PROTECTED SOURCE SCRIPT

Pro BTB Pour Samadi Indicator [TradingFinder] Back To Breakeven

🔵Introduction

The Pro BTB (Professional Back To Breakeven) strategy is one of the most advanced price action setups, designed and taught by Mohammad Ali Poursamadi, an international Iranian trader and a well-known instructor of financial market analysis.

The main logic of this strategy is based on the natural behavior of the market:

To better understand Pro BTB, it is necessary to first know the concept of a Spike. A spike refers to a sudden and powerful movement of price in one direction, usually caused by heavy order flow. Such a move creates an Imbalance between buyers and sellers. Because the market does not have enough time to distribute orders fairly, it leaves an Inefficiency on the chart.

The direct result of this process is the formation of a Fair Value Gap (FVG) a gap between candles that shows trades were not distributed evenly. In simple terms: the spike is the cause, and Imbalance, Inefficiency, and FVG are its consequences.

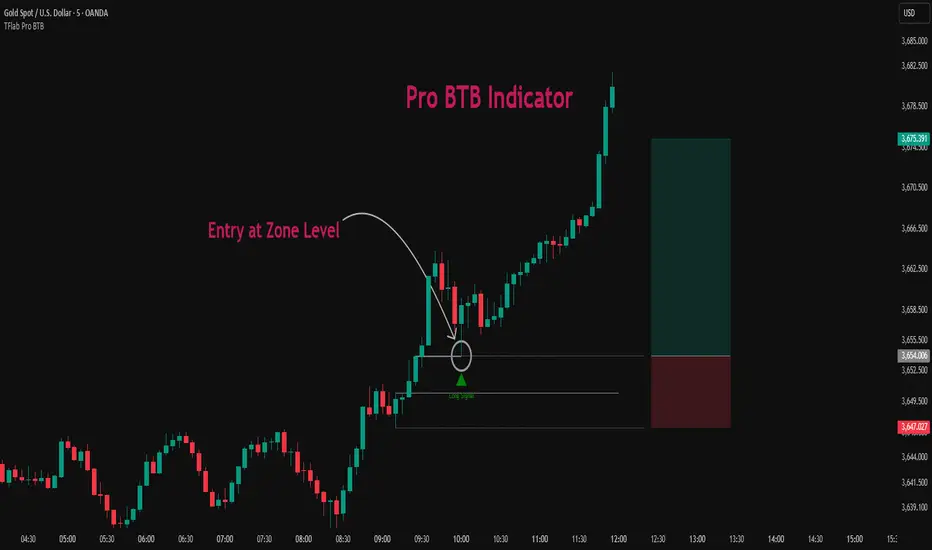

In practice, Pro BTB works effectively in both bullish and bearish structures. In a Bullish Setup, a bullish spike first breaks a resistance level. Then, when price returns to that same level, a safe and low-risk buying opportunity is created. Conversely, in a Bearish Setup, a bearish spike breaks a support level, and when price comes back to the broken level, it provides the best conditions for a short entry. These two examples illustrate how Pro BTB logic provides precise, low-risk entries in both directions of the market.

🔵How to Use

The Pro BTB (Back To Breakeven) strategy allows traders to enter precisely after price returns to the breakout level; this way the entry aligns with the natural market flow while risk is minimized. In practice, this method is simple yet powerful: first, identify a valid breakout on a key level, then wait for price to return to that level, and finally, take the entry in the direction of the main trend.

🟣Bullish Setup

When a bullish spike occurs and a key resistance is broken, price usually returns to the same level. This level, now acting as support, provides the best opportunity for a long entry. In this scenario, the stop-loss is placed behind the breakout candle or slightly below the broken level, and the take-profit target should be defined with at least a 1:2 risk-to-reward ratio. With strong momentum, higher targets can also be considered.

🟣Bearish Setup

In a bearish scenario, a bearish spike breaks a key support. After the breakout, price usually returns to the same level, which now acts as resistance. This creates the best conditions for a short entry. The stop-loss is placed behind the breakout candle or slightly above the broken level, while the take-profit target is set with a risk-to-reward ratio greater than 1:2.

