OPEN-SOURCE SCRIPT

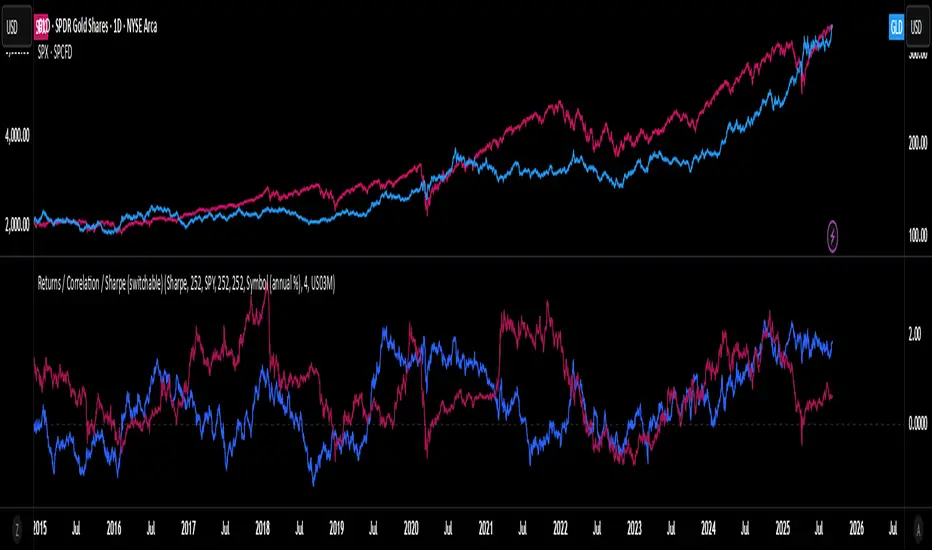

Rolling Performance Toolkit (Returns, Correlation and Sharpe)

This script provides a flexible toolkit for evaluating rolling performance metrics between any asset and a benchmark.

Features:

Library-based: Built on a custom utilities library for consistent return and statistics calculations.

Rolling Window Control: Choose the lookback period (in days) to calculate metrics.

Multiple Modes: Toggle between Rolling Returns, Rolling Correlation, and Rolling Sharpe Ratio.

Benchmark Comparison: Compare your selected ticker against a benchmark (default: S&P 500 / SPX), but you can easily switch to any symbol.

Risk-Free Rate Options: Choose from zero, a constant annual % rate, or a proxy symbol (default: US03M – 3-Month Treasury Yield).

Annualized Sharpe: Sharpe ratios are annualized by default (×√252) for intuitive interpretation.

This tool is useful for traders and investors who want to monitor relative performance, diversification benefits, or risk-adjusted returns over time.

Features:

Library-based: Built on a custom utilities library for consistent return and statistics calculations.

Rolling Window Control: Choose the lookback period (in days) to calculate metrics.

Multiple Modes: Toggle between Rolling Returns, Rolling Correlation, and Rolling Sharpe Ratio.

Benchmark Comparison: Compare your selected ticker against a benchmark (default: S&P 500 / SPX), but you can easily switch to any symbol.

Risk-Free Rate Options: Choose from zero, a constant annual % rate, or a proxy symbol (default: US03M – 3-Month Treasury Yield).

Annualized Sharpe: Sharpe ratios are annualized by default (×√252) for intuitive interpretation.

This tool is useful for traders and investors who want to monitor relative performance, diversification benefits, or risk-adjusted returns over time.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.