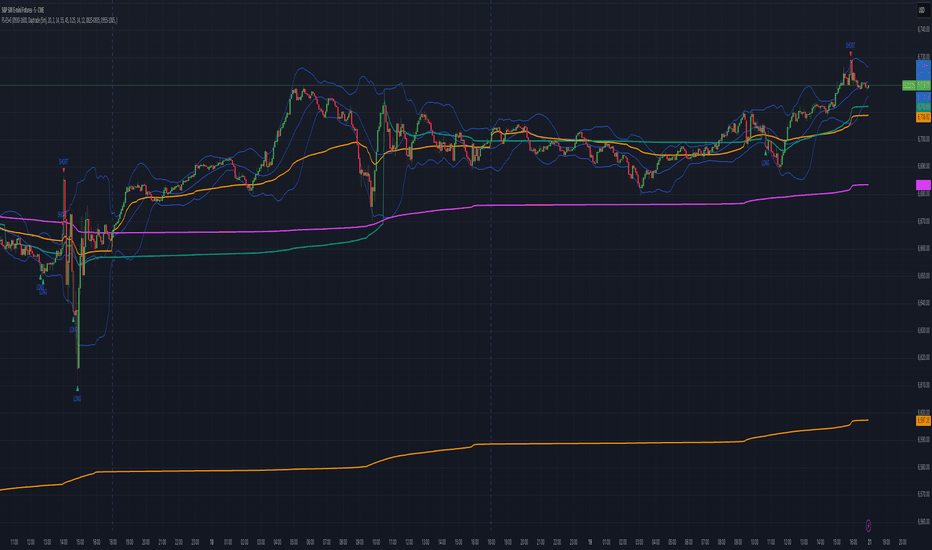

VWAP Momentum Oscillator How It Works

Core Calculation Method

The oscillator combines four key market measurements into a single, normalized reading:

1. Price-VWAP Deviation: `(Close - VWAP) / VWAP × 100`

2. VWAP-MA Momentum: `(VWAP - MovingAverage) / MovingAverage × 100`

3. Anchored VWAP Strength: Average of high/low anchor deviations from rolling VWAP

4. Range Position: `(Close - PeriodLow) / (PeriodHigh - PeriodLow) × 100 - 50`

Dynamic Signal Line

The signal line uses an EMA that automatically adjusts its length based on your chart timeframe:

- Futures: Always covers 23 hours of trading (1,380 minutes)

- Stocks: Always covers 6.5 hours of trading (390 minutes)

- Examples: 276 periods on 5-min futures chart, 1,380 periods on 1-min futures chart

Trading Signals

🟢 Buy Signals

- Condition: Main oscillator crosses above signal line while below zero

- Logic: Momentum turning bullish from oversold conditions

- Visual: Green "BUY" label below price action

🔴 Sell Signals

- Condition: Main oscillator crosses below signal line while above zero

- Logic: Momentum turning bearish from overbought conditions

- Visual: Red "SELL" label above price action

⚠️ Extreme Warnings

- Extreme Overbought: Red triangle when oscillator crosses above +4.0

- Extreme Oversold: Green triangle when oscillator crosses below -4.0

- Purpose: Risk management alerts, not entry/exit signals

Oscillator Zones

Interpretation Guide

- Above +2.0: Strong bullish momentum zone (green background)

- 0 to +2.0: Mild bullish territory

- 0 to -2.0: Mild bearish territory

- Below -2.0: Strong bearish momentum zone (red background)

- Above +4.0: Extreme overbought (caution advised)

- Below -4.0: Extreme oversold (potential reversal zone)

Customization Options

Moving Average Settings

- EMA/SMA Toggle: Choose between exponential or simple moving average

- Color Customization: Adjust MA line color and width

Visual Controls

- Bullish/Bearish Colors: Customize momentum zone colors

- Signal Line: Toggle visibility and adjust color

- Line Widths: Control thickness of all plot lines

Anchor Modes

- NY Session Only: Anchors reset at NY market open (9:30 AM ET)

- 24H NY Day: Anchors reset at NY calendar day change (midnight ET)

Best Practices

Timeframe Selection

- Scalping: 1-5 minute charts for quick momentum changes

- Day Trading: 5-15 minute charts for clearer trend signals

- Swing Trading: 1-4 hour charts for major momentum shifts

Signal Confirmation

- Wait for crossovers: Don't trade on oscillator position alone

- Respect extreme levels: Exercise caution above +4 or below -4

- Use with price action: Combine with support/resistance levels

Risk Management

- Extreme zones: Reduce position size when oscillator is extended

- Failed signals: Exit quickly if momentum doesn't follow through

- Market context: Consider overall trend direction and market volatility

Technical Specifications

Calculation Components

- Base Length: 1,380 periods (futures) / 390 periods (stocks)

- Signal Line: Dynamic EMA covering one full trading day

- Smoothing: 3-period SMA on raw oscillator (adjustable)

- Update Frequency: Real-time on every price tick

Performance Notes

- Resource Efficient: Optimized calculations minimize CPU usage

- Memory Friendly: Uses incremental VWAP calculations

- Fast Loading: Minimal historical data requirements

Version History & Development

This oscillator evolved from advanced VWAP overlay strategies, transforming complex multi-line analysis into a single, actionable momentum gauge. The indicator maintains the sophistication of institutional VWAP analysis while providing the clarity needed for retail trading decisions.

Core Philosophy

Traditional VWAP indicators show where price is relative to volume-weighted averages, but they don't quantify momentum or provide clear entry/exit signals. This oscillator solves that problem by normalizing all VWAP relationships into a single, bounded indicator that works consistently across all timeframes and asset classes.

---

Open Source License: This indicator is provided free for the TradingView community. Feel free to modify and enhance according to your trading needs.

متوسط الأسعار المرجح بحجم التداول

MYM Edge Booster MYM Long Trading Assistant - ATR-Based Edge Booster

Clean, simple indicator that tells you when MYM long setups meet high-probability criteria. No complicated charts - just clear numbers and signals.

• ATR Targets & Stops (whole numbers)

• Quality Score (0-3 stars)

• Green Circle when conditions perfect

• Warnings for choppy/high volatility

• ES/NQ sector confirmation

Eliminates guesswork. Trade when the green circle appears.

[MCN] Volume Weighted Average PriceStandard VWAP with custom stdv colourings and the ability to anchor by midnight price.

Anchored VWAP (Triple) MYRAXESAnchored VWAP Triple Indicator

The Anchored VWAP Triple indicator is a powerful tool for technical analysis, allowing traders to plot three customizable anchored Volume Weighted Average Price (VWAP) lines on a chart. Unlike traditional VWAP, which resets daily, this indicator lets you anchor each VWAP to a specific date and time, providing a unique perspective on price action relative to key market events.

Features

Three Independent VWAPs: Plot up to three VWAP lines, each anchored to a user-defined date and time.

Customizable Inputs: Set the year, month, day, hour, and minute for each VWAP anchor point. Choose distinct colors for easy identification.

