OPEN-SOURCE SCRIPT

تم تحديثه Master Litecoin Network Value Model

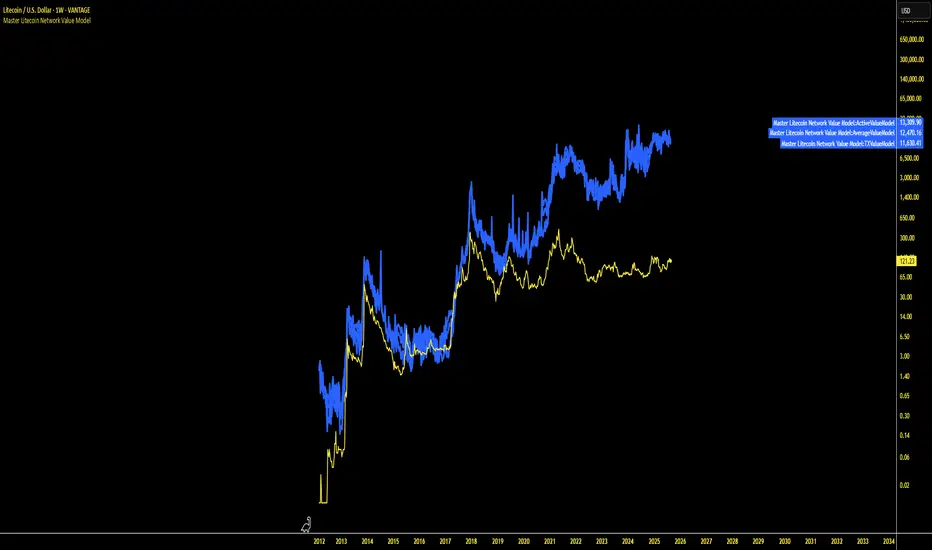

The Master Litecoin Network Value Model takes the following 6 network values for Litecoin. It compares them to Bitcoin's network values to determine a "fair" value based on Litecoin's network usage compared to Bitcoin's.

Please apply on an LTCUSD chart

This also includes an average of the 6 network metrics and is colored white with a slightly large line width.

New Addresses

Total Addresses

Active Addresses

Total Volume USD

Transaction Count

# of Retail

Please apply on an LTCUSD chart

This also includes an average of the 6 network metrics and is colored white with a slightly large line width.

New Addresses

Total Addresses

Active Addresses

Total Volume USD

Transaction Count

# of Retail

ملاحظات الأخبار

This one includes median transaction amount in USD.ملاحظات الأخبار

Updated version has label options now when plottingملاحظات الأخبار

updated the title. ملاحظات الأخبار

The Master Litecoin Network Value Model Best script provides a visualization of Litecoin's network fundamentals compared to Bitcoin, developed by @masterbtcltc. By analyzing various on-chain metrics and market data, this indicator helps users evaluate Litecoin's intrinsic value relative to Bitcoin.Key Features:

Network Metrics:

NewAddressValueModel: Tracks the ratio of new addresses in Litecoin compared to Bitcoin.

TotalAddressValueModel: Compares total addresses across the two networks.

Transaction & Volume Metrics:

TXValueModel: Compares transaction activity.

VolumeValueModel and VolumeUSDValueModel: Analyzes transaction volumes in native units and USD.

Usage & Adoption:

ActiveValueModel: Tracks the ratio of active addresses between Litecoin and Bitcoin.

RetailValueModel: Measures retail adoption strength in the Litecoin network.

Blockchain & Holder Data:

BlockValueModel: Compares block sizes.

NonZeroModel: Evaluates addresses with non-zero balances.

HodlerModel: Compares long-term holders between Litecoin and Bitcoin.

Averaged Insights:

AverageValueModel: Aggregates all metrics for a complete view of network valuation.

MultipleLTC: Highlights Litecoin’s potential value relative to its market price.

Important Instructions: To ensure accurate results, plot this indicator on the VANTAGE:LTCUSD pair. This ensures alignment with the data sources and guarantees the script performs as intended.

