PROTECTED SOURCE SCRIPT

RamanVol with Bull Snort Candles and Power Volumes

1. Volume Analysis and Conditions:

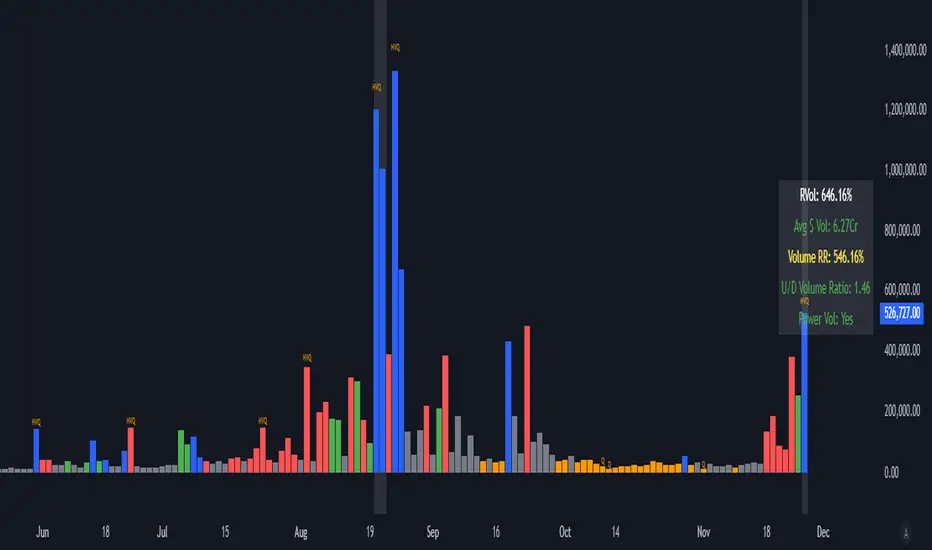

Pocket Pivot Volume (PPV): A condition where a bar's volume on an up day is greater than the highest down-day volume in the last lookbackPeriod (e.g., 10 days). This indicates strong buying interest and is highlighted with blue bars.

High Down-Bar Volume: Identifies high volume on down days, with the volume greater than the 50-period moving average. This is represented by red bars.

High Up-Bar Volume: Identifies high volume on up days, with the volume greater than the 50-period moving average, represented by green bars.

Low Volume: When the volume is below 20% of the moving average volume (lowVolumeFraction), the bar is colored orange, indicating a "dry" or low volume day.

HVE (Highest Volume Ever): Marks the highest volume ever observed, indicated by a purple label above the bar.

HVQ (Highest Volume in Quarter): Marks the highest volume in the last quarter (63 days), indicated by an orange label (Q).

LVQ (Lowest Volume in Quarter): Marks the lowest volume in the last quarter, indicated by a Q label above the bar.

LVY (Lowest Volume in Year): Marks the lowest volume in the last year, indicated by a Y label.

2. Bull Snort Candles:

A Bull Snort candle is a specific type of candle that meets the following criteria:

Volume is more than 3 times the 50-period volume moving average.

The price closes within the top 35% of the day's range.

The close is higher than the previous bar's close.

When a Bull Snort is detected, the background color of the chart turns purple, and a small dot is plotted below the bar (if enabled).

3. Power Volume:

Power Volume occurs when the volume exceeds a certain threshold (e.g., 500,000) and the price moves at least 5% on that bar.

When these conditions are met, the background of the chart is highlighted with a yellow headlight effect, indicating a significant volume and price movement.

4. Relative Volume (RVol):

Relative Volume compares the current volume to the moving average of volume (50-period), showing how much higher or lower the volume is relative to the average. This is expressed as a percentage (e.g., 200% if today's volume is twice the average volume).

5. Table Display:

The indicator updates a table on the right side of the chart with the following metrics:

RVol: Displays the relative volume as a percentage.

Avg Dollar Volume: Shows the average dollar volume (average volume * average price).

Volume RR (Run Rate): Displays the percentage by which today's volume is higher or lower than the moving average.

Up/Down Volume Ratio: A measure of the ratio of total volume on up days to down days. If this ratio is greater than 1, it's considered bullish.

6. Background Highlights:

Bull Snort Candles: The background turns purple when Bull Snort candles are detected.

Power Volumes: The background turns yellow when Power Volume conditions are met.

Low Volume: Days with very low volume are marked with orange bars.

CREDITS: finallynitin, Mark Minervini, Gill Morales, Dr Chris, Oliver Kell

Pocket Pivot Volume (PPV): A condition where a bar's volume on an up day is greater than the highest down-day volume in the last lookbackPeriod (e.g., 10 days). This indicates strong buying interest and is highlighted with blue bars.

High Down-Bar Volume: Identifies high volume on down days, with the volume greater than the 50-period moving average. This is represented by red bars.

High Up-Bar Volume: Identifies high volume on up days, with the volume greater than the 50-period moving average, represented by green bars.

Low Volume: When the volume is below 20% of the moving average volume (lowVolumeFraction), the bar is colored orange, indicating a "dry" or low volume day.

HVE (Highest Volume Ever): Marks the highest volume ever observed, indicated by a purple label above the bar.

HVQ (Highest Volume in Quarter): Marks the highest volume in the last quarter (63 days), indicated by an orange label (Q).

LVQ (Lowest Volume in Quarter): Marks the lowest volume in the last quarter, indicated by a Q label above the bar.

LVY (Lowest Volume in Year): Marks the lowest volume in the last year, indicated by a Y label.

2. Bull Snort Candles:

A Bull Snort candle is a specific type of candle that meets the following criteria:

Volume is more than 3 times the 50-period volume moving average.

The price closes within the top 35% of the day's range.

The close is higher than the previous bar's close.

When a Bull Snort is detected, the background color of the chart turns purple, and a small dot is plotted below the bar (if enabled).

3. Power Volume:

Power Volume occurs when the volume exceeds a certain threshold (e.g., 500,000) and the price moves at least 5% on that bar.

When these conditions are met, the background of the chart is highlighted with a yellow headlight effect, indicating a significant volume and price movement.

4. Relative Volume (RVol):

Relative Volume compares the current volume to the moving average of volume (50-period), showing how much higher or lower the volume is relative to the average. This is expressed as a percentage (e.g., 200% if today's volume is twice the average volume).

5. Table Display:

The indicator updates a table on the right side of the chart with the following metrics:

RVol: Displays the relative volume as a percentage.

Avg Dollar Volume: Shows the average dollar volume (average volume * average price).

Volume RR (Run Rate): Displays the percentage by which today's volume is higher or lower than the moving average.

Up/Down Volume Ratio: A measure of the ratio of total volume on up days to down days. If this ratio is greater than 1, it's considered bullish.

6. Background Highlights:

Bull Snort Candles: The background turns purple when Bull Snort candles are detected.

Power Volumes: The background turns yellow when Power Volume conditions are met.

Low Volume: Days with very low volume are marked with orange bars.

CREDITS: finallynitin, Mark Minervini, Gill Morales, Dr Chris, Oliver Kell

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.