Pure Anchored Design: VWAP lines start only from the anchor point, with no pre-anchor extensions, ensuring a clean and focused analysis.

Debug Mode: Optional display of hour and minute for troubleshooting or educational purposes.

Default Settings: Pre-configured with practical defaults (e.g., September 2025 dates) for immediate use.

How to Use

Add the indicator to your TradingView chart.

Adjust the anchor dates and times for each VWAP (VWAP 1, VWAP 2, VWAP 3) via the input settings.

Select custom colors for each VWAP line to differentiate them on the chart.

Enable Debug Mode if needed to verify time alignment.

Analyze price movements relative to the anchored VWAPs to identify support, resistance, or trend shifts.

Benefits

Ideal for swing traders and long-term analysts who need to anchor VWAP to significant price levels or events.

Enhances decision-making by comparing multiple VWAPs from different anchor points.

Fully compatible with TradingView’s Pine Script v6 for smooth performance.

This indicator is perfect for traders looking to deepen their market analysis with a flexible, multi-VWAP approach. Share your feedback or custom setups in the comments!

Anchored EMA/VWAP### Anchored EMA/VWAP Indicator

**Description:**

The **Anchored EMA/VWAP Indicator** is a powerful and versatile tool designed for traders seeking to analyze price trends and momentum from a user-defined anchor point in time. Built for TradingView using Pine Script v6, this indicator calculates and displays multiple **Exponential Moving Averages (EMAs)**, **Volume-Weighted Exponential Moving Averages (VWEMAs)**, and a **Volume-Weighted Average Price (VWAP)**, all anchored to a specific date and time chosen by the user. By anchoring these calculations, traders can focus on price action relative to significant market events, such as news releases, earnings reports, or key support/resistance levels.

The indicator supports multi-timeframe (MTF) analysis, allowing users to compute EMAs, VWEMAs, and VWAP on a higher or custom timeframe (e.g., 5-minute, 1-hour, daily) while overlaying the results on the current chart. It also includes customizable cross signals for EMA and VWEMA pairs, marked with distinct shapes (circles, diamonds, squares) to highlight potential trend changes or reversals. These features make the indicator ideal for trend-following, momentum trading, and identifying key price levels across various markets, including stocks, forex, cryptocurrencies, and commodities.

**Key Features:**

- **Anchored Calculations**: EMAs, VWEMAs, and VWAP start calculations from a user-specified anchor time, enabling analysis relative to significant market moments.

- **Multi-Timeframe Support**: Compute indicators on any timeframe (e.g., 60-minute, daily) and display them on the chart’s timeframe for flexible analysis.

- **Customizable EMAs and VWEMAs**: Four EMAs and four VWEMAs with adjustable lengths (default: 9, 21, 50, 100) and colors, with options to show or hide each.

- **Volume-Weighted Metrics**: VWAP and VWEMAs incorporate volume data, providing a more robust representation of market activity compared to standard EMAs.

- **Cross Signals**: Visual markers (circles, diamonds, squares) for crossovers between EMA and VWEMA pairs, with customizable visibility to highlight bullish (up) or bearish (down) signals.

- **User-Friendly Interface**: Organized input groups for General, EMA, VWEMA, VWAP, Arrow Settings, and Cross Visibility, with intuitive inline inputs for length and color customization.

- **Visual Clarity**: Overlaid on the price chart with distinct colors and line styles (dotted for EMAs, dashed for VWEMAs, solid for VWAP) to ensure easy interpretation.

**How to Use:**

1. **Set the Anchor Time**: Click a specific bar or enter a date/time (default: June 1, 2025) to start calculations from a significant market event.

2. **Select Timeframe**: Choose a timeframe (e.g., "5" for 5-minute, "D" for daily) to compute the indicators, allowing alignment with your trading strategy.

3. **Customize EMAs and VWEMAs**: Adjust lengths and colors for up to four EMAs and VWEMAs, and toggle their visibility to focus on relevant lines.

4. **Enable VWAP**: Display the anchored VWAP to identify volume-weighted price levels, useful as dynamic support/resistance.

5. **Monitor Cross Signals**: Enable cross visibility for specific EMA or VWEMA pairs to spot potential trend changes. Bullish crosses (e.g., shorter EMA crossing above longer EMA) are marked with green shapes below the bar, while bearish crosses are marked with red shapes above the bar.

6. **Interpret Signals**: Use EMA/VWEMA crossovers for trend confirmation, VWAP as a mean-reversion level, and volume-weighted VWEMAs for momentum analysis in high-volume markets.

**Use Cases:**

- **Trend Trading**: Identify trend direction using EMA and VWEMA crossovers, with shorter lengths (e.g., 9, 21) for faster signals and longer lengths (e.g., 50, 100) for trend confirmation.

- **Mean Reversion**: Use the anchored VWAP as a dynamic support/resistance level to trade pullbacks or breakouts.

- **Event-Based Analysis**: Anchor the indicator to significant events (e.g., earnings, economic data releases) to analyze price behavior post-event.

- **Multi-Timeframe Strategies**: Combine higher timeframe EMAs/VWAPs with lower timeframe price action for high-probability setups.

**Settings:**

- **Anchor Time**: Set the starting point for calculations (default: June 1, 2025).

- **Timeframe**: Choose the timeframe for calculations (default: 5-minute).

- **EMA/VWEMA Lengths**: Default lengths of 9, 21, 50, and 100 for both EMAs and VWEMAs, adjustable per user preference.

- **Colors**: Customizable colors with slight transparency for visual clarity.

- **Cross Visibility**: Toggle specific EMA and VWEMA cross signals (e.g., EMA1/EMA2, VWEMA1/VWEMA3) to reduce chart clutter.

- **Arrow Colors**: Green for bullish crosses, red for bearish crosses.

**Notes:**

- The indicator is overlaid on the price chart, ensuring seamless integration with price action analysis.

- VWEMAs and VWAP are volume-sensitive, making them particularly effective in markets with significant volume fluctuations.

- Ensure the anchor time is set to a valid historical or future bar to avoid calculation errors.

- Cross signals are conditional on non-NA values to prevent false positives during initialization.

**Author**: NEPOLIX

**Version**: 6 (Pine Script v6)

**Published**: For TradingView Community

This indicator is a must-have for traders looking to combine anchored, volume-weighted, and multi-timeframe analysis into a single, customizable tool. Whether you're a day trader, swing trader, or long-term investor, the Anchored EMA/VWAP Indicator provides actionable insights for informed trading decisions.

Foresight Cone (HoltxF1xVWAP) [KedArc Quant]Description:

This is a time-series forecasting indicator that estimates the next bar (F1) and projects a path a few bars ahead. It also draws a confidence cone based on how accurate the recent forecasts have been. You can optionally color the projection only when price agrees with VWAP.

Why it’s different

* One clear model: Everything comes from Holt’s trend-aware forecasting method—no mix of unrelated indicators.

