OPEN-SOURCE SCRIPT

تم تحديثه Turtle Strategy - Triple EMA Trend with ADX and ATR

Description

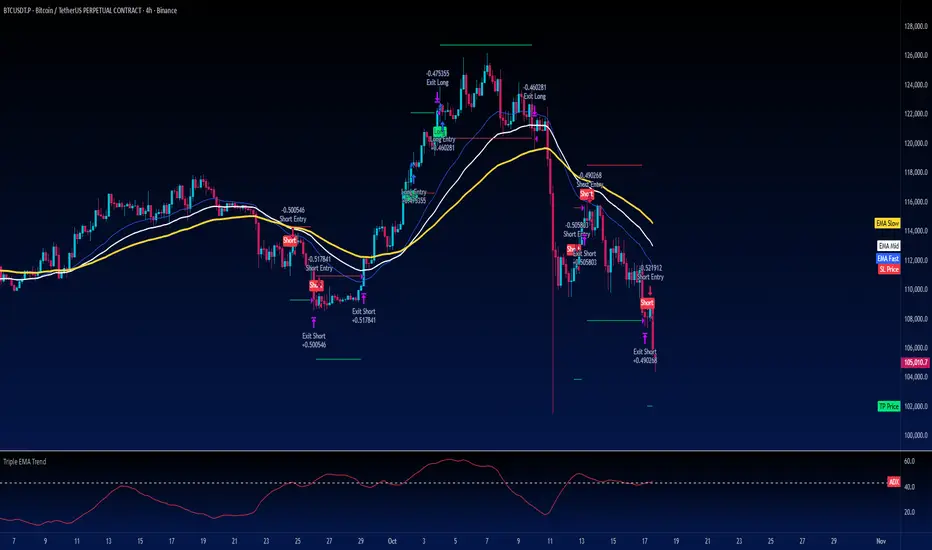

The Triple EMA Trend strategy is a directional momentum system built on the alignment of three exponential moving averages and a strong ADX confirmation filter. It is designed to capture established trends while maintaining disciplined risk management through ATR-based stops and targets.

Core Logic

The system activates only under high-trend conditions, defined by the Average Directional Index (ADX) exceeding a configurable threshold (default: 43).

A bullish setup occurs when the short-term EMA is above the mid-term EMA, which in turn is above the long-term EMA, and price trades above the fastest EMA.

A bearish setup is the mirror condition.

Execution Rules

Entry:

• Long when ADX confirms trend strength and EMA alignment is bullish.

• Short when ADX confirms trend strength and EMA alignment is bearish.

Exit:

• Stop Loss: 1.8 × ATR below (for longs) or above (for shorts) the entry price.

• Take Profit: 3.3 × ATR in the direction of the trade.

Both parameters are configurable.

Additional Features

• Start/end date inputs for controlled backtesting.

• Selective activation of long or short trades.

• Built-in commission and position sizing (percent of equity).

• Full visual representation of EMAs, ADX, stop-loss, and target levels.

This strategy emphasizes clean trend participation, strict entry qualification, and consistent reward-to-risk structure. Ideal for swing or medium-term testing across trending assets.

The Triple EMA Trend strategy is a directional momentum system built on the alignment of three exponential moving averages and a strong ADX confirmation filter. It is designed to capture established trends while maintaining disciplined risk management through ATR-based stops and targets.

Core Logic

The system activates only under high-trend conditions, defined by the Average Directional Index (ADX) exceeding a configurable threshold (default: 43).

A bullish setup occurs when the short-term EMA is above the mid-term EMA, which in turn is above the long-term EMA, and price trades above the fastest EMA.

A bearish setup is the mirror condition.

Execution Rules

Entry:

• Long when ADX confirms trend strength and EMA alignment is bullish.

• Short when ADX confirms trend strength and EMA alignment is bearish.

Exit:

• Stop Loss: 1.8 × ATR below (for longs) or above (for shorts) the entry price.

• Take Profit: 3.3 × ATR in the direction of the trade.

Both parameters are configurable.

Additional Features

• Start/end date inputs for controlled backtesting.

• Selective activation of long or short trades.

• Built-in commission and position sizing (percent of equity).

• Full visual representation of EMAs, ADX, stop-loss, and target levels.

This strategy emphasizes clean trend participation, strict entry qualification, and consistent reward-to-risk structure. Ideal for swing or medium-term testing across trending assets.

ملاحظات الأخبار

Updated data set.How to Use

Works best on trending markets such as BTC/USD, major forex pairs, or strong equities.

Use the inputs panel to:

• Adjust EMA, ADX, and ATR lengths to suit your timeframe.

• Enable or disable short trades.

• Set custom backtesting start and end dates.

The chart will display all EMAs, ADX, stop-loss, and take-profit levels, along with entry labels.

Default position size is 5% of equity per trade with commission simulation.

Originality

Unlike basic EMA crossover systems, this script combines triple EMA structure with a strict ADX filter to eliminate low-momentum periods. It also includes full ATR-based risk management and controlled backtesting inputs, making it a self-contained trend-following framework for systematic testing.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

🔥Get the Cyatophilum Indicators today and automate them on Binance! => blockchainfiesta.com/strategies/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

🔥Get the Cyatophilum Indicators today and automate them on Binance! => blockchainfiesta.com/strategies/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.