OPEN-SOURCE SCRIPT

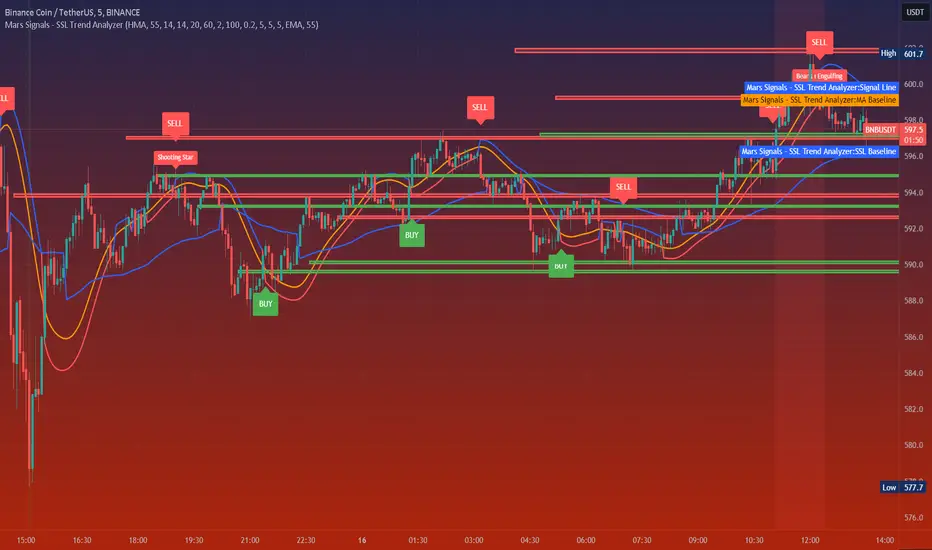

Mars Signals - SSL Trend Analyzer

Introduction

The "Mars Signals - Precision Trend Analyzer with SSL Baseline & Price Action Zones" is a comprehensive technical analysis tool designed for traders seeking to enhance their market analysis and trading strategies. This indicator integrates multiple advanced trading concepts, including dynamic moving averages, trend detection algorithms, momentum indicators, volume analysis, higher timeframe confirmation, candlestick pattern recognition, and precise price action zones. By combining these elements, the indicator aims to provide clear and actionable buy and sell signals, helping traders to make informed decisions in various market conditions.

Core Components and Functionality

1.Dynamic Baseline Calculation

2.SSL Baseline Integration

3.Momentum and Trend Filters

4.Volume Analysis

5.Higher Timeframe Confirmation

6.Candlestick Pattern Recognition

7.Price Action Zones

Interpreting the Signals

1.Buy Signals

Conditions:

Visual Indicators:

2.Sell Signals

Conditions:

Visual Indicators:

3.Support and Resistance Zones

Interpretation:

Background Color:

Effective Usage Strategies

1.Customization

2.Combining with Other Analysis

3.Backtesting

4.Monitoring Market Conditions

Indicator Inputs and Customization Options

Price Action Zones Settings:

Conclusion

The "Mars Signals - Precision Trend Analyzer with SSL Baseline & Price Action Zones" is a versatile and powerful tool that amalgamates essential technical analysis techniques into a single, user-friendly indicator. By providing clear visual signals and incorporating multiple layers of confirmation, it assists traders in identifying high-probability trading opportunities. Whether you are a day trader, swing trader, or long-term investor, this indicator can be tailored to suit your trading style and enhance your decision-making process.

To maximize the benefits of this indicator:

Disclaimer

Trading financial markets involves risk, and past performance is not indicative of future results. This indicator is a tool to aid in analysis and should not be the sole basis for any trading decision. Always conduct your own research and consider consulting with a licensed financial advisor.

The "Mars Signals - Precision Trend Analyzer with SSL Baseline & Price Action Zones" is a comprehensive technical analysis tool designed for traders seeking to enhance their market analysis and trading strategies. This indicator integrates multiple advanced trading concepts, including dynamic moving averages, trend detection algorithms, momentum indicators, volume analysis, higher timeframe confirmation, candlestick pattern recognition, and precise price action zones. By combining these elements, the indicator aims to provide clear and actionable buy and sell signals, helping traders to make informed decisions in various market conditions.