* Transparent visuals: You see the next-bar estimate (F1), the forward projection, and a cone that widens or narrows based on recent forecast error.

* Context, not signals: The VWAP option only changes colors. It doesn’t add trade rules.

* No look-ahead: Accuracy is measured using the forecast made on the previous bar versus the current bar.

Inputs (what they mean)

* Source: Price series to forecast (default: Close).

* Preset: Quick profiles for fast, smooth, or momentum markets (see below).

* Alpha (Level): How fast the model reacts to new prices. Higher = faster, twitchier.

* Beta (Trend): How fast the model updates the slope. Higher = faster pivots, more flips in chop.

* Horizon: How many bars ahead to project. Bigger = wider cone.

* Residual Window: How many bars to judge recent accuracy. Bigger = steadier cone.

* Confidence Z: How wide the cone should be (typical setting ≈ “95% style” width).

* Show Bands / Draw Forward Path: Turn the cone and forward lines on/off.

* Color only when aligned with VWAP: Highlights projections only when price agrees with the trend side of VWAP.

* Colors / Show Panel: Styling plus a small panel with RMSE, MAPE, and trend slope.

Presets (when to pick which)

* Scalp / Fast (1-min): Very responsive; best for quick moves. More twitch in chop.

* Smooth Intraday (1–5 min): Calmer and steadier; a good default most days.

* Momentum / Breakout: Quicker slope tracking during strong pushes; may over-react in ranges.

* Custom: Set your own values if you know exactly what you want.

What is F1 here?

F1 is the model’s next-bar fair value. Crosses of price versus F1 can hint at short-term momentum shifts or mean-reversion, especially when viewed with VWAP or the cone.

How this helps

* Gives a baseline path of where price may drift and a cone that shows normal wiggle room.

* Helps you tell routine noise (inside cone) from information (edges or breaks outside the cone).

* Keeps you aware of short-term bias via the trend slope and F1.

How to use (step by step)

1. Add to chart → choose a Preset (start with Smooth Intraday).

2. Set Horizon around 8–15 bars for intraday.

3. (Optional) Turn on VWAP alignment to color only when price agrees with the trend side of VWAP.

4. Watch where price sits relative to the cone and F1:

* Inside = normal noise.

* At edges = stretched.

* Outside = possible regime change.

5. Check the panel: if RMSE/MAPE spike, expect a wider cone; consider a smoother preset or a higher timeframe.

6. Tweak Alpha/Beta only if needed: faster for momentum, slower for chop.

7. Combine with your own plan for entries, exits, and risk.

Accuracy Panel — what it tells you

Preset & Horizon: Shows which preset you’re using and how many bars ahead the projection goes. Longer horizons mean more uncertainty.

RMSE (error in price units): A “typical miss” measured in the chart’s currency (e.g., ₹).

Lower = tighter fit and a usually narrower cone. Rising = conditions getting noisier; the cone will widen.

MAPE (error in %): The same idea as RMSE but in percent.

Good for comparing different symbols or timeframes. Sudden spikes often hint at a regime change.

Slope T: The model’s short-term trend reading.

Positive = gentle up-bias; negative = gentle down-bias; near zero = mostly flat/drifty.

How to read it at a glance

Calm & directional: RMSE/MAPE steady or falling + Slope T positive (or negative) → trends tend to respect the cone’s mid/upper (or mid/lower) area.

Choppy/uncertain: RMSE/MAPE climbing or jumping → expect more whipsaw; rely more on the cone edges and higher-TF context.

Flat tape: Slope T near zero → mean-revert behavior is common; treat cone edges as stretch zones rather than breakout zones.

Warm-up & tweaks

Warm-up: Right after adding the indicator, the panel may be blank for a short time while it gathers enough bars.

Too twitchy? Switch to Smooth Intraday or increase the Residual Window.

Too slow? Use Scalp/Fast or Momentum/Breakout to react quicker.

Timeframe tips

* 1–3 min: Scalp/Fast or Momentum/Breakout; horizon \~8–12.

* 5–15 min: Smooth Intraday; horizon \~12–15.

* 30–60 min+: Consider a larger residual window for a steadier cone.

FAQ

Q: Is this a strategy or an indicator?

A: It’s an indicator only. It does not place orders, TP/SL, or run backtests.

Q: Does it repaint?

A: The next-bar estimate (F1) and the cone are calculated using only information available at that time. The forward path is a projection drawn on the last bar and will naturally update as new bars arrive. Historical bars aren’t revised with future data.

Q: What is F1?

A: F1 is the indicator’s best guess for the next bar.

Price crossing above/below F1 can hint at short-term momentum shifts or mean-reversion.

Q: What do “Alpha” and “Beta” do?

A: Alpha controls how fast the indicator reacts to new prices

(higher = faster, twitchier). Beta controls how fast the slope updates (higher = quicker pivots, more flips in chop).

Q: Why does the cone width change?

A: It reflects recent forecast accuracy. When the market gets noisy, the cone widens. When the tape is calm, it narrows.

Q: What does the Accuracy Panel tell me?

A:

* Preset & Horizon you’re using.

* RMSE: typical forecast miss in price units.

* MAPE: typical forecast miss in percent.

* Slope T: short-term trend reading (up, down, or flat).

If RMSE/MAPE rise, expect a wider cone and more whipsaw.

Q: The panel shows “…” or looks empty. Why?

A: It needs a short warm-up to gather enough bars. This is normal after you add the indicator or change settings/timeframes.

Q: Which timeframe is best?

A:

* 1–3 min: Scalp/Fast or Momentum/Breakout, horizon \~8–12.

* 5–15 min: Smooth Intraday, horizon \~12–15.

Higher timeframes work too; consider a larger residual window for steadier cones.

Q: Which preset should I start with?

A: Start with Smooth Intraday. If the market is trending hard, try Momentum/Breakout.

For very quick tapes, use Scalp/Fast. Switch back if things get choppy.

Q: What does the VWAP option do?

A: It only changes colors (highlights when price agrees with the trend side of VWAP).

It does not add or remove signals.

Q: Are there alerts?

A: Yes—alerts for price crossing F1 (up/down). Use “Once per bar close” to reduce noise on fast charts.

Q: Can I use this on stocks, futures, crypto, or FX?

A: Yes. It works on any symbol/timeframe. You may want to adjust Horizon and the Residual Window based on volatility.

Q: Can I use it with Heikin Ashi or other non-standard bars?

A: You can, but remember you’re forecasting the synthetic series of those bars. For pure price behavior, use regular candles.

Q: The cone feels too wide/too narrow. What do I change?

A:

* Too wide: lower Alpha/Beta a bit or increase the Residual Window.

* Too narrow (misses moves): raise Alpha/Beta slightly or try Momentum/Breakout.

Q: Why do results change when I switch timeframe or symbol?

A: Different noise levels and trends. The accuracy stats reset per chart, so the cone adapts to each context.

Q: Any limits or gotchas?

A: Extremely large Horizon may hit TradingView’s line-object limits; reduce Horizon or turn

off extra visuals if needed. Big gaps or news spikes will widen errors—expect the cone to react.

