OPEN-SOURCE SCRIPT

Risk-On / Risk-Off Score

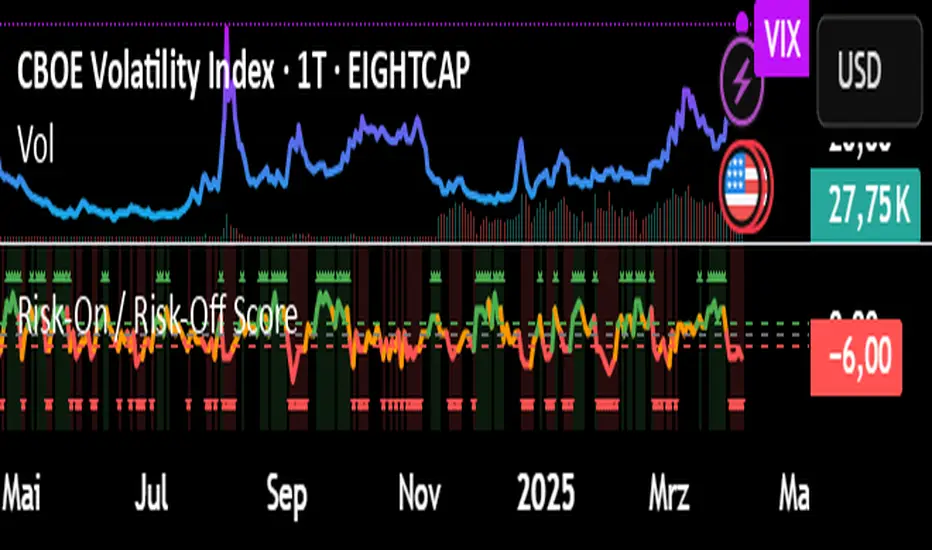

Risk-On / Risk-Off Score (Macro Sentiment Indicator)

This indicator calculates a custom Risk-On / Risk-Off Score to objectively assess the current market risk sentiment using a carefully selected basket of macroeconomic assets and intermarket relationships.

🧠 What does this indicator do?

The score is based on 14 key components grouped into three categories:

🟢 Risk-On Assets (rising = appetite for risk)

(+1 if performance over X days is positive, otherwise –1)

NASDAQ 100 (NAS100USD)

S&P 500 (SPX)

Bitcoin (BTCUSD)

Copper (HG1!)

WTI Crude Oil (CLK2025)

🔴 Risk-Off Assets (rising = flight to safety)

(–1 if performance is positive, otherwise +1)

Gold (XAUUSD)

US Treasury Bonds (TLT ETF) (TLT)

US Dollar Index (DXY)

USD/CHF

USD/JPY

US 10Y Yields (US10Y) (yields are interpreted inversely)

⚖️ Risk Spreads / Relative Indicators

(+1 if rising, –1 if falling)

Copper/Gold Ratio → HG1! / XAUUSD

NASDAQ/VIX Ratio → NAS100USD / VIX

HYG/TLT Ratio → HYG / TLT

📏 Score Calculation

Total score = sum of all components

Range: from –14 (extreme Risk-Off) to +14 (strong Risk-On)

Color-coded output:

🟢 Score > 2 = Risk-On

🟠 –2 to +2 = Neutral

🔴 Score < –2 = Risk-Off

Displayed as a line plot with background color and signal markers

🧪 Timeframe of analysis:

Default: 5 days (adjustable via input)

Calculated using Rate of Change (% change)

🧭 Use Cases:

Quickly assess macro sentiment

Filter for position sizing, hedging, or intraday bias

Especially useful for:

Swing traders

Day traders with macro filters

Volatility and options traders

📌 Note:

This is not a buy/sell signal indicator, but a contextual sentiment tool designed to help you stay aligned with overall market conditions.

This indicator calculates a custom Risk-On / Risk-Off Score to objectively assess the current market risk sentiment using a carefully selected basket of macroeconomic assets and intermarket relationships.

🧠 What does this indicator do?

The score is based on 14 key components grouped into three categories:

🟢 Risk-On Assets (rising = appetite for risk)

(+1 if performance over X days is positive, otherwise –1)

NASDAQ 100 (NAS100USD)

S&P 500 (SPX)

Bitcoin (BTCUSD)

Copper (HG1!)

WTI Crude Oil (CLK2025)

🔴 Risk-Off Assets (rising = flight to safety)

(–1 if performance is positive, otherwise +1)

Gold (XAUUSD)

US Treasury Bonds (TLT ETF) (TLT)

US Dollar Index (DXY)

USD/CHF

USD/JPY

US 10Y Yields (US10Y) (yields are interpreted inversely)

⚖️ Risk Spreads / Relative Indicators

(+1 if rising, –1 if falling)

Copper/Gold Ratio → HG1! / XAUUSD

NASDAQ/VIX Ratio → NAS100USD / VIX

HYG/TLT Ratio → HYG / TLT

📏 Score Calculation

Total score = sum of all components

Range: from –14 (extreme Risk-Off) to +14 (strong Risk-On)

Color-coded output:

🟢 Score > 2 = Risk-On

🟠 –2 to +2 = Neutral

🔴 Score < –2 = Risk-Off

Displayed as a line plot with background color and signal markers

🧪 Timeframe of analysis:

Default: 5 days (adjustable via input)

Calculated using Rate of Change (% change)

🧭 Use Cases:

Quickly assess macro sentiment

Filter for position sizing, hedging, or intraday bias

Especially useful for:

Swing traders

Day traders with macro filters

Volatility and options traders

📌 Note:

This is not a buy/sell signal indicator, but a contextual sentiment tool designed to help you stay aligned with overall market conditions.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.