Core Components and Functionality

1.Dynamic Baseline Calculation

- Moving Average Types: The indicator allows users to select from a variety of moving average types for the baseline calculation, including Simple Moving Average (SMA), Exponential Moving Average (EMA), Hull Moving Average (HMA), Weighted Moving Average (WMA), Double EMA (DEMA), Triple EMA (TEMA), Least Squares Moving Average (LSMA), Triangular Moving Average (TMA), Kijun (from Ichimoku Kinko Hyo), and McGinley's Dynamic.

- Baseline Length: Users can customize the length of the moving average, providing flexibility to adjust the sensitivity of the baseline to market movements.

- Signal Line Generation: The indicator computes a dynamic signal line based on the relationship between the close price and the moving averages of the high and low prices. This signal line adapts to market volatility and trend changes.

2.SSL Baseline Integration

- SSL Baseline: In addition to the primary baseline, the indicator incorporates an SSL (Semaphore Signal Level) Baseline, which further refines trend detection by considering the highs and lows over a specified period.

- Dual Confirmation: The combination of the primary baseline and the SSL baseline enhances the reliability of the trend signals by requiring agreement between both baselines before generating a signal.

3.Momentum and Trend Filters

- Relative Strength Index (RSI): The indicator uses the RSI to assess the momentum of price movements, filtering out signals that occur during overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): The MACD is employed to identify the direction and strength of the trend, adding another layer of confirmation to the signals.

- Average Directional Index (ADX): The ADX measures the strength of the trend, ensuring that signals are generated only when the market shows significant directional movement.

4.Volume Analysis

- Volume Filter: An optional volume filter compares the current volume to its moving average, allowing traders to focus on signals that occur during periods of higher market activity.

5.Higher Timeframe Confirmation

- Multi-Timeframe Analysis: The indicator can incorporate data from a higher timeframe, comparing the current price to the higher timeframe's baseline and signal line. This feature helps traders align their trades with the broader market trend.

6.Candlestick Pattern Recognition

- Bullish Patterns: The indicator detects bullish patterns such as Bullish Engulfing, Piercing Line, Hammer, and Doji.

- Bearish Patterns: It also identifies bearish patterns like Bearish Engulfing, Dark Cloud Cover, Shooting Star, and Doji.

- Pattern Prioritization: The patterns are prioritized to highlight the most significant formations, which can serve as additional confirmation for trade entries and exits.

7.Price Action Zones

- Support and Resistance Levels: The indicator automatically identifies pivot highs and lows to establish dynamic support and resistance levels.

- Zone Visualization: It draws shaded rectangles on the chart to represent these zones, providing a clear visual aid for potential reversal or breakout areas.

- ATR-Based Zone Width: The zones' thickness is dynamically calculated using the Average True Range (ATR), adjusting to the current market volatility.

- Background Coloring: The chart background changes color when the price is above the maximum resistance or below the minimum support, alerting traders to significant price movements.

Interpreting the Signals

1.Buy Signals

Conditions:

- Price crosses above the signal line.

- RSI is below 70 (not overbought).

- MACD line is above the signal line (indicating bullish momentum).

- ADX is above the user-defined threshold (default is 20), confirming a strong trend.

- (Optional) Volume is above its moving average if the volume filter is enabled.

- (Optional) Price is above the higher timeframe baseline and signal line if the higher timeframe filter is enabled.

- (Optional) A bullish candlestick pattern is detected if the candlestick pattern filter is enabled.

Visual Indicators:

- An upward-pointing label with the text "BUY" appears below the price bar.

- The baseline and SSL baseline lines turn to colors indicating bullish conditions.

2.Sell Signals

Conditions:

- Price crosses below the signal line.

- RSI is above 30 (not oversold).

- MACD line is below the signal line (indicating bearish momentum).

- ADX is above the user-defined threshold, confirming a strong trend.

- (Optional) Volume is above its moving average if the volume filter is enabled.