Q: Can this predict exact future prices?

A: No. It provides a baseline path and context. Always combine with your own rules and risk management.

Glossary

* TS (Time Series): Data over time (prices).

* Holt’s Method: A forecasting approach that tracks a current level and a trend to predict the next bars.

* F1: The indicator’s best guess for the next bar.

* F(h): The projected value h bars ahead.

* VWAP: Volume-Weighted Average Price—used here for optional color alignment.

* RMSE: Typical forecast miss in price units (how far off, on average).

* MAPE: Typical forecast miss in percent (scale-free, easy to compare).

Notes & limitations

* The panel needs a short warm-up; stats may be blank at first.

* The cone reflects recent conditions; sudden volatility changes will widen it.

* This is a tool for context. It does not place trades and does not promise results.

⚠️ Disclaimer

This script is provided for educational purposes only.

Past performance does not guarantee future results.

Trading involves risk, and users should exercise caution and use proper risk management when applying this strategy.

FlowSpike ES — BB • RSI • VWAP + AVWAP + News MuteThis indicator is purpose-built for E-mini S&P 500 (ES) futures traders, combining volatility bands, momentum filters, and session-anchored levels into a streamlined tool for intraday execution.

Key Features:

• ES-Tuned Presets

Automatically optimized settings for scalping (1–2m), daytrading (5m), and swing trading (15–60m) timeframes.

• Bollinger Band & RSI Signals

Entry signals trigger only at statistically significant extremes, with RSI filters to reduce false moves.

• VWAP & Anchored VWAPs

Session VWAP plus anchored VWAPs (RTH open, weekly, monthly, and custom) provide high-confidence reference levels used by professional order-flow traders.

• Volatility Filter (ATR in ticks)

Ensures signals are only shown when the ES is moving enough to offer tradable edges.

• News-Time Mute

Suppresses signals around scheduled economic releases (customizable windows in ET), helping traders avoid whipsaw conditions.

• Clean Alerts

Long/short alerts are generated only when all conditions align, with optional bar-close confirmation.

Why It’s Tailored for ES Futures:

• Designed around ES tick size (0.25) and volatility structure.

• Session settings respect RTH hours (09:30–16:00 ET), the period where most liquidity and institutional flows concentrate.

• ATR thresholds and RSI bands are pre-tuned for ES market behavior, reducing the need for manual optimization.

⸻

This is not a generic indicator—it’s a futures-focused tool created to align with the way ES trades day after day. Whether you scalp the open, manage intraday swings, or align to weekly/monthly anchored flows, FlowSpike ES gives you a clear, rules-based signal framework.

VWAP + RSI Strategytesting this method, based on RSI combine with Vwap

there is a buy and sell alert, if you like pls comment it, this is a simple method that can surely adapt to any assets,

Futures Playbook: VWAP + OR + Cross-Asset TellsFutures Playbook: VWAP + OR + Cross-Asset Tells (with Trade Messages + Coach Panel)

This all-in-one futures trading toolkit combines Opening Range (OR) levels, VWAP, and cross-asset signals to help traders quickly read intraday structure, manage execution, and filter noise.

Core Features

• Opening Range (OR):

• Customizable OR window with High/Low and Midpoint.

• Automatic shading of the OR zone.

• VWAP & Bands:

• Built-in or session-anchored VWAP.

• Optional standard deviation bands for context.

• Cross-Asset Tells:

• Live reads on US 10Y yield, DXY, Crude, and Gold.

• Regime detection: rates risk, USD strength, energy softness, and real-rate easing.

• Confirmations:

• Volume vs. moving average filter.

• Cumulative delta with smoothing.

• ATR-based chop filter to avoid low-quality trends.

Trade Messages + Coach Panel

• Trade Messages (labels): Automatic on-chart prompts for OR completion, VWAP reclaim/loss, long/short setups, and EU close flows.

• Coach Panel (table): Real-time dashboard with regime context, directional bias, execution notes, risk reminders, and key levels (ORH, ORL, VWAP).

Alerts

• OR breakout (long/short with confirmations).

• VWAP reclaim or loss.

• 10Y yield crossing risk threshold.

Use Case

Designed for futures traders and scalpers who rely on VWAP + OR dynamics and need cross-asset confirmation before committing to trades. Great for structuring entries, managing risk, and filtering market noise throughout the session.

Hybrid Trend MAHybrid Trend MA (Pine Script v6)

This indicator combines Exponential Moving Averages (EMA) and Arnaud Legoux Moving Averages (ALMA) into a single hybrid trend-following tool. It is designed to help traders visualize medium- and long-term trend directions while also capturing smoother short-term signals.

Key Features:

EMA Trend Structure

Three EMAs are plotted (lengths: 38, 62, 200).

Each EMA line changes color depending on whether it is rising or falling relative to the others:

Red → Strong uptrend alignment.

Lime → Strong downtrend alignment.

Aqua → Neutral or transition.

The indicator also fills the space between EMA zones with silver shading to highlight trend channels.

ALMA Trend Confirmation

Two ALMA curves are plotted (lengths: 13, 50).

Similar rising/falling logic is applied to color them:

Red → Bullish alignment and rising.

Green → Bearish alignment and falling.

Cyan → Neutral or uncertain trend.

A cross marker is plotted whenever the fast and slow ALMA lines cross, which may serve as an entry/exit confirmation.

Customizable Smoothing

The smoothe setting controls how many bars are checked to confirm whether an EMA or ALMA is rising/falling, helping reduce noise.

How to Use:

Trend Identification: The EMA set shows the larger market structure. When all EMAs align in direction and color, the trend is stronger.

Entry & Exit Confirmation: The ALMA cross signals can be used to refine entries and exits within the broader EMA trend.

Dynamic Visuals: Colored EMAs + ALMAs make it easy to distinguish bullish, bearish, and ranging conditions at a glance.

Volume Pressure Arrows[Blk0ut]Volume Pressure Arrows are an innovative (I think) market pressure tool designed to cut through noise and provide traders with a realistic, but quick insight into buying vs selling pressure and which has real control. Rather than relying on any single classic indicator, this script blends five complementary measures of price–volume dynamics—Cumulative Volume Delta (CVD), VWAP distance, OBV slope, ATR expansion, and the DMI ratio—into a unified “pressure score.”

Each component is normalized, weighted, and combined into a single metric that can be read at a glance through intuitive up and down arrows plotted directly on the chart. By transforming multiple complex data streams into a single aggregated signal, Volume Pressure Arrows help traders answer some of the hardest questions we can face: is the current move backed by conviction? is there true momentum? Is price action about to reverse?

Why It’s Different

Traditional oscillators often create conflicting signals, forcing traders to guess which one to trust. This indicator integrates five perspectives on volume and momentum pressure into a single framework, balancing raw flow (CVD), relative positioning (VWAP), trend conviction (OBV slope), volatility expansion (ATR), and directional bias (DMI). The result is a weighted, probability-minded score capped between -100 and +100 for consistency and clarity.