🟣General Rules of Pro BTB

To apply Pro BTB correctly, several key rules must be followed:

🟣Six Entry Methods in Pro BTB

For greater flexibility, Pro BTB offers six standard entry methods:

🔵Setting

🟣Spike Filter | Movement

Minimum Spike Bars: Defines the minimum number of consecutive candles required for a valid spike.

Movement Power: Enables or disables the momentum-based spike filter.

Movement Power Level: Sets the strength threshold; higher values filter out weaker moves and only detect strong spikes.

🟣Spike Filter | Gap

Gap Filter: Enables or disables the gap filter.

Gap Type: Selects which type of gap should be detected (All Gaps, Significant, Structural, Major).

🟣Spike Filter | Doji

Doji Tolerance: Defines whether doji candles are allowed within a spike.

Max Doji Body Ratio: Maximum ratio of body-to-total candle size for classifying a candle as a doji.

Max Doji in Spike Ratio: Maximum percentage of doji candles allowed within a spike.

🟣Position Management

Stop-Loss Threshold: Enables or disables the stop-loss threshold feature.

Stop-Loss Threshold Value: Defines the value of the stop-loss threshold for risk management.

Risk-Reward Ratio: Sets the desired risk-to-reward ratio (e.g., 1:1 or 1:2).

Include SL Threshold in R:R: Determines whether the stop-loss threshold is included in risk-to-reward calculations.

🟣Display Settings

Display Mode: Chooses between Setup (showing setups) or Signal (showing trade signals).

Show Entry Levels: Displays entry levels on the chart (buy/sell zones) when enabled

Only Display the Last Position: Displays only the most recent position on the chart when enabled.

Setup Width Drawing: Adjusts the visual width of the setup drawings on the chart for better visibility.

🟣Alert

Alert: Enables alert notifications. When turned on, you can set TradingView alerts to receive notifications once the setup or signal conditions are met

🔵Conclusion

The Pro BTB (Back To Breakeven) strategy is a smart and structured entry method based on natural market behavior after a breakout and retest of the broken level. It helps traders avoid emotional, high-risk entries by waiting for market confirmation and entering precisely at a point that aligns with the main trend and sits closest to the key level.

The simplicity of its rules, flexibility in entry methods, and a risk-to-reward ratio above 2 have made Pro BTB one of the most popular tools among price action traders. Nevertheless, as with any strategy, it is recommended to practice it in demo accounts or through personal backtesting before applying it to real trading, in order to find the entry conditions that best suit your trading style.

The Pro BTB (Professional Back To Breakeven) strategy is one of the most advanced price action setups, designed and taught by Mohammad Ali Poursamadi, an international Iranian trader and a well-known instructor of financial market analysis.

The main logic of this strategy is based on the natural behavior of the market:

- Breakout of a key level: Price moves beyond an important support or resistance.

- Retest / Back To Breakeven: Price returns to the broken level.

- Continuation of the main trend: Entry at this point allows alignment with the dominant market direction.

To better understand Pro BTB, it is necessary to first know the concept of a Spike. A spike refers to a sudden and powerful movement of price in one direction, usually caused by heavy order flow. Such a move creates an Imbalance between buyers and sellers. Because the market does not have enough time to distribute orders fairly, it leaves an Inefficiency on the chart.

The direct result of this process is the formation of a Fair Value Gap (FVG) a gap between candles that shows trades were not distributed evenly. In simple terms: the spike is the cause, and Imbalance, Inefficiency, and FVG are its consequences.

In practice, Pro BTB works effectively in both bullish and bearish structures. In a Bullish Setup, a bullish spike first breaks a resistance level. Then, when price returns to that same level, a safe and low-risk buying opportunity is created. Conversely, in a Bearish Setup, a bearish spike breaks a support level, and when price comes back to the broken level, it provides the best conditions for a short entry. These two examples illustrate how Pro BTB logic provides precise, low-risk entries in both directions of the market.

🔵How to Use

The Pro BTB (Back To Breakeven) strategy allows traders to enter precisely after price returns to the breakout level; this way the entry aligns with the natural market flow while risk is minimized. In practice, this method is simple yet powerful: first, identify a valid breakout on a key level, then wait for price to return to that level, and finally, take the entry in the direction of the main trend.