Visual Design:

Blue Themed Metrics: Network value models are displayed in a uniform blue color with a line thickness of 4 and 25% transparency for clarity.

Distinct Price Plot: Litecoin’s price is plotted in yellow, with a thin line (width 2) and no transparency, keeping it visually separate.

Use Cases: This tool is ideal for traders, investors, and enthusiasts aiming to:

Identify Litecoin's market trends.

Detect periods of undervaluation or overvaluation.

Gain deeper insights into Litecoin’s network fundamentals.

Feel free to explore, use, and share this open-source script to better understand Litecoin's value potential!

ملاحظات الأخبار

Master Litecoin Network Value Model DescriptionThe Master Litecoin Network Value Model is a powerful open-source TradingView script designed to provide insights into Litecoin's network fundamentals relative to Bitcoin. Developed by masterbtcltc, this model combines on-chain metrics and market data to assess Litecoin's intrinsic value in comparison to Bitcoin.

Key Features:

Network Metrics:

New Address Value Model: Measures the ratio of new Litecoin addresses to Bitcoin’s, scaled for block timing differences.

Total Address Value Model: Compares the total number of addresses between Litecoin and Bitcoin.

Transaction & Volume Metrics:

TX Value Model: Analyzes transaction activity across the two networks.

Volume Models:

Volume Value Model: Compares transaction volumes in native cryptocurrency units.

Volume USD Value Model: Evaluates transaction volumes in USD.

Usage & Adoption Metrics:

Active Value Model: Tracks active addresses on both networks.

Retail Value Model: Measures retail adoption strength in Litecoin.

Blockchain & Holder Data:

Block Value Model: Compares total block sizes between Litecoin and Bitcoin.

Non-Zero Model: Evaluates the number of addresses with a balance greater than zero.

Hodler Model: Tracks long-term holders in each network.

Averaged Insights:

Average Value Model: Aggregates all metrics for a comprehensive view.

MultipleLTC: Highlights potential undervaluation or overvaluation of Litecoin based on its network fundamentals.

Special Considerations:

The ltcbtcblocktimeratio value is set to 4 to account for Litecoin’s faster block times, which are four times quicker than Bitcoin’s. This adjustment ensures accurate comparison, as Litecoin's network growth can occur at a proportionally faster rate.

Visual Design:

Blue-Themed Metrics: Key value models are displayed in a consistent blue color with a line thickness of 4 and 25% transparency.

Distinct Price Plot: Litecoin's price is represented in yellow, with a thin line for better visibility.

How to Use:

Plotting Pair: Apply the script on the VANTAGE:LTCUSD pair for accurate results.

Use Cases:

Analyze Litecoin’s market trends and valuation cycles.

Detect undervalued or overvalued conditions.

Gain deeper insights into network fundamentals for strategic investment decisions.

Instructions for Users:

Setup: Load the script in TradingView and ensure data compatibility by selecting the correct chart pair.

Interpretation: Use the visualized metrics and average value model to assess market conditions.

This model is particularly suited for traders, investors, and enthusiasts looking to understand Litecoin's value potential compared to Bitcoin. Explore, share, and utilize this tool to enhance your crypto trading and investment strategies!

ملاحظات الأخبار

Master Litecoin Network Value Model DescriptionThe Master Litecoin Network Value Model is a powerful open-source TradingView script designed to provide insights into Litecoin's network fundamentals relative to Bitcoin. Developed by masterbtcltc, this model combines on-chain metrics and market data to assess Litecoin's intrinsic value in comparison to Bitcoin.

Key Features:

Network Metrics:

New Address Value Model: Measures the ratio of new Litecoin addresses to Bitcoin’s, scaled for block timing differences.

Total Address Value Model: Compares the total number of addresses between Litecoin and Bitcoin.

Transaction & Volume Metrics:

TX Value Model: Analyzes transaction activity across the two networks.

Volume Models:

Volume Value Model: Compares transaction volumes in native cryptocurrency units.