Important note : Inspiration for the use of directly plotted arrows came from dgtrd "https://www.tradingview.com/u/dgtrd/" and their brilliant work on LazyBear's Squeeze Indicator "https://www.tradingview.com/script/Dsr7B2xE-Squeeze-Momentum-Indicator-LazyBear-vX-by-DGT/"

How to Read It

Bullish Arrows appear below the candles when the pressure score pushes above the neutral threshold, signaling meaningful buyer dominance.

Bearish Arrows appear above the candles when pressure drops below the negative threshold, indicating strong selling pressure.

Neutral Arrows (smaller, faded) mark conditions where pressure exists but is not decisive—useful for spotting early rotations or fading momentum.

Color Gradients dynamically adjust with score intensity, making stronger signals visually brighter and weaker ones softer.

How to Use It Effectively

This tool is best applied as a confirmation and timing layer. It is not meant to replace your core strategy, but to validate whether momentum pressure supports your trade thesis.

Combine with trendlines, chart patterns, or breakouts to gauge conviction.

Use bullish or bearish arrows as filters, only take trades when price action aligns with strong directional pressure.

Watch neutral arrows near key levels; they often foreshadow balance breaking into directional moves.

Adjust the weightings to emphasize the components that matter most to your style (e.g., more weight on CVD for scalpers, or ATR expansion for volatility traders).

As with any indicator, this is not a magic ball and does not guarantee success. But it does allow you to increase the probability odds to your favor if you align it with your edge. Happy trading!

Structural Liquidity Signals [BullByte]Structural Liquidity Signals (SFP, FVG, BOS, AVWAP)

Short description

Detects liquidity sweeps (SFPs) at pivots and PD/W levels, highlights the latest FVG, tracks AVWAP stretch, arms percentile extremes, and triggers after confirmed micro BOS.

Full description

What this tool does

Structural Liquidity Signals shows where price likely tapped liquidity (stop clusters), then waits for structure to actually change before it prints a trigger. It spots:

Liquidity sweeps (SFPs) at recent pivots and at prior day/week highs/lows.

The latest Fair Value Gap (FVG) that often “pulls” price or serves as a reaction zone.

How far price is stretched from two VWAP anchors (one from the latest impulse, one from today’s session), scaled by ATR so it adapts to volatility.

A “percentile” extreme of an internal score. At extremes the script “arms” a setup; it only triggers after a small break of structure (BOS) on a closed bar.

Originality and design rationale, why it’s not “just a mashup”

This is not a mashup for its own sake. It’s a purpose-built flow that links where liquidity is likely to rest with how structure actually changes:

- Liquidity location: We focus on areas where stops commonly cluster—recent pivots and prior day/week highs/lows—then detect sweeps (SFPs) when price wicks beyond and closes back inside.

- Displacement context: We track the last Fair Value Gap (FVG) to account for recent inefficiency that often acts as a magnet or reaction zone.

- Stretch measurement: We anchor VWAP to the latest N-bar impulse and to the Daily session, then normalize stretch by ATR to assess dislocation consistently across assets/timeframes.

- Composite exhaustion: We combine stretch, wick skew, and volume surprise, then bend the result with a tanh transform so extremes are bounded and comparable.

- Dynamic extremes and discipline: Rather than triggering on every sweep, we “arm” at statistical extremes via percent-rank and only fire after a confirmed micro Break of Structure (BOS). This separates “interesting” from “actionable.”

Key concepts

SFP (liquidity sweep): A candle briefly trades beyond a level (where stops sit) and closes back inside. We detect these at:

Pivots (recent swing highs/lows confirmed by “left/right” bars).

Prior Day/Week High/Low (PDH/PDL/PWH/PWL).

FVG (Fair Value Gap): A small 3‑bar gap (bar2 high vs bar1 low, or vice versa). The latest gap often acts like a magnet or reaction zone. We track the most recent Up/Down gap and whether price is inside it.

AVWAP stretch: Distance from an Anchored VWAP divided by ATR (volatility). We use:

Impulse AVWAP: resets on each new N‑bar high/low.

Daily AVWAP: resets each new session.

PR (Percentile Rank): Where the current internal score sits versus its own recent history (0..100). We arm shorts at high PR, longs at low PR.

Micro BOS: A small break of the recent high (for longs) or low (for shorts). This is the “go/no‑go” confirmation.

How the parts work together

Find likely liquidity grabs (SFPs) at pivots and PD/W levels.

Add context from the latest FVG and AVWAP stretch (how far price is from “fair”).

Build a bounded score (so different markets/timeframes are comparable) and compute its percentile (PR).

Arm at extremes (high PR → short candidate; low PR → long candidate).

Only print a trigger after a micro BOS, on a closed bar, with spacing/cooldown rules.

What you see on the chart (legend)

Lines:

Teal line = Impulse AVWAP (resets on new N‑bar extreme).

Aqua line = Daily AVWAP (resets each session).

PDH/PDL/PWH/PWL = prior day/week levels (toggle on/off).

Zones:

Greenish box = latest Up FVG; Reddish box = latest Down FVG.

The shading/border changes after price trades back through it.

SFP labels:

SFP‑P = SFP at Pivot (dotted line marks that pivot’s price).

SFP‑L = SFP at Level (at PDH/PDL/PWH/PWL).

Throttle: To reduce clutter, SFPs are rate‑limited per direction.

Triggers:

Triangle up = long trigger after BOS; triangle down = short trigger after BOS.

Optional badge shows direction and PR at the moment of trigger.

Optional Trigger Zone is an ATR‑sized box around the trigger bar’s close (for visualization only).

Background:

Light green/red shading = a long/short setup is “armed” (not a trigger).

Dashboard (Mini/Pro) — what each item means

PR: Percentile of the internal score (0..100). Near 0 = bullish extreme, near 100 = bearish extreme.

Gauge: Text bar that mirrors PR.

State: Idle, Armed Long (with a countdown), or Armed Short.

Cooldown: Bars remaining before a new setup can arm after a trigger.

Bars Since / Last Px: How long since last trigger and its price.

FVG: Whether price is in the latest Up/Down FVG.

Imp/Day VWAP Dist, PD Dist(ATR): Distance from those references in ATR units.

ATR% (Gate), Trend(HTF): Status of optional regime filters (volatility/trend).

How to use it (step‑by‑step)

Keep the Safety toggles ON (default): triggers/visuals on bar‑close, optional confirmed HTF for trend slope.

Choose timeframe:

Intraday (5m–1h) or Swing (1h–4h). On very fast/thin charts, enable Performance mode and raise spacing/cooldown.

Watch the dashboard:

When PR reaches an extreme and an SFP context is present, the background shades (armed).

Wait for the trigger triangle:

It prints only after a micro BOS on a closed bar and after spacing/cooldown checks.

Use the Trigger Zone box as a visual reference only:

This script never tells you to buy/sell. Apply your own plan for entry, stop, and sizing.

