OPEN-SOURCE SCRIPT

Financial Ratios Fundamental Strategy

What are financial ratios?

Financial ratios are basic calculations using quantitative data from a company’s financial statements. They are used to get insights and important information on the company’s performance, profitability, and financial health.

Common financial ratios come from a company’s balance sheet, income statement, and cash flow statement.

Businesses use financial ratios to determine liquidity, debt concentration, growth, profitability, and market value.

The common financial ratios every business should track are

1) liquidity ratios

2) leverage ratios

3)efficiency ratio

4) profitability ratios

5) market value ratios.

Initially I had a big list of 20 different ratios for testing, but in the end I decided to stick for the strategy with these ones :

Current ratio: Current Assets / Current Liabilities

The current ratio measures how a business’s current assets, such as cash, cash equivalents, accounts receivable, and inventories, are used to settle current liabilities such as accounts payable.

Interest coverage ratio: EBIT / Interest expenses

Companies generally pay interest on corporate debt. The interest coverage ratio shows if a company’s revenue after operating expenses can cover interest liabilities.

Payables turnover ratio: Cost of Goods sold (or net credit purchases) / Average Accounts Payable

The payables turnover ratio calculates how quickly a business pays its suppliers and creditors.

Gross margin: Gross profit / Net sales

The gross margin ratio measures how much profit a business makes after the cost of goods and services compared to net sales.

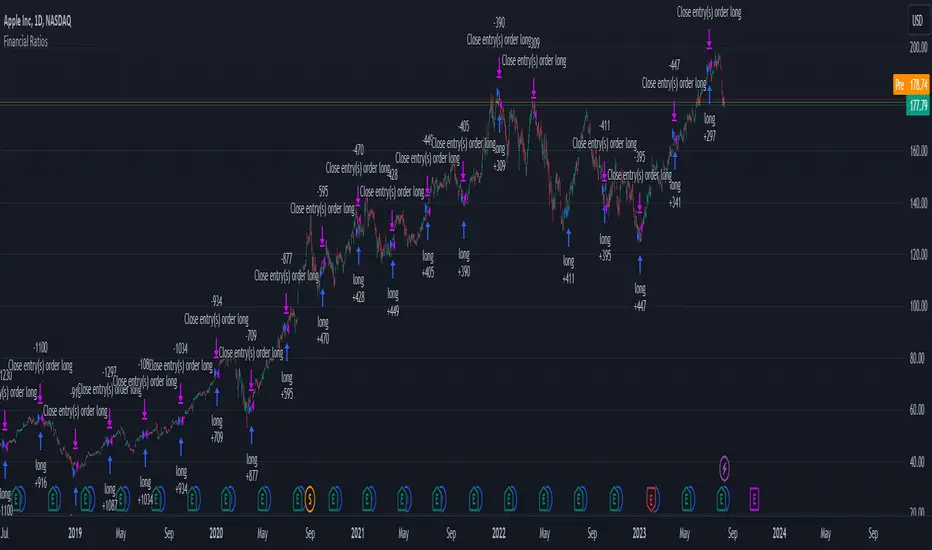

With this data, I have created the long and long exit strategy:

For long, if any of the 4 listed ratios,such as current ratio or interest coverage ratio or payable turn ratio or gross margin ratio is ascending after a quarter, its a potential long entry.

For example in january the gross margin ratio is at 10% and in april is at 15%, this is an increase from a quarter to another, so it will get a long entry trigger.

The same could happen if any of the 4 listed ratios follow the ascending condition since they are all treated equally as important

For exit, if any of the 4 listed ratios are descending after a quarter, such as current ratio or interest coverage ratio or payable turn ratio or gross margin ratio is descending after a quarter, its a potential long exit.

For example in april we entered a long trade, and in july data from gross margin comes as 12% .

In this case it fell down from 15% to 12%, triggering an exit for our trade.

However there is a special case with this strategy, in order to make it more re active and make use of the compound effect:

So lets say on july 1 when the data came in, the gross margin data came descending (indicating an exit for the long trade), however at the same the interest coverage ratio came as positive, or any of the other 3 left ratios left . In that case the next day after the trade closed, it will enter a new long position and wait again until a new quarter data for the financial is being published.

Regarding the guidelines of tradingview, they recommend to have more than 100 trades.

With this type of strategy, using Daily timeframe and data from financials coming each quarter(4 times a year), we only have the financial data available since 2016, so that makes 28 quarters of data, making a maximum potential of 28 trades.

