA provides a more stable measure of the overall trend direction, helping filter out market noise.

• Bullish Crossovers: When the short EMA crosses above the long EMA, it signals a potential uptrend (buy condition).

• Bearish Crossovers: When the short EMA crosses below the long EMA, it signals a potential downtrend (sell condition).

2. Average True Range (ATR):

• ATR is used to assess market volatility and avoid false signals during low volatility periods.

• A trailing stop loss mechanism based on ATR ensures that the indicator adapts to the current market environment, with higher volatility allowing for wider stops and lower volatility leading to tighter stops.

• A flat ATR threshold is used to avoid signals during quiet periods, where price movement may be too insignificant to trade effectively.

3. Buy and Sell Visual Cues:

• Green Triangle at the bottom of the candle when a bullish crossover (buy) condition is met.

• Red Triangle at the top of the candle when a bearish crossover (sell) condition is met.

• These visual cues help traders quickly identify trade entry points based on the trend signals.

4. Dynamic Exit Management:

• The indicator provides an Blue candle background to highlight exit points, with an “EXIT” label at the bottom of the candle in blue. This visual exit signal ensures clarity when a trade should be exited based on the trend reversal.

Justification for Combining EMAs and ATR in This Script:

The Exponential Moving Averages (EMAs) and Average True Range (ATR) serve complementary purposes in this script, enhancing each other’s functionality to provide a more complete trading system:

1. Trend Identification with EMAs:

• The combination of short and long EMAs is a widely trusted method for determining the trend direction. The crossovers between these EMAs provide clear entry signals for buy or sell trades. However, relying solely on EMAs can lead to false signals during periods of low volatility or market consolidation.

2. ATR for Volatility and Stop Loss:

• To prevent false signals during low-volatility conditions, the script uses ATR as a filter. This ensures that trades are only taken when the market has enough momentum, reducing the risk of being caught in “choppy” conditions where price action may be flat and untradeable.

• Additionally, the ATR-based trailing stop provides dynamic trade management, adjusting stop-loss levels according to the current volatility. This makes the system adaptive and prevents tight stops in volatile conditions or unnecessarily wide stops in calm markets.

3. Why They Work Together:

• The EMAs handle the trend direction, which is the foundation of the trading system, while the ATR adjusts the trade management to account for changing volatility. This means that the trader is always entering trades that are likely to follow a strong trend, while avoiding stagnant markets and using volatility-adaptive exit points.

• Without ATR, EMAs might generate signals during low-volatility periods that are unreliable. On the other hand, ATR alone wouldn’t provide a clear direction for trend-following. Together, these indicators create a balanced approach where trades are not only timely but also carefully managed.

How to Use:

• Buy Entry: Enter when the green triangle appears, indicating a bullish EMA crossover.

• Sell Entry: Enter short when the red triangle appears, indicating a bearish EMA crossover.

• Exit: Follow the orange background and blue “EXIT” label as a visual cue to exit the trade.

The combination of these tools allows traders to identify meaningful trend reversals while also managing risk dynamically, making the Arjunology for Stocks Indicator both versatile and effective for various market conditions.

ملاحظات الأخبار

just did some cosmetic changes for look and feel and made it compliant to Pine Editor V6نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

Thanks.

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

Thanks.

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.