Example:

Bullish: Sweep under PDL (SFP‑L) and reclaim; PR in lower tail arms long; BOS up confirms → long trigger on bar close (ATR-sized trigger zone shown).

Bearish: Sweep above PDH/pivot (SFP‑L/P) and reject; PR in upper tail arms short; BOS down confirms → short trigger on bar close (ATR-sized trigger zone shown).

Settings guide (with “when to adjust”)

Safety & Stability (defaults ON)

Confirm triggers at bar close, Draw visuals at bar close: Keep ON for clean, stable prints.

Use confirmed HTF values: Applies to HTF trend slope only; keeps it from changing until the HTF bar closes.

Performance mode: Turn ON if your chart is busy or laggy.

Core & Context

ATR Length: Bigger = smoother distances; smaller = more reactive.

Impulse AVWAP Anchor: Larger = fewer resets; smaller = resets more often.

Show Daily AVWAP: ON if you want session context.

Use last FVG in logic: ON to include FVG context in arming/score.

Show PDH/PDL/PWH/PWL: ON to see prior day/week levels that often attract sweeps.

Liquidity & Microstructure

Pivot Left/Right: Higher values = stronger/rarer pivots.

Min Wick Ratio (0..1): Higher = only more pronounced SFP wicks qualify.

BOS length: Larger = stricter BOS; smaller = quicker confirmations.

Signal persistence: Keeps SFP context alive for a few bars to avoid flicker.

Signal Gating

Percent‑Rank Lookback: Larger = more stable extremes; smaller = more reactive extremes.

Arm thresholds (qHi/qLo): Move closer to 0.5 to see more arms; move toward 0/1 to see fewer arms.

TTL, Cooldown, Min bars and Min ATR distance: Space out triggers so you’re not reacting to minor noise.

Regime Filters (optional)

ATR percentile gate: Only allow triggers when volatility is at/above a set percentile.

HTF trend gate: Only allow longs when the HTF slope is up (and shorts when it’s down), above a minimum slope.

Visuals & UX

Only show “important” SFPs: Filters pivot SFPs by Volume Z and |Impulse stretch|.

Trigger badges/history and Max badge count: Control label clutter.

Compact labels: Toggle SFP‑P/L vs full names.

Dashboard mode and position; Dark theme.

Reading PR (the built‑in “oscillator”)

PR ~ 0–10: Potential bullish extreme (long side can arm).

PR ~ 90–100: Potential bearish extreme (short side can arm).

Important: “Armed” ≠ “Enter.” A trigger still needs a micro BOS on a closed bar and spacing/cooldown to pass.

Repainting, confirmations, and HTF notes

By default, prints wait for the bar to close; this reduces repaint‑like effects.

Pivot SFPs only appear after the pivot confirms (after the chosen “right” bars).

PD/W levels come from the prior completed candles and do not change intraday.

If you enable confirmed HTF values, the HTF slope will not change until its higher‑timeframe bar completes (safer but slightly delayed).

Performance tips

If labels/zones clutter or the chart lags:

Turn ON Performance mode.

Hide FVG or the Trigger Zone.

Reduce badge history or turn badge history off.

If price scaling looks compressed:

Keep optional “score”/“PR” plots OFF (they overlay price and can affect scaling).

Alerts (neutral)

Structural Liquidity: LONG TRIGGER

Structural Liquidity: SHORT TRIGGER

These fire when a trigger condition is met on a confirmed bar (with defaults).

Limitations and risk

Not every sweep/extreme reverses; false triggers occur, especially on thin markets and low timeframes.

This indicator does not provide entries, exits, or position sizing—use your own plan and risk control.

Educational/informational only; no financial advice.

License and credits

© BullByte - MPL 2.0. Open‑source for learning and research.

Built from repeated observations of how liquidity runs, imbalance (FVG), and distance from “fair” (AVWAPs) combine, and how a small BOS often marks the moment structure actually shifts.

VWAP Fade RTHSame as

Except this version only updates during CME Regular Trading Hours

9:30 AM NY/EST -4 PM NY/EST

VWAP FadeVWAP fade indicator simple parameters for how it works and the logic behind VWAP fade

You can try other products but recommended for Copper/Silver futures due to how they tend to do the VWAP fade

Identify VWAP retest:

Price moves back into VWAP after trending away.

Fail condition:

Candle touches VWAP but fails to close across it (stays on trend side).

Signal:

Short if price came from below and fails to close above VWAP.

Long if price came from above and fails to close below VWAP.

Confirm with volume spike (optional filter).

Monthly VWAPDescription

This indicator identifies potential mean reversion opportunities by tracking price deviations from monthly VWAP with dynamic volatility-adjusted thresholds.

Core Logic:

The indicator monitors when price moves significantly away from monthly VWAP and looks for potential reversal opportunities. It uses ATR-based dynamic thresholds that adapt to current market volatility, combined with volume confirmation to filter out weak signals.

Key Features:

Adaptive Thresholds: ATR-based bands that adjust to market volatility

Volume Confirmation: Requires average volume spike to validate signals

Monthly Reset: VWAP anchors reset each month for fresh reference levels

Visual Clarity: Color-coded deviation line with background highlights for active signals

Info Panel: Shows days from anchor and current price context vs fair value

Signal Generation:

Buy Signal: Price below monthly VWAP by threshold amount with elevated volume

Sell Signal: Price above monthly VWAP by threshold amount with elevated volume

Neutral: Price within threshold range or insufficient volume

Best Used For:

Mean reversion strategies in ranging markets

Identifying potential oversold/overbought conditions

Understanding price position relative to monthly fair value

Weekly VwapsThe Weekly Vwaps indicator lets you plot weekly Volume-Weighted Average Price (VWAP) lines for up to six months of your choosing, with years ranging from 2020 to 2050. It’s a focused tool pulled straight from the weekly VWAP section of the Advanced VWAP Calendar indicator, keeping all the same controls and look but expanded to handle more months. You can use it alongside the original indicator if you need extra weekly VWAPs (up to 30 lines total) or run it on its own for a clean, dedicated setup.

How It Works: Six Month Groups: Pick any six months (e.g., Jan 2020, Sep 2025, or Jul 2040) and enable up to five weekly VWAPs per month (W1–W5), starting from Monday midnight.

Default Setup: Loads with September 2025 VWAPs turned on, with other months (August–April 2025) off but ready to enable. All default to 2025.

Customization: Toggle all weeks in a month or pick specific ones. Adjust label sizes (tiny to huge) and line widths (1–5). Colors are teal, fuchsia, red, green, and yellow/orange for weeks 1–5, with clear labels like “W1 Sep 2025 123.45”.

Label Control: A “Show All Labels” switch lets you hide labels to keep your chart tidy.

Intraday Only: Works on intraday timeframes (e.g., 5-minute, 1-hour) for accurate VWAPs.

Why Use It: Add to Advanced VWAP Calendar: If the original’s two-month limit isn’t enough, this adds six more months of weekly VWAPs for deeper analysis.