This can however be "bypassed" to check the integrity of the strategy and its edge, by taking for example multiple stocks and test them in a row, for example, appl, msft, goog, brk and so on, and you can see the correlation between them all.

At the same time I have to say that this strategy is more as an educational one since it miss a risk management and other additional filters to make it more adapted for real live trading, and instead serves as a guiding tool for those that want to make use of fundamentals in their trades

If you have any questions, please let me know !

Financial ratios are basic calculations using quantitative data from a company’s financial statements. They are used to get insights and important information on the company’s performance, profitability, and financial health.

Common financial ratios come from a company’s balance sheet, income statement, and cash flow statement.

Businesses use financial ratios to determine liquidity, debt concentration, growth, profitability, and market value.

The common financial ratios every business should track are

1) liquidity ratios

2) leverage ratios

3)efficiency ratio

4) profitability ratios

5) market value ratios.

Initially I had a big list of 20 different ratios for testing, but in the end I decided to stick for the strategy with these ones :

Current ratio: Current Assets / Current Liabilities

The current ratio measures how a business’s current assets, such as cash, cash equivalents, accounts receivable, and inventories, are used to settle current liabilities such as accounts payable.

Interest coverage ratio: EBIT / Interest expenses

Companies generally pay interest on corporate debt. The interest coverage ratio shows if a company’s revenue after operating expenses can cover interest liabilities.

Payables turnover ratio: Cost of Goods sold (or net credit purchases) / Average Accounts Payable

The payables turnover ratio calculates how quickly a business pays its suppliers and creditors.

Gross margin: Gross profit / Net sales

The gross margin ratio measures how much profit a business makes after the cost of goods and services compared to net sales.

With this data, I have created the long and long exit strategy:

For long, if any of the 4 listed ratios,such as current ratio or interest coverage ratio or payable turn ratio or gross margin ratio is ascending after a quarter, its a potential long entry.

For example in january the gross margin ratio is at 10% and in april is at 15%, this is an increase from a quarter to another, so it will get a long entry trigger.

The same could happen if any of the 4 listed ratios follow the ascending condition since they are all treated equally as important

For exit, if any of the 4 listed ratios are descending after a quarter, such as current ratio or interest coverage ratio or payable turn ratio or gross margin ratio is descending after a quarter, its a potential long exit.

For example in april we entered a long trade, and in july data from gross margin comes as 12% .

In this case it fell down from 15% to 12%, triggering an exit for our trade.

However there is a special case with this strategy, in order to make it more re active and make use of the compound effect:

So lets say on july 1 when the data came in, the gross margin data came descending (indicating an exit for the long trade), however at the same the interest coverage ratio came as positive, or any of the other 3 left ratios left . In that case the next day after the trade closed, it will enter a new long position and wait again until a new quarter data for the financial is being published.

Regarding the guidelines of tradingview, they recommend to have more than 100 trades.

With this type of strategy, using Daily timeframe and data from financials coming each quarter(4 times a year), we only have the financial data available since 2016, so that makes 28 quarters of data, making a maximum potential of 28 trades.

This can however be "bypassed" to check the integrity of the strategy and its edge, by taking for example multiple stocks and test them in a row, for example, appl, msft, goog, brk and so on, and you can see the correlation between them all.

At the same time I have to say that this strategy is more as an educational one since it miss a risk management and other additional filters to make it more adapted for real live trading, and instead serves as a guiding tool for those that want to make use of fundamentals in their trades

If you have any questions, please let me know !

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

🔻Website: finaur.com/

🔻Strategies: finaur.com/lab/

🔻Blog: finaur.com/blog/

🔻Telegram : t.me/finaur_com/

🔻Trader Psychology Profile – thelumenism.com/

🔻Strategies: finaur.com/lab/

🔻Blog: finaur.com/blog/

🔻Telegram : t.me/finaur_com/

🔻Trader Psychology Profile – thelumenism.com/

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

🔻Website: finaur.com/

🔻Strategies: finaur.com/lab/

🔻Blog: finaur.com/blog/

🔻Telegram : t.me/finaur_com/

🔻Trader Psychology Profile – thelumenism.com/

🔻Strategies: finaur.com/lab/

🔻Blog: finaur.com/blog/

🔻Telegram : t.me/finaur_com/

🔻Trader Psychology Profile – thelumenism.com/

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.