Volume USD Value Model: Evaluates transaction volumes in USD.

Usage & Adoption Metrics:

Active Value Model: Tracks active addresses on both networks.

Retail Value Model: Measures retail adoption strength in Litecoin.

Blockchain & Holder Data:

Block Value Model: Compares total block sizes between Litecoin and Bitcoin.

Non-Zero Model: Evaluates the number of addresses with a balance greater than zero.

Hodler Model: Tracks long-term holders in each network.

Averaged Insights:

Average Value Model: Aggregates all metrics for a comprehensive view.

MultipleLTC: Highlights potential undervaluation or overvaluation of Litecoin based on its network fundamentals.

Special Considerations:

The ltcbtcblocktimeratio value is set to 4 to account for Litecoin’s faster block times, which are four times quicker than Bitcoin’s. This adjustment ensures accurate comparison, as Litecoin's network growth can occur at a proportionally faster rate.

Visual Design:

Blue-Themed Metrics: Key value models are displayed in a consistent blue color with a line thickness of 4 and 25% transparency.

Distinct Price Plot: Litecoin's price is represented in yellow, with a thin line for better visibility.

How to Use:

Plotting Pair: Apply the script on the VANTAGE:LTCUSD pair for accurate results.

Use Cases:

Analyze Litecoin’s market trends and valuation cycles.

Detect undervalued or overvalued conditions.

Gain deeper insights into network fundamentals for strategic investment decisions.

ملاحظات الأخبار

Master Litecoin Network Value Model DescriptionThe Master Litecoin Network Value Model is a powerful open-source TradingView script designed to provide insights into Litecoin's network fundamentals relative to Bitcoin. Developed by masterbtcltc, this model combines on-chain metrics and market data to assess Litecoin's intrinsic value in comparison to Bitcoin.

Key Features:

Network Metrics:

New Address Value Model: Measures the ratio of new Litecoin addresses to Bitcoin’s, scaled for block timing differences.

Total Address Value Model: Compares the total number of addresses between Litecoin and Bitcoin.

Transaction & Volume Metrics:

TX Value Model: Analyzes transaction activity across the two networks.

Volume Models:

Volume Value Model: Compares transaction volumes in native cryptocurrency units.

Volume USD Value Model: Evaluates transaction volumes in USD.

Usage & Adoption Metrics:

Active Value Model: Tracks active addresses on both networks.

Retail Value Model: Measures retail adoption strength in Litecoin.

Blockchain & Holder Data:

Block Value Model: Compares total block sizes between Litecoin and Bitcoin.

Non-Zero Model: Evaluates the number of addresses with a balance greater than zero.

Hodler Model: Tracks long-term holders in each network.

Averaged Insights:

Average Value Model: Aggregates all metrics for a comprehensive view.

MultipleLTC: Highlights potential undervaluation or overvaluation of Litecoin based on its network fundamentals.

Special Considerations:

The ltcbtcblocktimeratio value is set to 4 to account for Litecoin’s faster block times, which are four times quicker than Bitcoin’s. This adjustment ensures accurate comparison, as Litecoin's network growth can occur at a proportionally faster rate.

Visual Design:

Blue-Themed Metrics: Key value models are displayed in a consistent blue color with a line thickness of 4 and 25% transparency.

Distinct Price Plot: Litecoin's price is represented in yellow, with a thin line for better visibility.

How to Use:

Plotting Pair: Apply the script on the VANTAGE:LTCUSD pair for accurate results.

Use Cases:

Analyze Litecoin’s market trends and valuation cycles.

Detect undervalued or overvalued conditions.

Gain deeper insights into network fundamentals for strategic investment decisions.

ملاحظات الأخبار

Master Litecoin Network Value Model DescriptionThe Master Litecoin Network Value Model is a powerful open-source TradingView script designed to provide insights into Litecoin's network fundamentals relative to Bitcoin. Developed by masterbtcltc, this model combines on-chain metrics and market data to assess Litecoin's intrinsic value in comparison to Bitcoin.