Standalone Option: Perfect if you only want weekly VWAPs without other features, with flexibility to pick any months and years.

User-Friendly: Ready to go with September 2025 enabled, easy to tweak for past or future data.

Get Started: Add it to your TradingView chart, and September 2025 VWAPs will show up instantly. Adjust months, years, or toggles in the settings to focus on what you need. Test it on intraday charts and use the label toggle to manage clutter. Great for traders wanting precise, customizable weekly VWAPs!

FuTech : Preferential Price📌 First Ever Indicator : FuTech : Preferential Price

💡 What if you could instantly know the Preferential Price — as if the company announced a preferential issue in today’s meeting surprisingly?

Normally, you’d be stuck with tedious valuation spreadsheets and SEBI formula checks 🧮📑…

✨ But not anymore — this tool does the hard work for you!

With just one click, it auto-calculates the Preferential Issue Floor Price under SEBI ICDR Regulations, 2018 - Regulation 164 (as amended), directly from your chart symbol.

✅ How it works ?

📅 Relevant Date = 30 days prior to either:

• Today’s date (default mode)

• Or your chosen EGM date (user input)

📊 For the Relevant Date, the indicator automatically computes:

• VWAP (90 trading days preceding Relevant Date)

• VWAP (10 trading days preceding Relevant Date)

🔎 As per SEBI Reg.164, the higher of these two VWAPs is selected as the Minimum Issue Price (Preferential Price).

💰 Price is neatly formatted in Indian style (e.g. ₹1,00,000).

✅ Key Features:

⚡ Auto-calculates from chart symbol — no manual entry.

🎛️ Option to input EGM date for accurate floor price compliance.

🎨 Fully customizable: text color, size, background, position.

🪄 Clean display → shows only the final Preferential Price (Reg.164).

📌 Usage:

This indicator is built for analysts, fund managers, and corporate professionals dealing with Preferential Allotment pricing compliance.

It ensures quick visibility of the floor price under SEBI ICDR rules, directly on your chart.

⚠️ Disclaimer:

📌 The calculated Preferential Price is an approximation based on SEBI ICDR Reg.164 methodology.

📊 Actual price determined by the company / merchant banker may vary slightly (±5) due to rounding, data source differences, or timing adjustments.

📅 Ensure to verify with official exchange data and SEBI filings before relying on these numbers.

📝 This tool is meant for analytical and educational purposes only, not a substitute for regulatory or professional advice.

EMA/VWAP SuiteEMA/VWAP Suite

Overview

The EMA/VWAP Suite is a versatile and customizable Pine Script indicator designed for traders who want to combine Exponential Moving Averages (EMAs) and Volume Weighted Average Prices (VWAPs) in a single, powerful tool. It overlays up to eight EMAs and six VWAPs (three anchored, three rolling) on the chart, each with percentage difference labels to show how far the current price is from these key levels. This indicator is perfect for technical analysis, supporting strategies like trend following, mean reversion, and VWAP-based trading.

By default, the indicator displays eight EMAs and a session-anchored VWAP (AVWAP 1, in fuchsia) with their respective percentage difference labels, keeping the chart clean yet informative. Other VWAPs and their bands are disabled by default but can be enabled and customized as needed. The suite is designed to minimize clutter while providing maximum flexibility for traders.

Features

- Eight Customizable EMAs: Plot up to eight EMAs with user-defined lengths (default: 3, 9, 19, 38, 50, 65, 100, 200), each with a unique color for easy identification.

- EMA Percentage Difference Labels: Show the percentage difference between the current price and each EMA, displayed only for visible EMAs when enabled.

- Three Anchored VWAPs: Plot VWAPs anchored to the start of a session, week, or month, with customizable source, offset, and band multipliers. AVWAP 1 (session-anchored, fuchsia) is enabled by default.

- Three Rolling VWAPs: Plot VWAPs calculated over fixed periods (default: 20, 50, 100), with customizable source, offset, and band multipliers.

- VWAP Bands: Optional upper and lower bands for each VWAP, based on standard deviation with user-defined multipliers.

- VWAP Percentage Difference Labels: Display the percentage difference between the current price and each VWAP, shown only for visible VWAPs. Enabled by default to show the AVWAP 1 label.

- Customizable Colors: Each VWAP has a user-defined color via input settings, with labels matching the VWAP line colors (e.g., AVWAP 1 defaults to fuchsia).

Flexible Display Options: Toggle individual EMAs, VWAPs, bands, and labels on or off to reduce chart clutter.

Settings

The indicator is organized into intuitive setting groups:

EMA Settings

Show EMA 1–8 : Toggle each EMA on or off (default: all enabled).

EMA 1–8 Length : Set the period for each EMA (default: 3, 9, 19, 38, 50, 65, 100, 200).

Show EMA % Difference Labels : Enable/disable percentage difference labels for all EMAs (default: enabled).

EMA Label Font Size (8–20) : Adjust the font size for EMA labels (default: 10, mapped to “tiny”).

Anchored VWAP 1–3 Settings

Show AVWAP 1–3 : Toggle each anchored VWAP on or off (default: AVWAP 1 enabled, others disabled).

AVWAP 1–3 Color : Set the color for each VWAP line and its label (default: fuchsia for AVWAP 1, purple for AVWAP 2, teal for AVWAP 3).

AVWAP 1–3 Anchor : Choose the anchor period (“Session,” “Week,” “Month”; default: Session for AVWAP 1, Week for AVWAP 2, Month for AVWAP 3).

AVWAP 1–3 Source : Select the price source (default: hlc3).

AVWAP 1–3 Offset : Set the horizontal offset for the VWAP line (default: 0).

Show AVWAP 1–3 Bands : Toggle upper/lower bands (default: disabled).

AVWAP 1–3 Band Multiplier : Adjust the standard deviation multiplier for bands (default: 1.0).

Rolling VWAP 1–3 Settings

Show RVWAP 1–3 : Toggle each rolling VWAP on or off (default: disabled).

RVWAP 1–3 Color : Set the color for each VWAP line and its label (default: navy for RVWAP 1, maroon for RVWAP 2, fuchsia for RVWAP 3).

RVWAP 1–3 Period Length : Set the period for the rolling VWAP (default: 20, 50, 100).

RVWAP 1–3 Source : Select the price source (default: hlc3).

RVWAP 1–3 Offset : Set the horizontal offset (default: 0).

Show RVWAP 1–3 Bands : Toggle upper/lower bands (default: disabled).

RVWAP 1–3 Band Multiplier : Adjust the standard deviation multiplier for bands (default: 1.0).

VWAP Label Settings

Show VWAP % Difference Labels : Enable/disable percentage difference labels for all VWAPs (default: enabled, showing AVWAP 1 label).

VWAP Label Font Size (8–20) : Adjust the font size for VWAP labels (default: 10, mapped to “tiny”).

How It Works

EMAs : Calculated using ta.ema(close, length) for each user-defined period. Percentage differences are computed as ((close - ema) / close) * 100 and displayed as labels for visible EMAs when show_ema_labels is enabled.