- (Optional) Price is below the higher timeframe baseline and signal line if the higher timeframe filter is enabled.

- (Optional) A bearish candlestick pattern is detected if the candlestick pattern filter is enabled.

Visual Indicators:

- A downward-pointing label with the text "SELL" appears above the price bar.

- The baseline and SSL baseline lines turn to colors indicating bearish conditions.

3.Support and Resistance Zones

Interpretation:

- Resistance Zones: Represent areas where the price may face selling pressure. A break above these zones can signal a strong bullish move.

- Support Zones: Represent areas where the price may find buying interest. A break below these zones can signal a strong bearish move.

Background Color:

- The background turns red when the price is above the maximum resistance, indicating potential overextension.

- The background turns green when the price is below the minimum support, indicating potential undervaluation.

Effective Usage Strategies

1.Customization

- Adjusting Baseline and SSL Settings: Traders should experiment with different moving average types and lengths to match their trading style and the specific characteristics of the asset being analyzed.

- Filtering Parameters: Modify RSI, MACD, and ADX settings to fine-tune the sensitivity of the signals.

- Volume and Higher Timeframe Filters: Enable these filters to add robustness to the signals, especially in volatile markets or when trading higher timeframes.

2.Combining with Other Analysis

- Fundamental Analysis: Use the indicator in conjunction with fundamental insights to validate technical signals.

- Risk Management: Always apply proper risk management techniques, such as setting stop-loss and take-profit levels based on the support and resistance zones provided by the indicator.

3.Backtesting

- Historical Analysis: Utilize the indicator's settings to backtest trading strategies on historical data, helping to identify the most effective configurations before applying them in live trading.

4.Monitoring Market Conditions

- Volatility Awareness: Pay attention to the ATR and ADX readings to understand market volatility and trend strength, adjusting strategies accordingly.

- Event Considerations: Be cautious around major economic announcements or events that may impact market behavior beyond technical indications.

Indicator Inputs and Customization Options

- Baseline Type and Length: Select from multiple moving average types and specify the period length.

- ADX Settings: Adjust the length, smoothing, and threshold for trend strength confirmation.

- Volume Filter: Enable or disable the volume confirmation filter.

- Higher Timeframe Filter: Choose to incorporate higher timeframe analysis and specify the desired timeframe.

- Candlestick Patterns: Enable or disable the detection of candlestick patterns for additional signal confirmation.

- SSL Baseline Type and Length: Customize the SSL baseline settings separately from the primary baseline.

Price Action Zones Settings:

- Zone Thickness: Adjust the visual thickness of the support and resistance zones.

- Lookback Period: Define how far back the indicator looks for pivot points.

- ATR Multiplier for Zone Width: Set the multiplier for ATR to determine the dynamic width of the zones.

- Maximum Number of Zones: Limit the number of support and resistance zones displayed.

- Pivot Bars: Customize the number of bars to the left and right used for identifying pivot highs and lows.

Conclusion

The "Mars Signals - Precision Trend Analyzer with SSL Baseline & Price Action Zones" is a versatile and powerful tool that amalgamates essential technical analysis techniques into a single, user-friendly indicator. By providing clear visual signals and incorporating multiple layers of confirmation, it assists traders in identifying high-probability trading opportunities. Whether you are a day trader, swing trader, or long-term investor, this indicator can be tailored to suit your trading style and enhance your decision-making process.

To maximize the benefits of this indicator:

- Understand Each Component: Familiarize yourself with how each part of the indicator contributes to the overall signal generation.

- Customize Thoughtfully: Adjust the settings based on the asset class, market conditions, and your risk tolerance.

- Practice Diligently: Use demo accounts or paper trading to practice and refine your strategy before deploying it in live markets.

- Stay Informed: Continuously educate yourself on technical analysis and market dynamics to make the most informed decisions.

Disclaimer

Trading financial markets involves risk, and past performance is not indicative of future results. This indicator is a tool to aid in analysis and should not be the sole basis for any trading decision. Always conduct your own research and consider consulting with a licensed financial advisor.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.