Key Features:

Network Metrics:

New Address Value Model: Measures the ratio of new Litecoin addresses to Bitcoin’s, scaled for block timing differences.

Total Address Value Model: Compares the total number of addresses between Litecoin and Bitcoin.

Transaction & Volume Metrics:

TX Value Model: Analyzes transaction activity across the two networks.

Volume Models:

Volume Value Model: Compares transaction volumes in native cryptocurrency units.

Volume USD Value Model: Evaluates transaction volumes in USD.

Usage & Adoption Metrics:

Active Value Model: Tracks active addresses on both networks.

Retail Value Model: Measures retail adoption strength in Litecoin.

Blockchain & Holder Data:

Block Value Model: Compares total block sizes between Litecoin and Bitcoin.

Non-Zero Model: Evaluates the number of addresses with a balance greater than zero.

Hodler Model: Tracks long-term holders in each network.

Averaged Insights:

Average Value Model: Aggregates all metrics for a comprehensive view.

MultipleLTC: Highlights potential undervaluation or overvaluation of Litecoin based on its network fundamentals.

Special Considerations:

The ltcbtcblocktimeratio is dynamically calculated using:

This ratio accounts for the actual average block interval differences between Bitcoin and Litecoin. It ensures precise scaling for Litecoin’s faster block times, reflecting its potential for quicker network growth.

Visual Design:

Blue-Themed Metrics: Key value models are displayed in a consistent blue color with a line thickness of 4 and 25% transparency.

ملاحظات الأخبار

The Master Litecoin Network Value Model is a powerful open-source TradingView script designed to provide insights into Litecoin's network fundamentals relative to Bitcoin. Developed by masterbtcltc, this model combines on-chain metrics and market data to assess Litecoin's intrinsic value in comparison to Bitcoin.Key Features:

Network Metrics:

New Address Value Model: Measures the ratio of new Litecoin addresses to Bitcoin’s, scaled for block timing differences.

Total Address Value Model: Compares the total number of addresses between Litecoin and Bitcoin.

Transaction & Volume Metrics:

Volume USD Value Model: Evaluates transaction volumes in USD.

Usage & Adoption Metrics:

Active Value Model: Tracks active addresses on both networks.

Retail Value Model: Measures retail adoption strength in Litecoin.

Blockchain & Holder Data:

Block Value Model: Compares total block sizes between Litecoin and Bitcoin.

Non-Zero Model: Evaluates the number of addresses with a balance greater than zero.

Hodler Model: Tracks long-term holders in each network.

Averaged Insights:

Average Value Model: Aggregates all metrics for a comprehensive view.

MultipleLTC: Highlights potential undervaluation or overvaluation of Litecoin based on its network fundamentals.

Special Considerations:

The ltcbtcblocktimeratio is dynamically calculated using:

ltcbtcblocktimeratio = request.security("GLASSNODE:BTC_BLOCKMEANINTERVAL", "D", high) / request.security("GLASSNODE:LTC_BLOCKMEANINTERVAL", "D", high)

This ratio accounts for the actual average block interval differences between Bitcoin and Litecoin. It ensures precise scaling for Litecoin’s faster block times, reflecting its potential for quicker network growth.

How to Use:

Plotting Pair: Apply the script on the VANTAGE:LTCUSD pair for accurate results.

Use Cases:

Analyze Litecoin’s market trends and valuation cycles.

Detect undervalued or overvalued conditions.

Gain deeper insights into network fundamentals for strategic investment decisions.

This model is ideal for traders, investors, and enthusiasts looking to understand Litecoin's value potential compared to Bitcoin. Explore, share, and utilize this tool to enhance your crypto trading and investment strategies!

ملاحظات الأخبار

ratioملاحظات الأخبار

chartملاحظات الأخبار

updated model for clarityملاحظات الأخبار

glassnode removed litecoin data in december 2024... had to update to into the block...ملاحظات الأخبار

updated sourceملاحظات الأخبار

Had to change source from INTOTHEBLOCK to COINMETRICS.نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.