Anchored VWAPs : Calculated using ta.vwap(source, anchor, 1), where the anchor is determined by the selected timeframe (Session, Week, or Month). Bands are computed using the standard deviation from ta.vwap.

Rolling VWAPs : Calculated using ta.vwap(source, length), with bands based on ta.stdev(source, length).

Labels : Updated on each new bar (ta.barssince(ta.change(time) != 0) == 0) to show percentage differences. Labels are only displayed for visible EMAs/VWAPs to avoid clutter.

Color Matching: VWAP labels use the same color as their corresponding VWAP lines, set via input settings (e.g., avwap1_color for AVWAP 1).

Example Use Cases

- Trend Following: Use longer EMAs (e.g., 100, 200) to identify trends and shorter EMAs (e.g., 3, 9) for entry/exit signals.

- Mean Reversion: Monitor percentage difference labels to spot overbought/oversold conditions relative to EMAs or VWAPs.

- VWAP Trading: Use the default session-anchored AVWAP 1 for intraday trading, adding weekly/monthly VWAPs or rolling VWAPs for broader context.

- Intraday Analysis: Leverage the session-anchored AVWAP 1 (enabled by default) for day trading, with bands as support/resistance zones.

Cumulative VWAPThis indicator plots the cumulative VWAP from the first bar loaded on the chart. Unlike the traditional daily VWAP that resets at the start of each trading session, this version continuously aggregates price and volume over the full visible chart history.

(Fixed-Range) Anchored VWAPThis "Fixed-Range Anchored VWAP" indicator allows traders full control over where the VWAP calculation begins and ends. VWAP combines both price and volume to reflect the true average price paid, often serving as a benchmark for gauging value, sentiment, and trend strength.

With this tool, traders can anchor VWAP to any candle, optionally define an end point, or keep it running forward with a single toggle. Up to three bands can be added around VWAP, either as standard deviations or percentage offsets.

How to Use

The indicator is particularly useful for analyzing VWAP around significant events, like earnings announcements or sharp price swings, to identify support, resistance, and mean-reversion opportunities.

Add the indicator and select a candle to set the Anchor.

Choose an End point or enable Cancel End for an open-ended VWAP.

Pick Std Dev or Percent for band mode.

Turn on up to three bands, adjust multipliers, and set fill colors.

Use VWAP and its bands to evaluate extensions, trend context, and fair value zones.

VWAP Price ChannelVWAP Price Channel cuts the crust off of a traditional price channel (Donchian Channel) by anchoring VWAPs at the highs and lows. By doing this, the flat levels, characteristic of traditional Donchian Channels, are no more!

Author's Note: This indicator is formed with no inherent use, and serves solely as a thought experiment.

> Concept

I would be hesitant to call this a "predictive" indicator, however the behavior of it would suggest it could be considered at least partially predictive

Essentially, the Anchored VWAPs creates something from otherwise nothing.

While the DC upper or lower values are staying flat, the VWAPs improvise based on price and volume to project a level that may be a better representation of where future highs or lows may settle.

Visually, this looks like we have cut off the corners of the Donchian Channel.

Note: Notice how we are calculating values before the corners are realized.

> Implementation

While this is only a concept indicator, The specific application I've gone with for this, is a sort of supertrend-ish display (A Trend Flipping Trailing Stop Loss).

The script uses basic logic to create a trend direction, and then displays the Anchored VWAPs as a form of trailing stop loss.

While "In Trend", the script fills in the area between the VWAP and Price in the direction of trend.

When new highs or lows are made while in trend, the opposite VWAP will start to generate at the new highs or lows. These happen on every new high or low, so they are not indicating the trend shift, but could be interpreted as breakout levels for the current trend direction in order for continuation.

Note: All values are drawn live, but when using higher timeframes, there is a natural calculation discrepancy when using live data vs. historical.

> Technicals

In this script, I'm simply detecting new highs or lows from the DC and using those as the anchor frequency on the built-in VWAP function.

So each time a new high or low is made based on DC, the VWAP function re-anchors to the high or low of the candle.

Past that, I have implemented some logic in order to account for a common occurrence I faced during development.

Frequently, the price would outpace the anchored VWAP, so we would end up with the VWAP being further from price than the actual DC upper or lower.

Due to this, what I have ended up with was a third value which, rather than switching between raw VWAP values and DC values, it adjusts the value based on the change in the VWAP value.

This can be simply thought of as a "Start + Change" type of setup.

By doing this, I can use the change values from the actual anchored VWAP, and under normal conditions, this will also be the true VWAP value.

However, situationally, I am able to update the start value which we're applying the VWAP change to.

In other words, when these situations happen, the VWAP change is added to the new (closer to price) DC value.

The specific trend logic being used is nothing fancy at all, we are simply checking if a new high or low is created and setting the trend in that direction.

This is in line with some traditional DC Strategies.

To those who made it here,

Just remember:

The chart may be ugly, but it's the fastest analysis of the data you can get.

Nicer displays often come at the hidden cost of latency.

You have to shoot your shot to make it.

Choose 2: Fast, Clean, Useful

Enjoy!

VWMA MACD Trend Grinder Buy/Sell SignalsDescription:

This indicator combines a VWMA-based MACD with volume and trend filters to reduce false buy and sell signals.

It is designed to give more reliable entry and exit points in trending markets while avoiding low-volume noise.

Features:

1. VWMA MACD:

- MACD is calculated using Volume-Weighted Moving Averages (VWMA) instead of standard EMAs.

- Histogram shows the difference between MACD and its signal line.

2. Volume Filter:

- Signals are only triggered when current volume exceeds a multiple of its moving average.

- Reduces false signals in low-volume periods.

3. Trend Filter:

- Only triggers buy signals when price is above a long-term VWMA (uptrend).

- Only triggers sell signals when price is below the long-term VWMA (downtrend).

- Helps avoid counter-trend trades.

4. Plots:

- MACD (blue), Signal (orange), Histogram (green/red)

- Trend VWMA (purple)

- Buy and Sell arrows in the indicator pane (green/red)

5. Alerts:

- Configurable alerts for buy and sell signals filtered by volume and trend.

Inputs:

- Fast Length: VWMA period for the fast MACD line (default 12)

- Slow Length: VWMA period for the slow MACD line (default 26)

- Signal Length: EMA period for the MACD signal line (default 9)

- Volume MA Length: Length for volume moving average filter (default 20)

- Volume Threshold Multiplier: Multiplier for volume filter (default 1.2)

- Trend VWMA Length: Period for long-term trend VWMA (default 50)

- Price Source: Close, HL2, HLC3, OHLC4

Usage:

- Use as a confirmation tool along with other analysis techniques.

- Buy when the green triangle appears (MACD crossover, above trend VWMA, sufficient volume).

- Sell when the red triangle appears (MACD crossunder, below trend VWMA, sufficient volume).

- Trend VWMA helps visually confirm the market trend.