🟣Bullish Setup

When a bullish spike occurs and a key resistance is broken, price usually returns to the same level. This level, now acting as support, provides the best opportunity for a long entry. In this scenario, the stop-loss is placed behind the breakout candle or slightly below the broken level, and the take-profit target should be defined with at least a 1:2 risk-to-reward ratio. With strong momentum, higher targets can also be considered.

🟣Bearish Setup

In a bearish scenario, a bearish spike breaks a key support. After the breakout, price usually returns to the same level, which now acts as resistance. This creates the best conditions for a short entry. The stop-loss is placed behind the breakout candle or slightly above the broken level, while the take-profit target is set with a risk-to-reward ratio greater than 1:2.

🟣General Rules of Pro BTB

To apply Pro BTB correctly, several key rules must be followed:

- The breakout must be valid and occur on a key level.

- Always wait for the retest; do not enter immediately after the breakout.

- Entry should only happen when price touches the broken level and shows candlestick confirmation.

- The stop-loss (SL) must be placed behind the breakout candle or the broken level.

- The take-profit (TP) must always be at least twice the trade risk.

- For higher reliability, the breakout should align with the trend on higher timeframes.

🟣Six Entry Methods in Pro BTB

For greater flexibility, Pro BTB offers six standard entry methods:

- Market Entry: Enter immediately at the breakout level.

- Limit Order: Place a limit order on the breakout level.

- Stop Order: Enter only after confirmation of continuation.

- Confirmation Candle: Enter after a confirmation candle closes on the level.

- Pattern Entry: Enter based on candlestick patterns such as Pin Bar or Engulfing.

- Zone Entry: Enter from a zone instead of an exact point to account for market noise.

🔵Setting

🟣Spike Filter | Movement

Minimum Spike Bars: Defines the minimum number of consecutive candles required for a valid spike.

Movement Power: Enables or disables the momentum-based spike filter.

Movement Power Level: Sets the strength threshold; higher values filter out weaker moves and only detect strong spikes.

🟣Spike Filter | Gap

Gap Filter: Enables or disables the gap filter.

Gap Type: Selects which type of gap should be detected (All Gaps, Significant, Structural, Major).

🟣Spike Filter | Doji

Doji Tolerance: Defines whether doji candles are allowed within a spike.

Max Doji Body Ratio: Maximum ratio of body-to-total candle size for classifying a candle as a doji.

Max Doji in Spike Ratio: Maximum percentage of doji candles allowed within a spike.

🟣Position Management

Stop-Loss Threshold: Enables or disables the stop-loss threshold feature.

Stop-Loss Threshold Value: Defines the value of the stop-loss threshold for risk management.

Risk-Reward Ratio: Sets the desired risk-to-reward ratio (e.g., 1:1 or 1:2).

Include SL Threshold in R:R: Determines whether the stop-loss threshold is included in risk-to-reward calculations.

🟣Display Settings

Display Mode: Chooses between Setup (showing setups) or Signal (showing trade signals).

Show Entry Levels: Displays entry levels on the chart (buy/sell zones) when enabled

Only Display the Last Position: Displays only the most recent position on the chart when enabled.

Setup Width Drawing: Adjusts the visual width of the setup drawings on the chart for better visibility.

🟣Alert

Alert: Enables alert notifications. When turned on, you can set TradingView alerts to receive notifications once the setup or signal conditions are met

🔵Conclusion

The Pro BTB (Back To Breakeven) strategy is a smart and structured entry method based on natural market behavior after a breakout and retest of the broken level. It helps traders avoid emotional, high-risk entries by waiting for market confirmation and entering precisely at a point that aligns with the main trend and sits closest to the key level.

The simplicity of its rules, flexibility in entry methods, and a risk-to-reward ratio above 2 have made Pro BTB one of the most popular tools among price action traders. Nevertheless, as with any strategy, it is recommended to practice it in demo accounts or through personal backtesting before applying it to real trading, in order to find the entry conditions that best suit your trading style.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.